Bitcoin’s price faced rejection at its December range-high area of $94k-$96k, capping its January rebound. This, after the early 2026 recovery was marked by strong institutional inflows of over $1 billion. These inflows drove the price of BTC from $87.5k to $94.7k.

However, at press time, the bulls had failed to break out of December’s sideways structure.

In fact, Bitcoin had dropped to $90k, driven by a liquidity hunt. According to trader Cryp Nuevo’s projections, an extended correction to the lows of $80k might also be feasible.

Source: Cryp Nuevo/X

Analysts’ views on BTC recovery

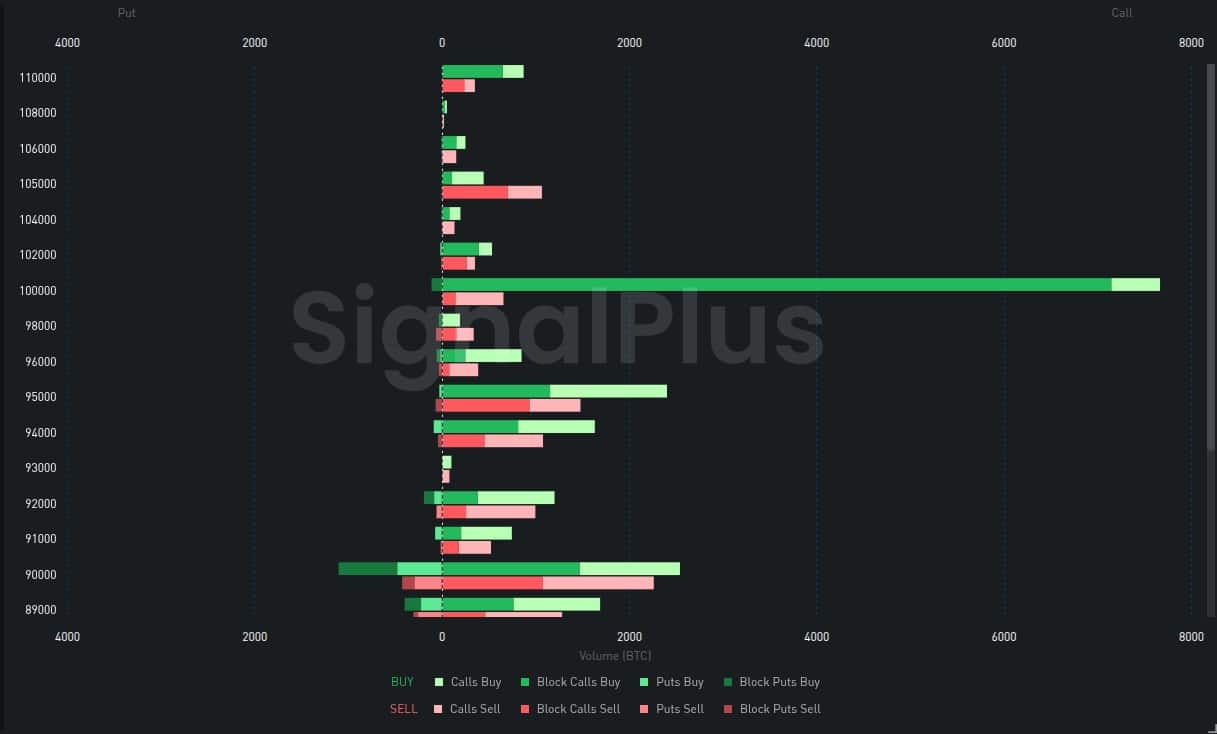

Although such an outlook would slow a breakout chance to $100k, institutional players might be increasingly positioned for the psychological level.

According to Jake Ostrovskis, Head of OTC markets at Wintermute, recent positioning signalled an “early Q1 relief rally.” He stated,

“The bid for topside continues, with an additional $13m paid overnight for 27FEB $100k calls and 30JAN $98k calls. Fresh positioning is building into the new year, with direction of travel pricing in a Q1 relief rally.”

Source: Jake Ostrovskis/X

Put differently, there seemed to be renewed expectation of a bullish breakout (demand for calls) to $98k-$100k in January or February.

Other analysts have been predicting a bullish recovery based on historical and correlation data.

For example, Matt Mena, a Crypto Research Strategist at 21Shares, told AMBCrypto that 2026 will likely be positive, given the dismal results in 2025. He said,

“Historically, in the last 15 years, Bitcoin has never recorded two back-to-back down years.”

For him, BTC could become the best-performing asset this year after lagging behind top assets in 2025. He added,

“Furthermore, following a year where crypto is one of the worst-performing assets, it is typically the best-performing asset in the following year – a pattern seen in 2014 & 2015, 2018 & 2019, and 2022 & 2023.”

For his part, Farzam Ehsani, CEO of VALR crypto exchange, foresees sustained capital inflows into BTC if gold and silver rallies completely cool off. According to him, BTC could climb to $130k in Q1 2026, with the current consolidation acting as a potential springboard.

“Bitcoin’s current sideways movement against the backdrop of record-breaking gains in gold and silver resembles a ‘calm before the storm’ typically followed by a broader crypto market rally.”

Odds of regaining $100k

Here, it’s worth pointing out that the market has higher expectations of reclaiming $100,000 in March and April, compared to January. This seemed to be in line with Ostrovskis’ Options insights too.

Source: Kalshi

Some of the key bullish catalysts would be the passage of the crypto bill and a “reasonable equity market,” according to Bitwise CIO Matt Hougan. On the contrary, blow-ups such as the 10 October crash could dent the positive 2026 outlook.

Final Thoughts

- A potential breakout from BTC’s price range to $100k might be on the cards by the end of January or February, according to some analysts.

- Others believe BTC could print a record high of $130k in Q1 2026.

Source: https://ambcrypto.com/can-bitcoins-price-rally-swiftly-to-100k-in-january-2026/