- Cantor Fitzgerald announces a gold-hedged Bitcoin fund launch.

- Seeks to entice risk-sensitive investors into cryptocurrency.

- Hybrid investing balances Bitcoin growth and gold stability.

Cantor Fitzgerald has announced the launch of a gold-hedged Bitcoin fund, marking the institution’s first venture into Bitcoin-themed investments. This initiative—envisioned as a five-year plan—aims to offer 1:1 downside protection by pegging Bitcoin to gold. Chairman Brandon Lutnick emphasized this product’s capacity to usher traditional investors into the crypto sector.

The introduction of this fund signifies an exciting change, allowing investors to leverage Bitcoin’s upside while minimizing risk exposure. By balancing Bitcoin’s potential with gold’s stability, Cantor Fitzgerald seeks to mitigate potential capital erosion, ensuring appealing returns with enhanced security.

Cantor Fitzgerald’s Pioneering Move into Crypto-Backed Investments

Cantor Fitzgerald has announced the launch of a gold-hedged Bitcoin fund, marking the institution’s first venture into Bitcoin-themed investments. This initiative—envisioned as a five-year plan—aims to offer 1:1 downside protection by pegging Bitcoin to gold. Chairman Brandon Lutnick emphasized this product’s capacity to usher traditional investors into the crypto sector.

The introduction of this fund signifies an exciting change, allowing investors to leverage Bitcoin’s upside while minimizing risk exposure. By balancing Bitcoin’s potential with gold’s stability, Cantor Fitzgerald seeks to mitigate potential capital erosion, ensuring appealing returns with enhanced security.

“We believe this is a truly groundbreaking investment vehicle—one that helps investors to tap into Bitcoin’s potential growth with downside protection based on the price of gold.” — Brandon G. Lutnick, Chairman, Cantor Fitzgerald

The financial community is responding with curiosity towards the innovative fund structure, hailed for its potential to foster a safer entry into the cryptocurrency market, attracting attention for its blending of traditional and modern financial elements and reinforcing confidence in crypto adoption among conservative capital groups.

First Wall Street Endorsed Gold-Bitcoin Fund: Market Reactions

Did you know? This is the first time a major Wall Street entity offers direct Bitcoin investment with gold hedge protection, potentially setting a precedent for future hybrid financial products.

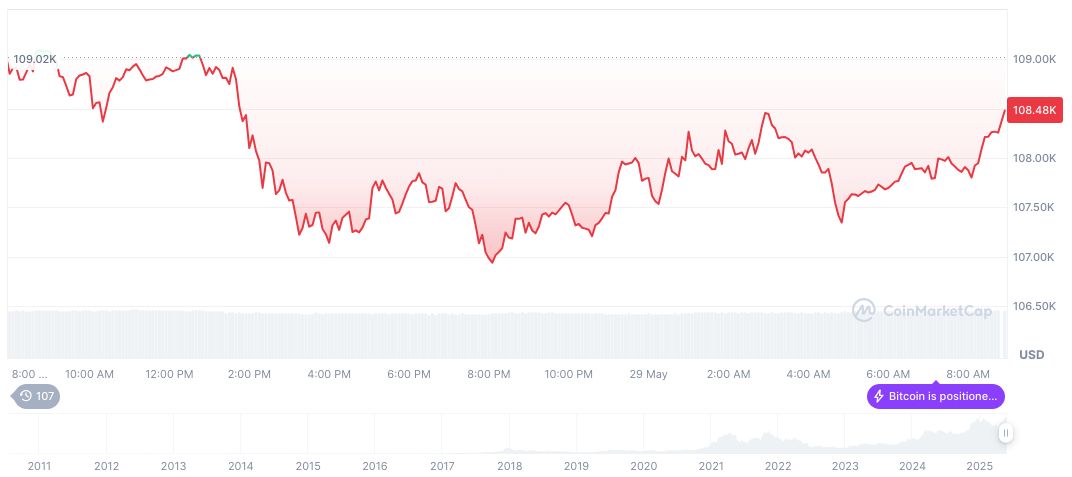

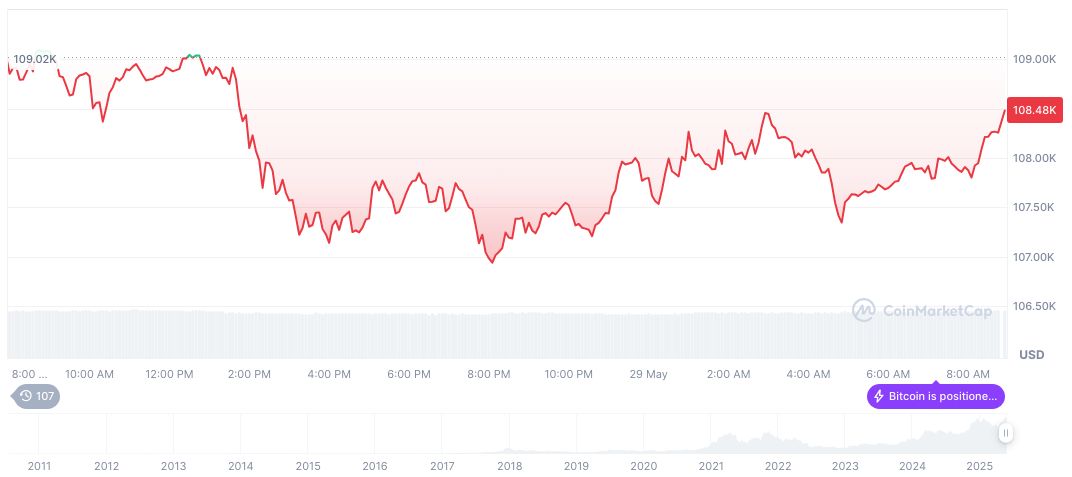

Bitcoin (BTC), as of the latest data from CoinMarketCap, is priced at $106044.97, representing a 24-hour decline of 2.18%. Over the past week, BTC has seen a 4.65% drop but maintains a 29.28% increase over 60 days. Market capitalization stands at formatNumber(2107308760056, 2), indicating a continued dominance of 62.99%. Current supply is tracked at 19,871,840 BTC from a 21,000,000 maximum capacity.

According to insights from the Coincu research team, this gold-hedged Bitcoin fund may significantly influence capital flows toward cryptocurrency. By integrating a protective element with gold, this product adds a layer of stability favored by cautious investors, potentially fostering broader market confidence. The fund may prompt regulatory advancements surrounding hybrid financial instruments, aligning traditional finance with digital assets.

Source: https://coincu.com/340602-cantor-fitzgerald-gold-bitcoin-fund-2/