Market veteran Peter Brandt has shared his perspective on Bitcoin long-term outlook, sharing his top target for the premier crypto asset.

Brandt’s analysis comes at a time when Bitcoin is facing uncertainty, as it battles to maintain the STH cost basis, as discussed by Glassnode. The report draws attention to Bitcoin’s historical price patterns, particularly after the halving cycles.

Bitcoin’s Macro Picture

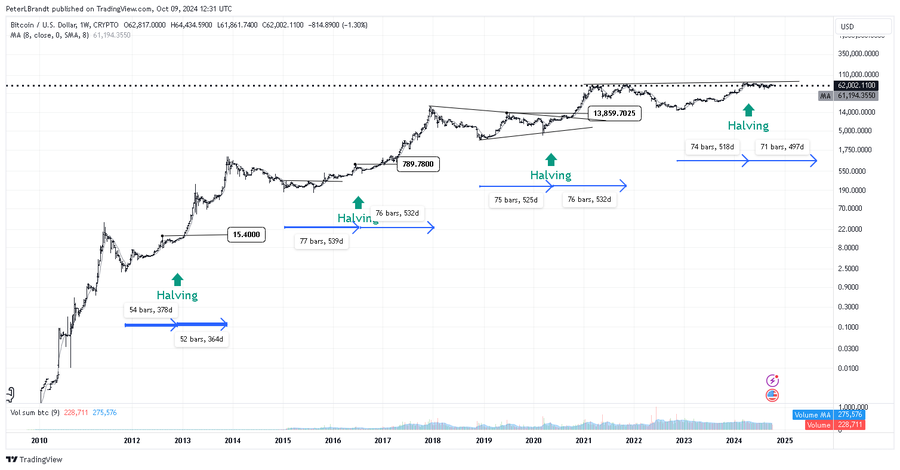

In an accompanying chart, he showed Bitcoin’s price behavior during halving cycles, which have triggered substantial price gains. As the chart revealed, Bitcoin’s price surged after each halving event. Brandt emphasized that the most significant gains usually come in the latter half of each halving cycle.

The chart marks three previous halving events, each followed by notable upward trends in Bitcoin’s price. Brandt believes that the period after the latest halving, which occurred in April 2024, is a brief pause rather than a deviation from the overall bullish trend.

For context, in all its having cycle history, Bitcoin had not clinched a new all-time high before the halving during a bull market. This occurred in the ongoing cycle, which BTC clinching a new ATH above $73K in March.

The new trend has led to speculation that the current market cycle might be different from others, with Bitcoin unable to record more bullishness after the halving. Previously, Brandt also had the opinion that BTC might not see higher prices this cycle.

Now, with a renewed perspective, he expects Bitcoin to follow its historical pattern and resume a strong upward trajectory. His analysis sets a clear price target of $135,000 for Bitcoin, projected to be reached around August or September 2025.

Brandt’s chart suggests that this target is in line with previous post-halving cycle price gains, where Bitcoin reached new all-time highs after each halving.

However, he also called attention to an important level of support. Brandt warned that a price drop below $48,000 would invalidate his bullish outlook, signaling a potential trend reversal and negating his target of $135,000. BTC currently trades for $61,747, down 2% this month.

Bitcoin vs. Gold

In a subsequent chart, Brandt compared Bitcoin to gold, measuring their relative value through the BTC/Gold (XAU) ratio. According to the analyst, Bitcoin has outperformed gold in recent years.

Bitcoin or Gold $BTC vs $XAU

Which is king of the store of value story?

-Bitcoin is kicking Gold’s arse

-Resistance at 32 to 1

-Currently at 23 to 1

-Support in high teens to 1

-New ATH sets target at 100+ to 1

-Bayesian analysis at 30% that market rolling over for good pic.twitter.com/lIygUnG7T1— Peter Brandt (@PeterLBrandt) October 9, 2024

Brandt noted that Bitcoin has encountered resistance at 32 ounces (oz). This occurred in March amid Bitcoin’s rally to the $73K all-time high. Since then, BTC has dropped against gold, with the price sitting at 23.69 XAU.

According to Brandt, Bitcoin now relies on support in the high teens. Interestingly, the analyst suggests that Bitcoin could see a new all-time high target of over 100 oz in the foreseeable future. This outlook aligns with his macro picture for BTC, which sees greater gains.

However, Brandt is cautious, applying Bayesian analysis to suggest a 30% probability that Bitcoin’s recent performance against gold might indicate a market top. This suggests Bitcoin is still capable of losing some ground to gold if the market begins to roll over.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/10/09/brandt-shares-his-bitcoin-macro-picture-targeting-135k-as-cycle-top/?utm_source=rss&utm_medium=rss&utm_campaign=brandt-shares-his-bitcoin-macro-picture-targeting-135k-as-cycle-top