Bitcoin Analysis

Bitcoin’s price continued its recent ascent on Tuesday and bullish market participants sent BTC’s price higher for a fourth consecutive day. BTC’s price closed Tuesday’s daily session +$65.7.

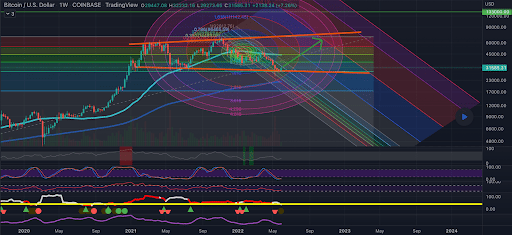

The first chart we’re looking at today is the BTC/USD 1W chart below from perrynoid. BTC’s price is trading between the 1.618 fibonacci level [$28,666.36] and 0.786 [$36,891.54].

The chartist posits that BTC’s price is forming a broadening wedge that dates back to January 2021.

The Fear and Greed Index is 17 Extreme Fear and is +1 from Tuesday’s reading of 16 Extreme Fear.

Bitcoin’s Moving Averages: 5-Day [$30,159.94], 20-Day [$30,958.25], 50-Day [$37,668.64], 100-Day [$39,060.72], 200-Day [$45,772.51], Year to Date [$39,358.79].

BTC’s 24 hour price range is $31,319-$32,227 and its 7 day price range is $28,448-$32,227. Bitcoin’s 52 week price range is $26,600-$69,044.

The price of bitcoin on this date last year was $36,672.7.

The average price of BTC for the last 30 days is $31,713 and BTC’s -15.7% over the same duration. Bitcoin dominance closed Tuesday at 47.7%.

Bitcoin’s price [+0.21%] closed its daily candle worth $31,792 on Tuesday.

Ethereum Analysis

Ether’s price had its lowest monthly candle close since March of 2021 on Tuesday and also closed its daily session -$56.52.

The next chart we’re looking at today is the ETH/USD 1D chart below by ansfar. Ether’s price is trading between the 0 fib level [$1,709.34] and 0.236 [$2,149.27], at the time of writing.

Bullish traders are trying to regain the $2k level firstly with a secondary target of 0.236 followed by 0.382 [$2,421.44]. The next target to the upside for bullish ETH traders is 0.5 [$2,641.41].

Conversely, bearish traders are looking to push ETH’s price down to retest a full retracement at the 0 fib level and then the $1,700 level.

Ether’s Moving Averages: 5-Day [$1,886.90], 20-Day [$2,122.43], 50-Day [$2,713.04], 100-Day [$2,769.00], 200-Day [$3,303.83], Year to Date [$2,812.74].

ETH’s 24 hour price range is $1,934.43-$1,999.54 and its 7 day price range is $1,724.88-$2,016.43. Ether’s 52 week price range is $1,707-$4,878.

The price of ETH on this date in 2021 was $2,633.30.

The average price of ETH for the last 30 days is $2,188.41 and ETH’s -27.26% over the same timespan.

Ether’s price [-2.83%] closed its daily candle on Tuesday worth $1,941.78 and snapped a streak of three straight days in green figures.

Cardano Analysis

Cardano’s price rallied over 9% on Tuesday and market participants witnessed ADA markup in price +$0.0559 per unit.

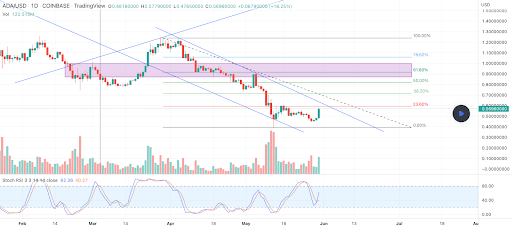

The third chart we’re analyzing today is the ADA/USD 1D chart below from Hirushan. ADA’s price is trading between the 23.60% fib level [$0.591] and 38.20% fib level [$0.717], at the time of writing.

The first target overhead for bullish traders is 38.20% followed by 50.00% [$0.817], and 61.80% [$0.916]. If bearish traders manage to retest those levels it will clearly nullify the larger downtrend at least for the interim.

Bearish traders alternatively are looking to push Cardano’s price back below the 23.60% fib level and then test a full retracement at 0.00 [$0.392].

Cardano’s Moving Averages: 5-Day [$0.52], 20-Day [$0.58], 50-Day [$0.83], 100-Day [$0.92], 200-Day [$1.43], Year to Date [$0.94].

Cardano’s 24 hour price range is $0.578-$0.679 and its 7 day price range is $0.451-$0.679. Cardano’s 52 week price range is $0.040-$3.09.

Cardano’s price on this date last year was $1.73.

The average price of ADA over the last 30 days is $0.599 and ADA’s -16.7% over the same time frame.

Cardano’s price [+9.81%] closed its daily session worth $0.625 on Tuesday and in green figures for a fourth consecutive day.

Source: https://en.cryptonomist.ch/2022/06/01/bitcoins-price-straight-green/