- An analyst has predicted that Bitcoin (BTC) could record a 30% correction before “charging” towards $100k.

- Meanwhile, another analyst believes that a renewed inflow of spot Bitcoin ETFs and MicroStrategy’s Bitcoin acquisition strategy could fuel a price surge to a new all-time high.

Bitcoin’s (BTC) effort to reach $100k was recently met with a sudden broad market liquidation, forcing the asset to take a nosedive to $90k on November 26. However, the asset was steadily climbing up the price curve at press time, recording a 2% surge on its 24-hour chart and a 0.44% surge on the weekly chart.

Analyst Says Bitcoin Could Pull Back

Subjecting BTC to technical analysis, the chief analyst at Bitget Research, Ryan Lee, pointed out that the asset could witness a 30% correction before breaching the $100k resistance level.

In its bid to cross the psychologically important $100,000 price level, investors will need to deal with intense corrections. Historical data trends show that Bitcoin may still correct as much as 30% before it reaches its cyclical top.

Analyzing this thesis, we observed that a 30% correction from the top implies that Bitcoin could decline to $70,000. Meanwhile, multiple analysts believe that any “pullback” recorded on the “journey” to $100k would be temporal. One of them is the author and intergovernmental blockchain expert, Anndy Lian. According to him, the $100k mark is “more than a price point.” Per his observation, this symbolizes a rising trust in decentralized finance and a testament to significant adoption.

Bitcoin reaching $100,000 isn’t just a milestone; it’s a testament to the growing trust in decentralized finance and the relentless pursuit of financial sovereignty. As global adoption accelerates and institutional interest deepens, the $100,000 mark symbolizes not just a price, but a paradigm shift in how we perceive and utilize money.

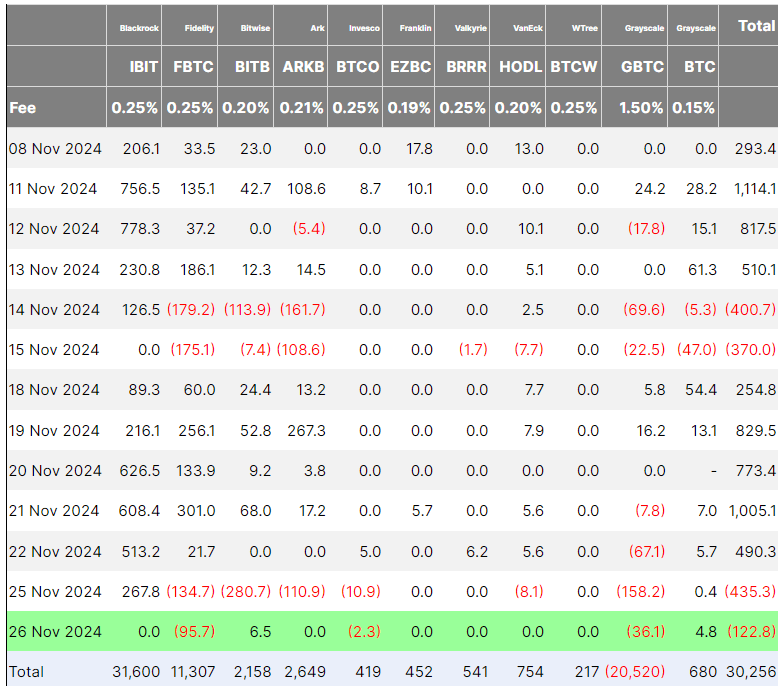

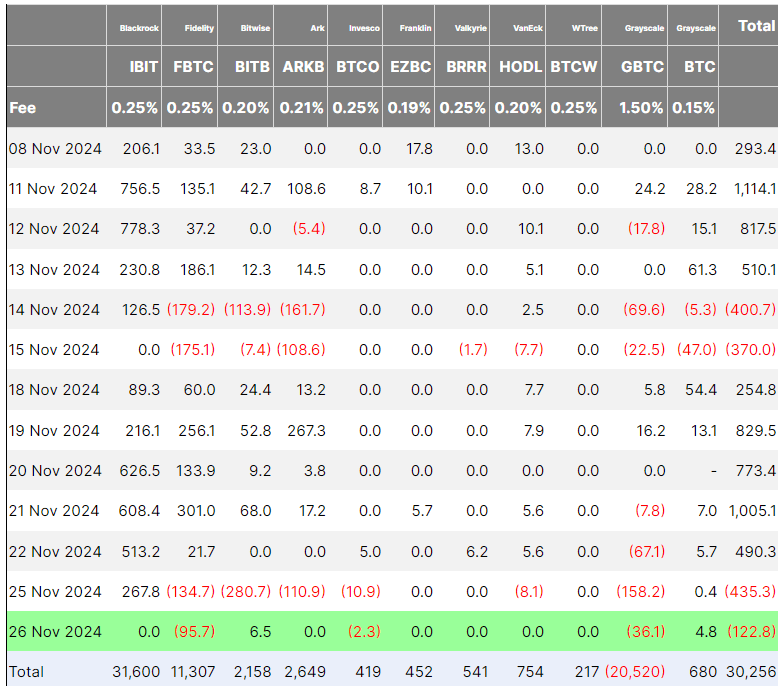

Meanwhile, the spot Bitcoin Exchange-Traded Fund (ETF) performance in the US has been sluggish, contributing to the recent market corrections.

More on the Bitcoin Price Analysis

According to our research, the spot Bitcoin ETFs recorded two-day straight negative outflows, with a cumulative figure of $122 million on November 26. Based on data, this level of “sluggishness” is common at the end of the month. This implies that a resurgence in ETF buying pressure could position Bitcoin for another rally to target the $100k level.

According to a Bitfinex analyst, the current market pullback is normal. In agreement with the Bitget analyst, he hinted that Bitcoin’s correction could be up to 20%. However, the recent sale of MicroStrategy’s $2.6 billion note and a possible resurgence of ETF buying pressure could “send” Bitcoin to a new all-time high in 2025.

Now that ETF flows appear to have hit a bump in the road and MicroStrategy purchases seem to have paused, it is quite normal for the price to undergo some correction and seek out a new supply-demand equilibrium as marginal buying ends.

Delving into MicroStrategy’s latest sale, we discovered that the company is offering $1.75 billion aggregate principal amount of notes to support its Bitcoin purchases.

Recommended for you:

Source: https://www.crypto-news-flash.com/btc-set-for-30-dip-before-100k-breakout-experts-weigh-in/?utm_source=rss&utm_medium=rss&utm_campaign=btc-set-for-30-dip-before-100k-breakout-experts-weigh-in