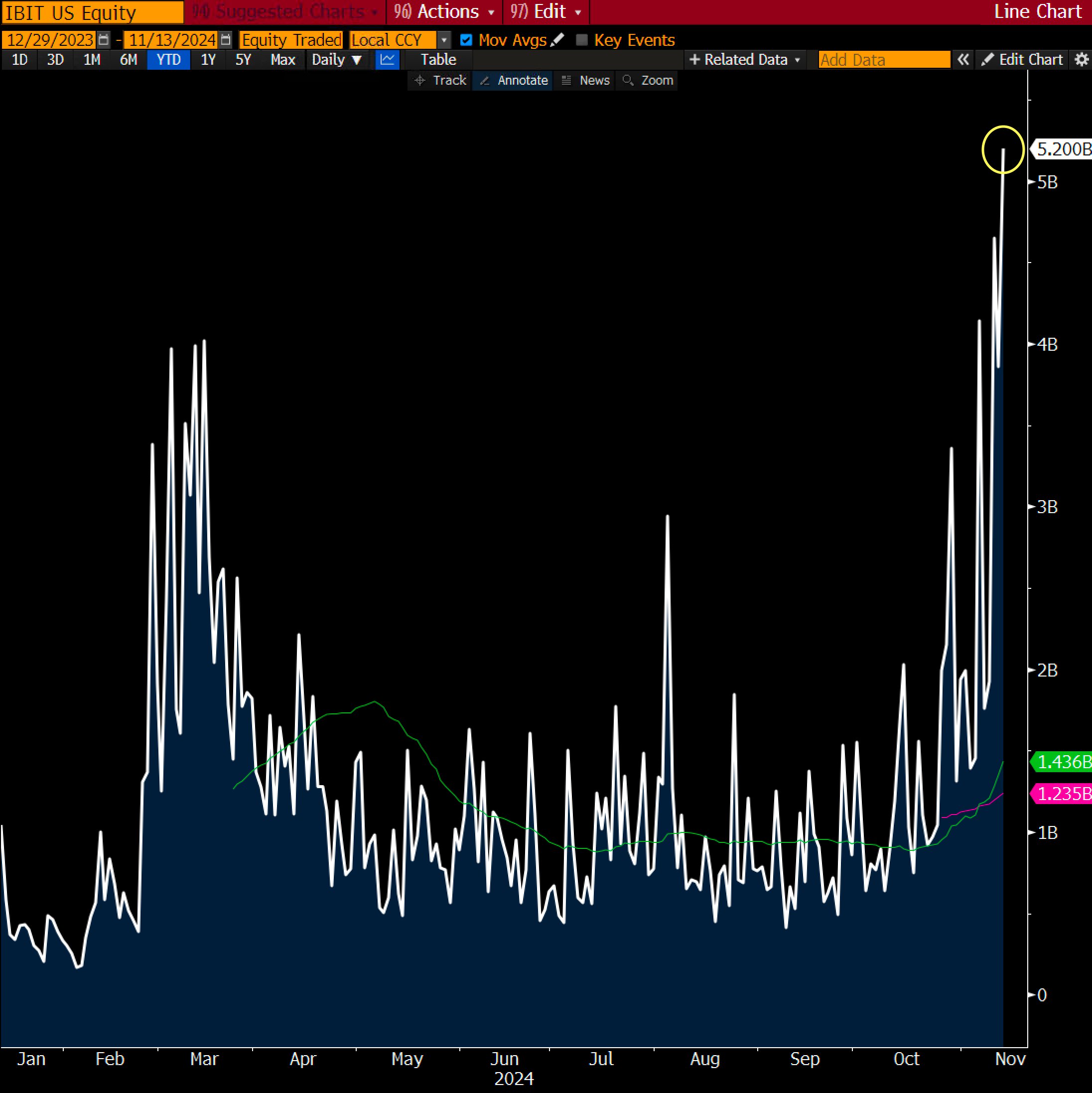

BlackRock’s Bitcoin ETF has seen a record-breaking single-day turnover of $5 billion amid Bitcoin’s ongoing spectacular price rallies.

Bitcoin reached a new all-time high on November 13, hitting $93,477 during late trading. This milestone was accompanied by unprecedented activity in the Bitcoin exchange-traded funds (ETFs) market.

In a post on X, Bloomberg analyst Eric Balchunas revealed that the iShares Bitcoin Trust (IBIT), managed by BlackRock, recorded a $5 billion daily trading volume on Wednesday, surpassing its previous record.

Balchunas noted that only three other ETFs and eight individual stocks saw higher volumes on that day. Over a three-day period, IBIT amassed $13 billion in trading activity, signaling a substantial rise in investor interest.

Other Bitcoin ETFs, such as Fidelity’s FBTC, also saw notable increases in trading volumes, though on a smaller scale.

Meanwhile, the broader Bitcoin ecosystem has also experienced a surge, with weekly trading volumes hitting $110 billion — an all-time record — with two days still remaining in the trading week.

Spot-Driven Rally and Record Weekly Volumes

The surge in ETF volumes has been attributed to a spot-driven rally, with data showing a muted increase in CME open interest.

