Bitcoin [BTC] officially closed 2025 with an annual loss of 6.2%, underperforming other asset class, such as gold and the S&P 500, which posted gains of 62% and 16%, respectively.

Ahead of the new year’s rebalancing by key players, there has been an increasing sense of caution and bearish sentiment. Hedging activity also surged, as Bitcoin’s downside protection eyed a range of $75K-$80K in January.

However, Bo Hines, Tether’s strategic advisor and former White House executive on digital assets, warned bears against shorting BTC in 2026.

“Anyone bearish on Bitcoin heading into 2026 is foolish.”

The likely passage of the crypto market structure bill and the appointment of the new Fed chair are viewed as bullish catalysts for 2026.

Even the short-term price action suggested a potential bottoming phase, but the mid-term outlook remained mixed for the crypto asset.

Is Bitcoin’s bottom really in?

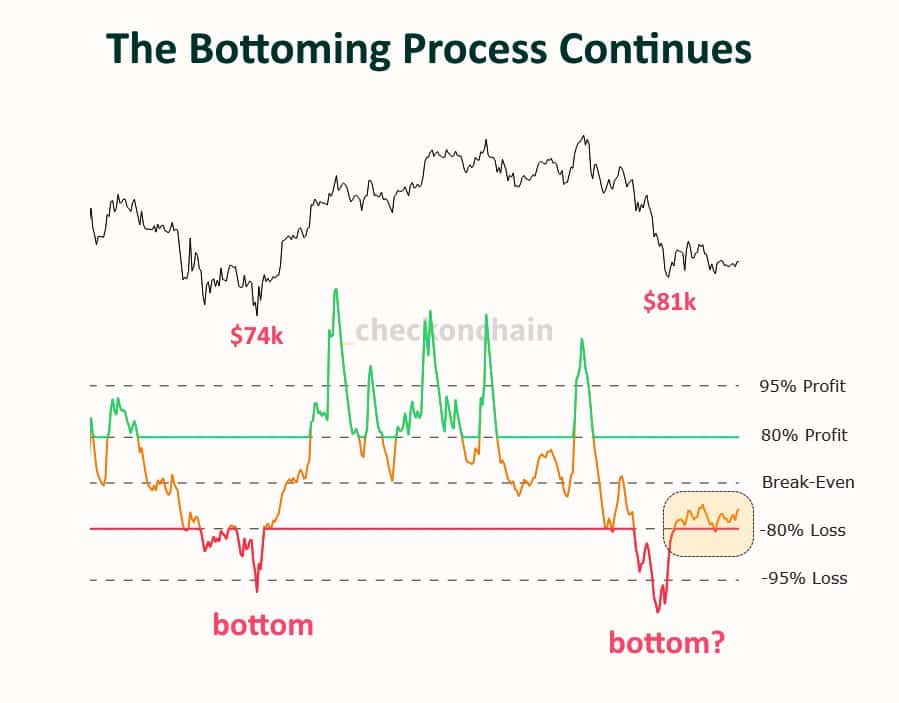

From an on-chain perspective, the BTC bottoming process was underway, according to analyst Frank Fetter.

Frank cited the easing of the short-term holder supply ratio and recovery towards ‘break-even’, which marked past bottoms.

Source: Checkonchain

The first sign of potential would be decisively reclaiming the STH realized price, which was $87.5K at the time of writing. This would reduce panic sell-off at a loss by STH or investors who have held BTC for less than five months.

However, institutional inflows have not steadied. The U.S. spot ETFs attracted $355 million in daily net inflows on the 30th of December.

This marked the first time of inflow after seven consecutive days of outflows. But the trend was reversed again after another $348 million outflow on New Year’s Eve.

Collectively, the BTC demand, including that of BTC treasury firms, has dropped significantly and could turn negative if the contraction persists, warned Julio Moreno, head of research at CryptoQuant.

Such a negative flip would drag BTC price lower.

Source: CryptoQuant

Meanwhile, it’s unclear whether the crypto asset will hold and extend its current price range of $85K-$90K in the short-term.

In the mid- to long-term outlook, analysts’ projections are split, with bulls, such as Grayscale and Bitwise, calling for a new all-time high in 2026.

On the other hand, Galaxy Research and other analysts have adopted a conservative and cautious stance, noting that 2026 may be too “chaotic to predict.”

Final Thoughts

- Former White House expressed a bullish outlook for BTC in 2026 and downplayed bears as ‘foolish.’

- While the bottoming phase was still ongoing, the demand front didn’t suggest a likely reversal in the near term.

Source: https://ambcrypto.com/bo-hines-anyone-bearish-on-bitcoin-heading-into-2026-is-foolish/