- Cantor Fitzgerald’s SPAC strikes a major Bitcoin acquisition with Blockstream.

- Deal involves nearly 30,000 Bitcoin valued over $3.5 billion.

- Market anticipates continued institutional demand.

Cantor Fitzgerald, through its SPAC, is nearing completion of a $4 billion Bitcoin acquisition with Blockstream CEO Adam Back. The transaction holds significant implications for institutional Bitcoin demand, highlighting Cantor’s strategic direction.

Cantor’s $4 Billion Bitcoin Deal: Institutional Influence

Cantor Fitzgerald is finalizing a $4 billion Bitcoin acquisition, engaging Adam Back, Blockstream CEO, in discussions. The firm’s SPAC, Cantor Equity Partners 1, is at the forefront of this notable transaction. This acquisition, involving 30,000 Bitcoins, enhances Cantor’s cryptocurrency portfolio, elevating it as a pivotal institutional investor in the sector. This move underscores heightened institutional interest in Bitcoin, with financial institutions expanding their cryptocurrency holdings. Industry analysts note that substantial acquisitions like these often result in increased market capitalization and may influence Bitcoin’s liquidity and price dynamics. With no public statements from Adam Back or Cantor’s leadership, the community eagerly anticipates official confirmation, fostering speculation and discussion among market participants on forums and social media.

Bitcoin Valuation Surges Amid Institutional Investments

Did you know? Cantor Fitzgerald’s move resembles MicroStrategy’s strategy, with corporate treasuries increasingly viewing Bitcoin as a viable asset.

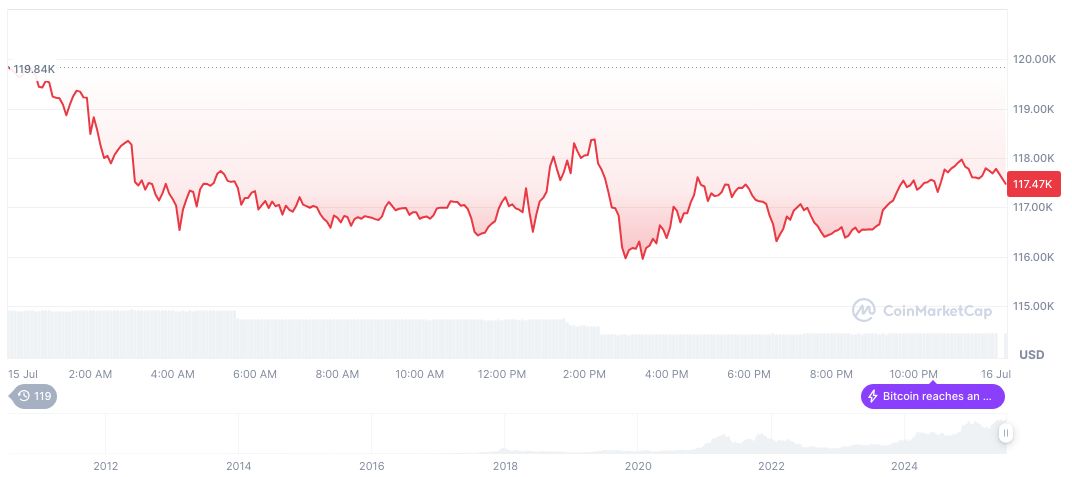

Based on CoinMarketCap data, Bitcoin (BTC) is valued at $117,184.81 with a market cap of $2.33 trillion. Recent price movements include a 7.77% increase over seven days and a 39.33% rise in 90 days, despite a slight 0.75% decrease in the past 24 hours. With a significant market presence, BTC dominates the crypto market with a 62.93% share. Insights from Coincu suggest that institutional investment trends indicate a maturing market, as financial entities integrate digital assets amidst evolving regulatory frameworks. The potential regulatory clarity during “crypto week” in Congress bolsters confidence in the long-term adoption and investment strategies within the crypto sector.

Brandon Lutnick, Chairman, Cantor Fitzgerald, remarked, “Cantor Fitzgerald’s entry into the Bitcoin market with this acquisition signals our commitment to leading institutional investments in crypto.”

Market Analysis and Future Outlook

Did you know? Cantor Fitzgerald’s move resembles MicroStrategy’s strategy, with corporate treasuries increasingly viewing Bitcoin as a viable asset.

As Bitcoin continues to attract institutional interest, analysts predict that Cantor Fitzgerald’s acquisition could lead to further price increases and market stability, reinforcing Bitcoin’s position as a leading digital asset.

Experts believe that this acquisition is a significant indicator of the growing acceptance of Bitcoin among traditional finance entities, potentially paving the way for more institutional investments in the future.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348899-cantor-fitzgerald-bitcoin-acquisition-deal/