- Coinbase’s Wrapped BTC supply rises, expanding market influence significantly.

- cbBTC achieves 25.1% market share within wrapped Bitcoin segment.

- Market impacts seen on Ethereum and Base blockchain activities.

While no major statements from Coinbase executives or industry leaders like Brian Armstrong have been documented, the crypto community acknowledges the underlying trust transition to Coinbase’s custody capability. Social channels remain positive but lack specific primary-sourced quotes.

cbBTC now forms a significant part of the wrapped Bitcoin market, reflecting a shift in user trust from dominant wBTC. The surge mirrors past DeFi activity peaks that impacted wrapped BTC supply dynamics.

Coinbase’s cbBTC Surpasses 46,000 Coins to Gain 25.1% Market Share

The circulating supply of Coinbase’s wrapped Bitcoin, cbBTC, has surpassed 46,000 coins according to Dune Analytics data. Over the past month, it has increased by more than 13,000 coins. This advancement positions cbBTC as a crucial player, with a market cap reaching approximately $4,725,000,000.00, now holding 25.1% of the market.

Significant trust increase in Coinbase’s product may spark competitive reactions from other players. Immediate implications include enhanced liquidity and trading activity on Ethereum and Base blockchains, reflecting cbBTC’s utilization for DeFi operations. Coinbase’s infrastructure cues a potential user preference shift.

As of June 29, 2025, there are no direct quotes or statements from key players or leadership at Coinbase related to the recent developments surrounding Coinbase Wrapped BTC (cbBTC) supply. Key executives such as Brian Armstrong, Emilie Choi, and Paul Grewal have not publicly commented on this topic through social media or blog posts. Similarly, no major crypto opinion leaders (KOLs) have made relevant statements regarding the cbBTC supply surge.

DeFi Impact and Market Reactions to Coinbase’s cbBTC Growth

Did you know? During significant DeFi activity phases, alternatives like cbBTC have previously struggled to gain market share over wBTC, making this rise to 25.1% noteworthy.

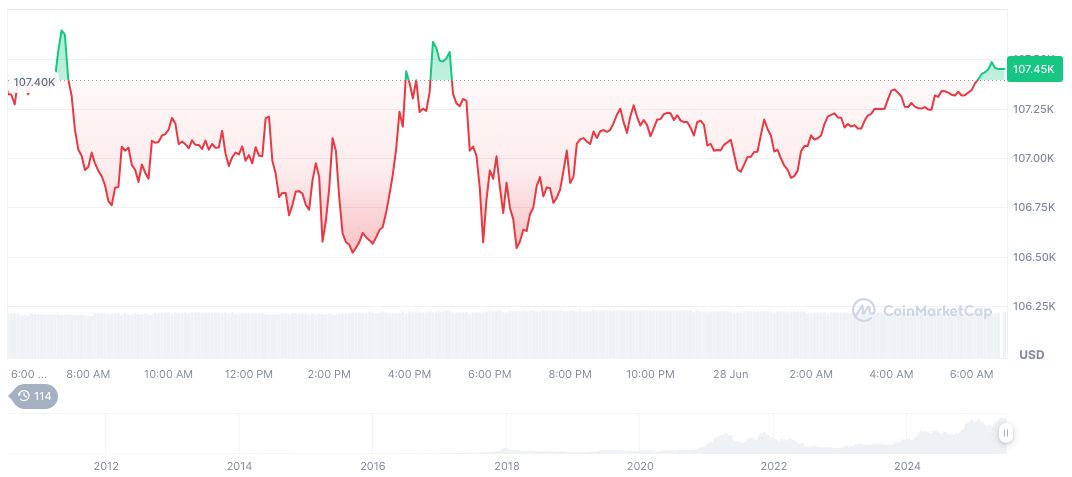

Bitcoin (BTC) currently trades at $107,377.11, with a market cap of $2,135,185,444,713.77 according to CoinMarketCap. BTC’s 24-hour trading volume fell by 32.90%, and the price declined by 0.05% in the same period. A 60-day increase of 13.22% showcases BTC’s volatile trends.

Coincu’s research team suggests consistent expansion in wrapped BTC could elevate DeFi trust, impacting protocol involvement positively. Ethereum’s and Base’s current adoption rates reflect cbBTC’s increasing necessity for liquidity movements. It may prompt enhanced oversight from custodial operations in financial sectors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345810-coinbase-wrapped-btc-market-share/