- Coinbase launches 24/7 futures for Bitcoin and Ethereum on CFTC approval.

- Access perpetual contracts in the U.S. via regulated platform.

- Enhanced derivatives offerings in regulated U.S. market.

On May 9, 2025, Coinbase officially launched 24/7 futures trading for Bitcoin and Ethereum, marking it the first CFTC-regulated platform in the U.S.

The move allows investors round-the-clock access to leveraged futures contracts, addressing the limitations of traditional market hours.

Coinbase Pioneers Continuous Crypto Futures Amid CFTC Approval

Coinbase Derivatives LLC spearheaded this initiative, with Nodal Clear announced as the clearing support. Nodal Clear Executive stated, “We are excited to provide clearing support for the 24×7 trading of cryptocurrency futures contracts, facilitating a new level of access for U.S. traders in the derivatives market.” This breakthrough aligns U.S. trading with the crypto market’s continuous operations, providing broader market access and opening up new opportunities for investors.

Market responses have been positive, with industries noting the transformed accessibility of futures trading. Coinbase emphasized the regulated environment for these products, signaling a new era for U.S. retail investors.

Bitcoin’s $2 Trillion Market Cap Reflects Dynamic Shifts

Did you know? The launch of 24/7 regulated futures trading marks a significant departure from traditional U.S. market constraints, underscoring the evolving landscape of cryptocurrency investments.

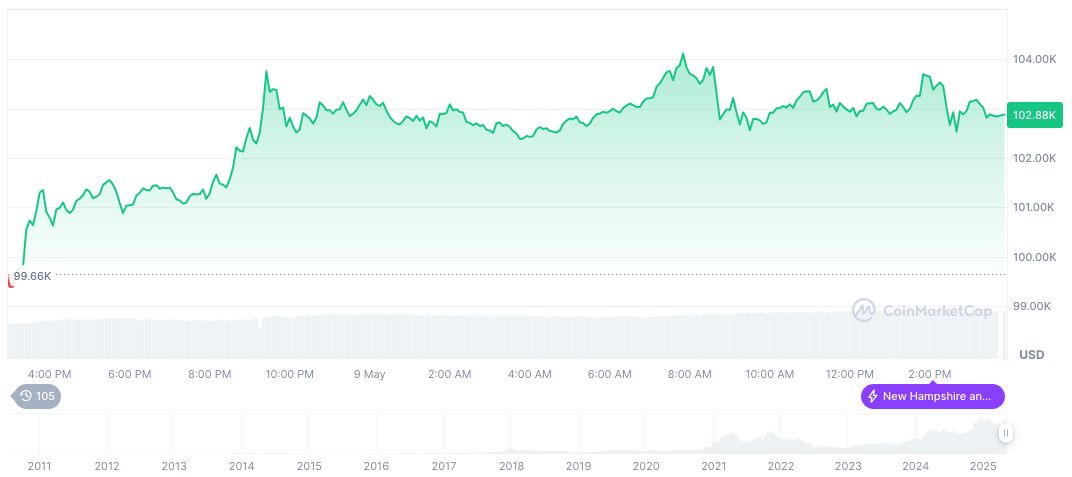

Bitcoin (BTC)’s market metrics provide vital context for this event. With a current price of $103,240.99, BTC holds a market cap of $2.05 trillion and a dominance of 62.85%. Over the past 24 hours, trading volume reached $66.93 billion, reflecting an 8.22% increase. These figures, sourced from CoinMarketCap, exhibit a strong market presence with notable movements, such as a 6.34% rise over seven days.

According to insights from Coincu’s research team, the expanded availability of derivatives products may lead to increased regulatory scrutiny. This aligns with a historical trend of convergence between traditional financial systems and cryptocurrency markets, potentially setting new precedents for both financial instruments and investor engagement.

Source: https://coincu.com/336699-coinbase-24-7-bitcoin-ethereum/