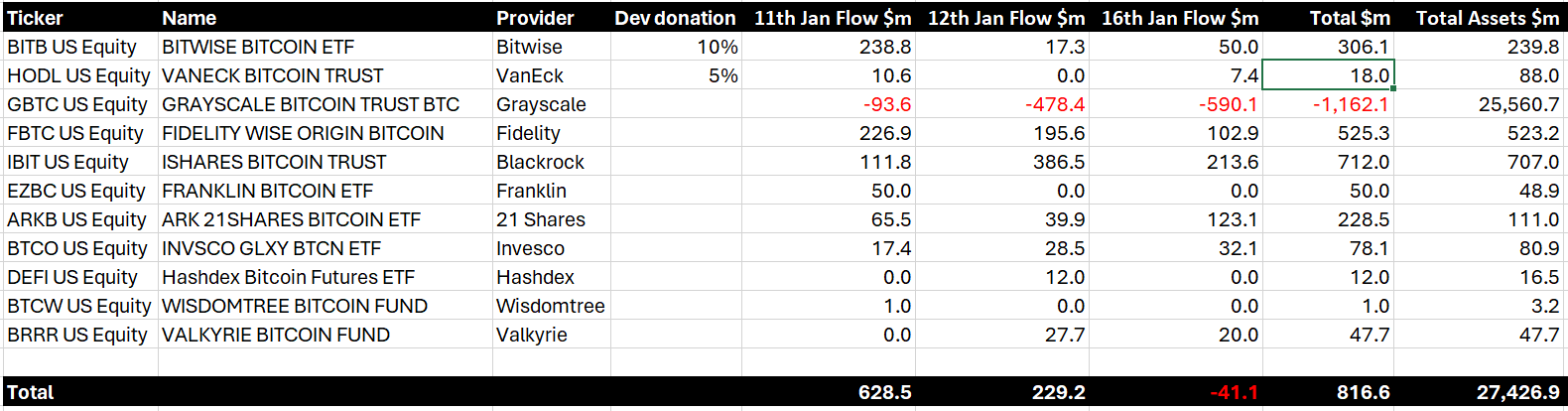

According to a report from BitMEX Research, the spot Bitcoin Exchange Traded Fund (ETF) group experienced significant financial movements on its third day of operation. The group saw a net outflow of $41.1 million, indicating a shift in investor sentiment or strategy.

BitMEX Research Reveals Significant Movements in Spot BTC ETF Group

The report detailed the individual performances of several organizations within the group. Grayscale Bitcoin Trust (GBTC) recorded a net outflow of $590 million, marking a significant withdrawal of funds.

In comparison, BlackRock’s IBIT saw a net inflow of $213.6 million, indicating increased investor interest or confidence in this particular fund. Similarly, Fidelity’s FBTC experienced a net inflow of $103 million.

Another notable performance was 21 Shares’ ARKB, which recorded a net inflow of $123 million.

The cryptocurrency market, particularly in the ETF space, continues to be a dynamic space influenced by a variety of factors, from regulatory developments to broader economic trends.

Investors and industry observers are watching these movements carefully as they make predictions about the evolving landscape of digital asset investments.

*This is not investment advice.

Follow our Telegram and Twitter account now for exclusive news, analytics and on-chain data!

Source: https://en.bitcoinsistemi.com/bitmex-released-a-new-bitcoin-etf-report-which-company-bought-how-much-here-are-the-details/