- California state pension funds have substantially increased their Bitcoin exposure.

- Held $276M in Strategy stock, indicating institutional confidence.

- U.S. pension funds position cryptocurrency as a strategic investment.

Industry analysts are closely monitoring related movements in both Bitcoin and Strategy shares, suggesting confidence in escalated cryptocurrency adoption.

Coincu research insights suggest these purchases by pension funds could further pave the way for regulatory clarity and adoption. As Bitcoin’s status as an asset class strengthens, institutional endorsements are anticipated to drive long-term stability.

CalSTRS and CalPERS Make Major Bitcoin-Linked Acquisition

California’s largest pension funds, CalSTRS and CalPERS, have confirmed a combined $276 million acquisition in Strategy shares. This strategic move follows detailed exchanges among pension fund managers to enhance portfolio diversity with Bitcoin exposure. Strategy, formerly MicroStrategy, is a recognized institutional Bitcoin vehicle, led by Michael Saylor. The funds’ acquisition is seen as a validation of Bitcoin’s potential, following prior investments by other states, including Wisconsin and Illinois.

Market sentiment remains optimistic, with key figures like Michael Saylor emphasizing institutional momentum. On X, Saylor commented:

Institutional capital continues to embrace Bitcoin as a strategic treasury reserve asset.

Bitcoin’s Rise as Institutional Asset Class

Did you know? California pension funds now lead U.S. states in indirect Bitcoin investment through public equity proxies, marking a significant step in institutional acceptance.

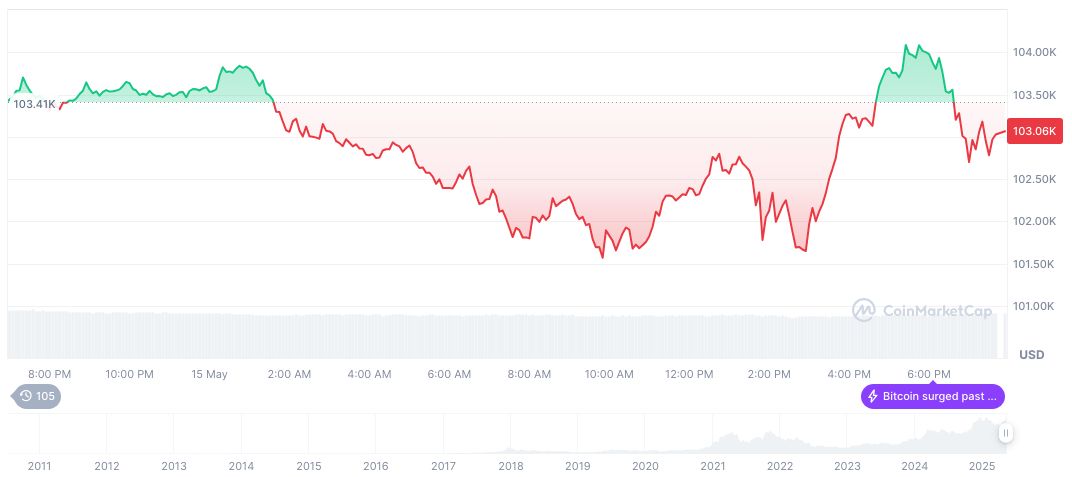

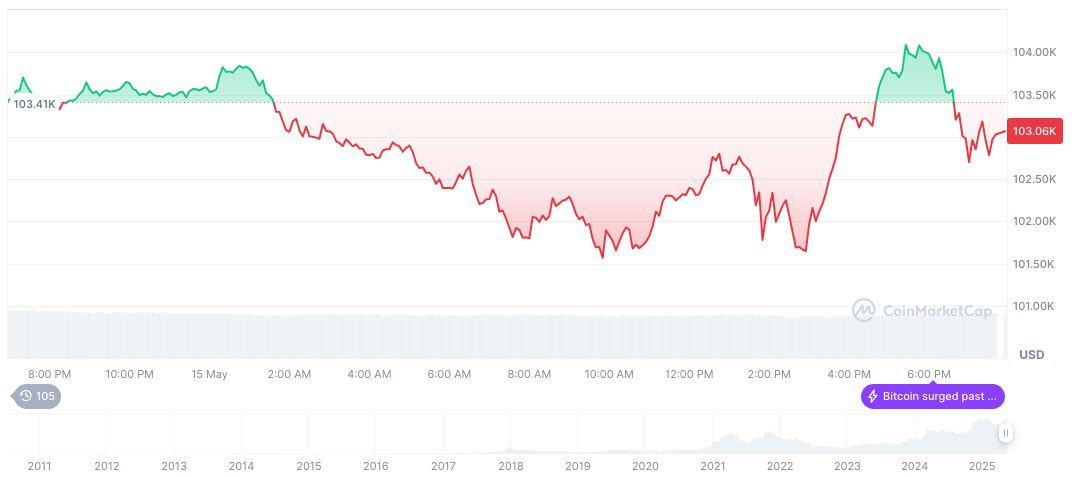

Bitcoin (BTC), as of May 16, 2025, holds a price of $104,121.12 with a market cap of $2.07 trillion, according to Coincu research insights. Dominating the market at 62.16%, Bitcoin’s value changed by 1.22% over the past 24 hours, continuing its steady upward trend.

Coincu research insights suggest these purchases by pension funds could further pave the way for regulatory clarity and adoption. As Bitcoin’s status as an asset class strengthens, institutional endorsements are anticipated to drive long-term stability.

Source: https://coincu.com/337866-california-pension-funds-bitcoin-strategy/