BlackRock, the world’s largest asset manager by assets under management, recently recommended Bitcoin allocation by including the asset in its model portfolios.

The prominent asset manager has been big on Bitcoin and its rare qualities. Now, it has taken another step in promulgating the pioneering cryptocurrency by recently adding it to its model portfolio offerings.

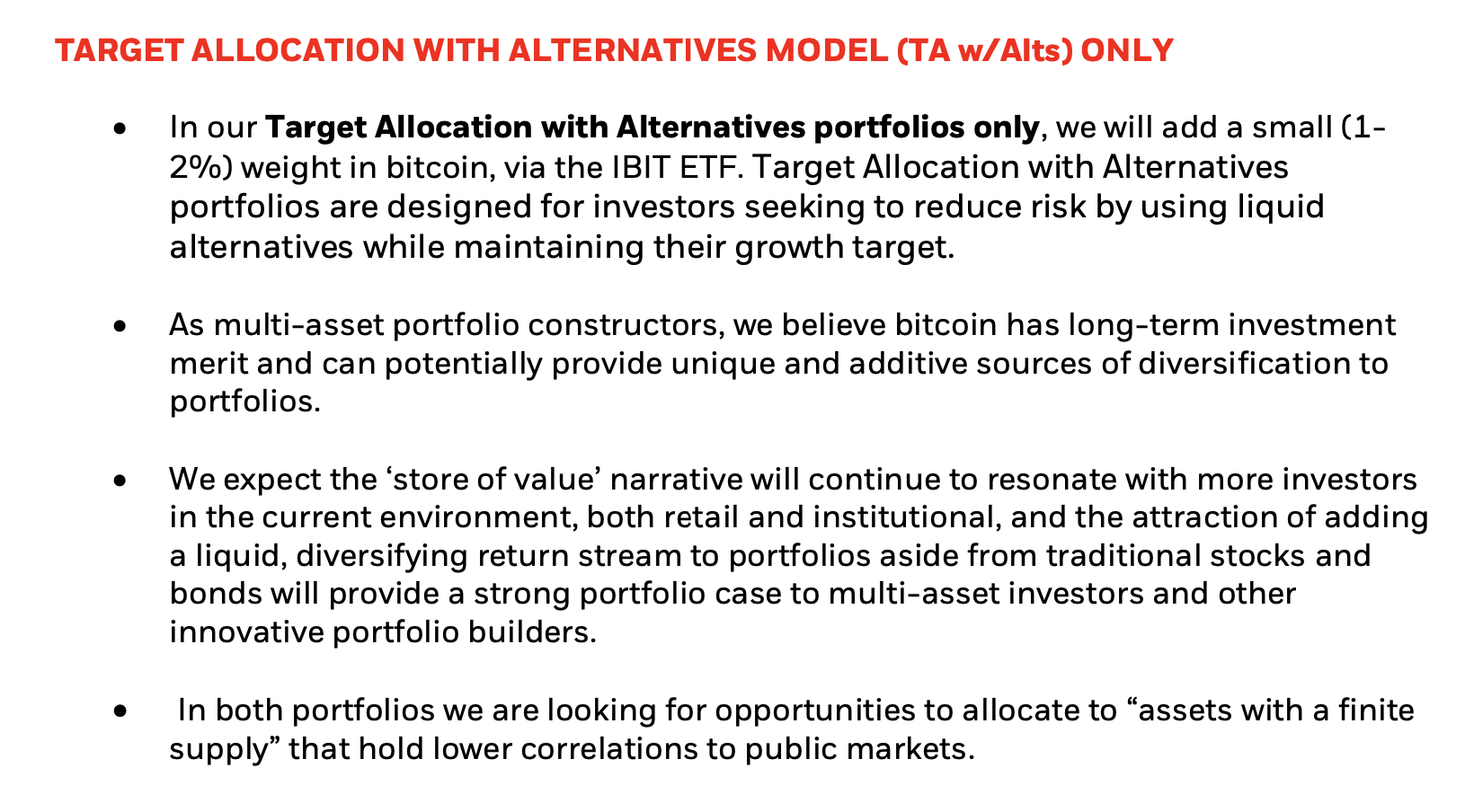

BlackRock confirmed on Friday that it has added the iShares Bitcoin Trust (IBIT)—the fastest-growing fund in ETF history, providing alternative exposure to Bitcoin—to the Target Allocation with Alternatives models.

BlackRock Adds Bitcoin to Institution-Tailored Portfolio Model

For perspective, a model portfolio is a collection of predefined asset allocations tailored to meet clients’ risks and reward objectives. Asset managers alter these portfolios over time according to changing market conditions and clients’ dispositions.

On Thursday, BlackRock added IBIT to the Target Allocation with Alternatives and Target Allocation with Alternatives Tax-Aware portfolios. The asset manager confirmed adding 1% to 2% of the Bitcoin-focused product to the model portfolios.

Michael Gates, the lead portfolio for the BlackRock alternative model portfolio, noted that several theses confirm intrinsic value and long-term investment merits. Some include the asset’s scarce property and track record of hedge against inflation.

As a result, the addition could provide its clients with a higher risk appetite and portfolio growth target exposure to Bitcoin. Notably, this is the first time BlackRock is adding IBIT to any of its model portfolios, a shift teased to spur demand for the ETF.

The Addition Is a Big Deal

Meanwhile, the addition followed BlackRock’s allocation adjustments of its funds on Thursday. The asset manager made several changes to its model portfolios, affixing IBIT for the first time.

Analysis suggests that although the models BlackRock added IBIT to were some of its low-end funds in AUM, it is a big deal for Bitcoin. Brain Rose, the host of London Real, stated that the development looks more significant than it seems.

He noted that BlackRock’s model portfolios guide “billions” of funds as large investors copy them for allocation. Furthermore, he suggested that it could stir other asset managers to pursue a similar ploy, increasing inflows into Bitcoin.

Recall that BlackRock’s head of digital asset research, Robert Mitchnick, stated that the asset manager would focus on attracting institutions and wealth managers to adopt Bitcoin. The addition reflects one means BlackRock looks to use to draw demand for the IBIT.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/03/01/blackrock-recommends-bitcoin-allocation-with-addition-to-its-model-portfolio/?utm_source=rss&utm_medium=rss&utm_campaign=blackrock-recommends-bitcoin-allocation-with-addition-to-its-model-portfolio