BlackRock continued its Bitcoin and Ethereum sell-off today, moving a substantial portion of its assets to crypto exchange Coinbase Prime.

The panic in the cryptocurrency market has intensified, with the Crypto Fear and Greed index dropping to 10, a level last seen in 2022. Notably, the Solana meme coin fallout and Donald Trump’s recent tariff vows have spurred this skepticism.

Notably, the sell-off has spilled over to diamond-handed asset manager BlackRock, which has resumed liquidating its Bitcoin and Ethereum stash. The leading Bitcoin exchange-traded fund (ETF) issuer has had a track record of holding onto its stash despite market downturns until now.

BlackRock Dumps Fresh Bitcoin and Ethereum

Data from Arkham shows that the issuer of the fastest-growing fund in ETF history continued its selling spree today. BlackRock shifted 5,100 BTC ($441 million) and 30,280 ETH ($71.85 million) to the Coinbase Prime deposit address.

The prominent asset manager transferred the Bitcoin in batches of 300 BTC over 17 transactions, starting around 11:15 (UTC) on Thursday. Before then, the address tied to BlackRock had moved 30,280 ETH over four transactions to the same recipient.

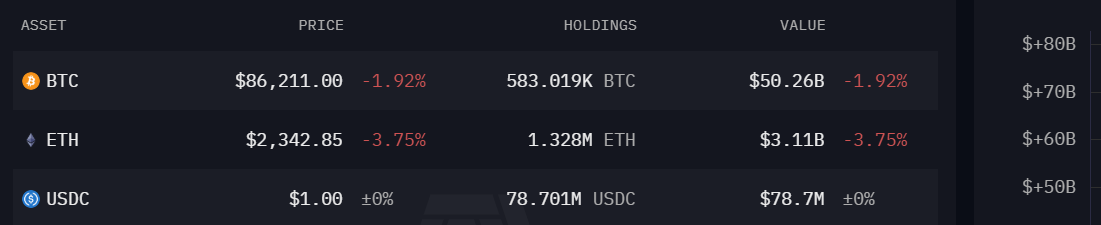

Nevertheless, BlackRock still holds significant amounts of both assets. At the time of writing, the leading asset manager by assets under management (AUM) holds 583,019 BTC ($50.26 billion) and 1.328 million ETH ($3.11 billion).

Other Asset Managers Also Selling

Meanwhile, the sales reflect the outflows recorded in the US Bitcoin and Ethereum spot ETFs. Other asset managers also sold substantial amounts of the assets in the past 24 hours. For context, the Bitcoin products sold $754 million worth of the asset yesterday, with BlackRock leading the dumps.

The BlackRock iShares Bitcoin Trust (IBIT) sold $418 million in BTC yesterday as investors massively withdrew funds from the issuer. Other notable sales came from the Fidelity Wise Origin Bitcoin Fund (FBTC) and the Ark 21 Shares Bitcoin ETF (ARKB), which recorded an outflow of $145.7 million and $60.46 million, respectively.

Moreover, BlackRock’s Ethereum fund (iShares Ethereum Trust) also led outflows in the US Ethereum spot ETFs yesterday, dumping nearly $70 million worth of the asset. Fidelity, Grayscale, and Bitwise saw outflows culminating in a combined $24.5 million.

At the time of writing, Bitcoin trades at $85,712 and Ethereum at $2,329.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/02/27/blackrock-dumps-441m-in-bitcoin-and-71m-worth-of-ethereum-amid-market-sell-off/?utm_source=rss&utm_medium=rss&utm_campaign=blackrock-dumps-441m-in-bitcoin-and-71m-worth-of-ethereum-amid-market-sell-off