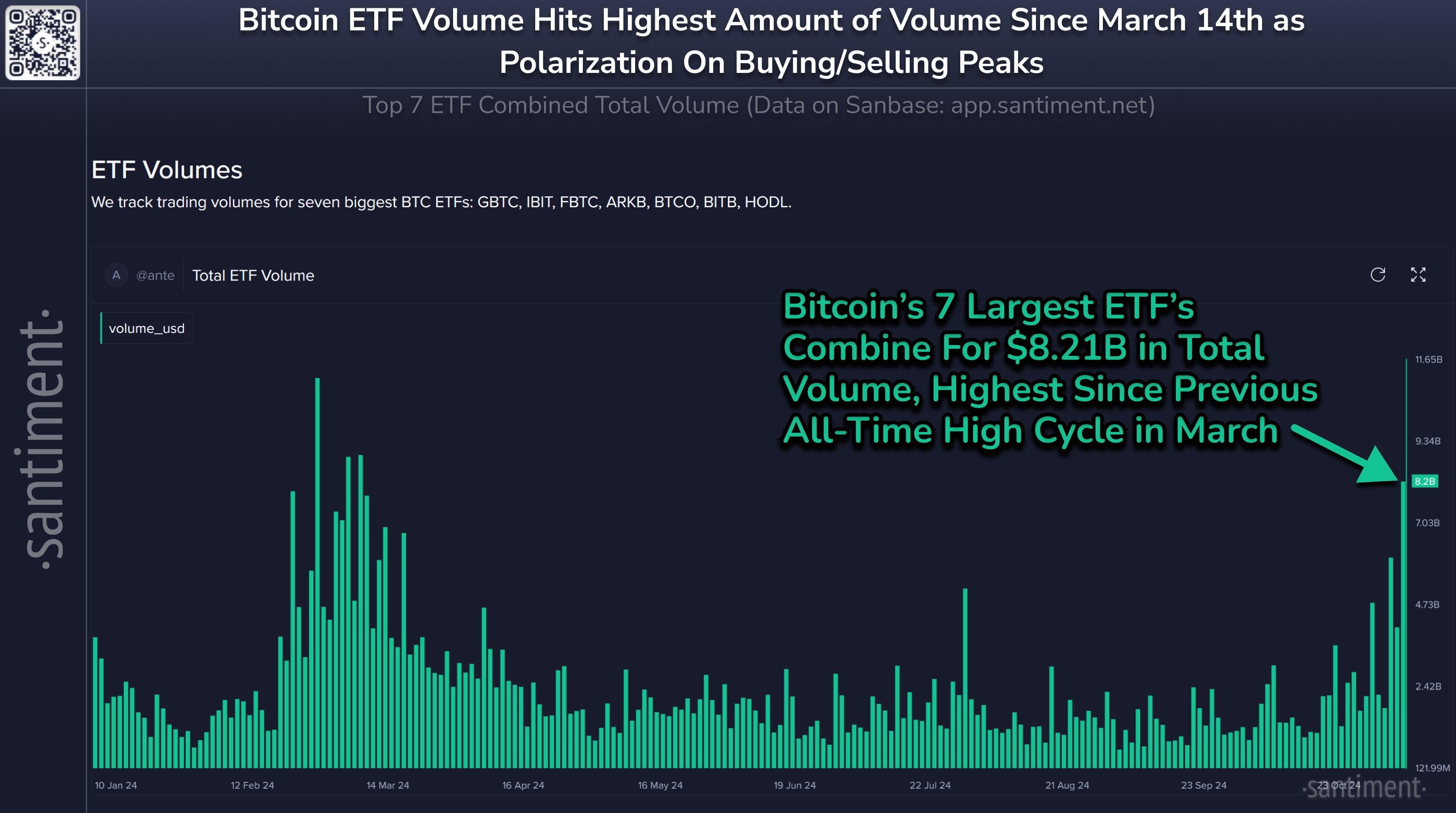

Santiment also highlighted that Bitcoin’s seven largest ETFs collectively saw $8.21 billion in trading volume on November 13, the highest since the March 14 peak when Bitcoin reached $73,700.

According to Santiment, this heightened activity reflects a strong polarity between buyers and sellers. It noted that the current peak may represent a temporary top if historical patterns hold.

BlackRock ETF Leads Inflows

In terms of inflows, BlackRock’s ETF continued to dominate. On November 12, it attracted $778.3 million, significantly outpacing its peers. The following day, IBIT added another $230.8 million. In comparison, Fidelity’s FBTC saw $37.2 million in inflows on November 12 and $186.1 million on November 13.

Other ETFs, including Bitwise’s BITB and ARK’s ARKB, reported smaller inflows over the same period. Year-to-date inflow data shows IBIT leading with $29.15 billion, followed by FBTC at $11.12 billion.

Goldman Sachs’ Exposure to BlackRock Bitcoin ETF

In related news, Goldman Sachs has emerged as a significant player in the Bitcoin ETF market. According to recent SEC filings, the bank holds approximately $418.65 million in Bitcoin ETFs. Its largest position is in IBIT, where it owns nearly 7 million shares valued at $238.6 million.

The bank also reported holdings in several other Bitcoin ETFs, including Fidelity’s Wise Origin Bitcoin Fund and Invesco’s Galaxy Bitcoin ETF. Collectively, these investments underscore Goldman Sachs’ broad-based approach to Bitcoin exposure. Smaller positions in ETFs such as the WisdomTree Bitcoin Fund and ARK’s 21Shares Bitcoin ETF further diversify its portfolio.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/11/14/blackrock-bitcoin-etf-sees-record-breaking-5b-turnover-amid-btc-all-time-high-surge/?utm_source=rss&utm_medium=rss&utm_campaign=blackrock-bitcoin-etf-sees-record-breaking-5b-turnover-amid-btc-all-time-high-surge