The Wall Street giant, BlackRock has released its Bitcoin Whitepaper calling it a unique hedge against global fiscal, monetary and geopolitical risks.

The nine-paged whitepaper is authored by chief officials for digital assets of BlackRock-Samara Cohen, Robert Mitchnick and Russell Brownback.

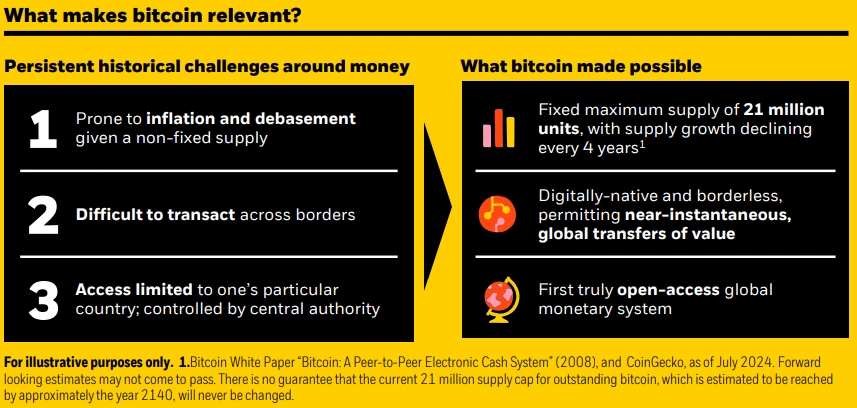

The whitepaper says, “Bitcoin, as the first decentralized, non-sovereign monetary alternative to gain widespread global adoption, has no traditional counterparty risk, depends on no centralized system, and is not driven by any one country’s fortunes. These properties make it an asset that is largely detached (on fundamentals) from certain critical macro risk factors, including banking system crises, sovereign debt crises, currency debasement, geopolitical disruption, and other country-specific political and economic risks.”

The paper also cites two reasons behind Bitcoin’s short term-trading reactions that were negative in the initial stage: a. Bitcoin being a 24×7 tradeable asset makes it a highly saleable asset whenever traditional markets are challenged by stressed liquidity. b. A function of the yet-to-mature nature of bitcoin and crypto asset markets, and of investors’ understanding around bitcoin.

BlackRock said that bitcoin has outperformed all other major asset classes in seven of the last 10 years. However, Bitcoin also had been the worst performing asset in the remaining three of those ten years, with ‘four drawdowns in excess of 50%’, says BlackRock.

The whitepaper ends with a cautionary statement warning readers about bitcoin being a standalone risky asset due to its volatility, uncertainty towards adoption, regulatory challenges, and an immature ecosystem.

Also Read: Pro-Bitcoin Sen. Lummis Reveals Details On Revolutionary Senate Crypto Bill

Source: https://www.cryptonewsz.com/blackrock-bitcoin-whitepaper-btc-unique-hedge/