Key Takeaways

What’s next for Bitcoin’s price trajectory?

Bitcoin could be exiting its pre-parabolic phase after three years, with a promising rally ahead.

Is there an accumulation trend in play right now?

Inactive supply continues to climb as exchange reserves drop, hinting at ongoing accumulation.

Bitcoin [BTC] has struggled to perform on the price charts recently, oscillating around the $100,000-zone for weeks.

However, recent market dynamics suggest that this consolidation could be ending soon, with Bitcoin poised for a significant rally in the coming weeks.

Bitcoin in a pre-parabolic phase?

Market analyst TechDev noted in a recent analysis that Bitcoin may be nearing the end of its pre-parabolic phase.

The pre-parabolic phase is a period when the asset builds momentum ahead of a major rally. According to chart data, Bitcoin has been in this phase since 2022. This indicator has historically predicted bull and bear markets with strong accuracy.

Source: X

The aforementioned chart also highlighted that the “business cycle signal,” which tracks the start of different market phases, has reached a level that could signal the potential for a major price swing.

While Bitcoin’s price had fallen below $100k at press time, these findings alluded to a semblance of rising bullish sentiment across the market.

Exchange reserves drop, inactive Bitcoin supply rises

That’s not all though as Bitcoin reserves across centralized exchanges (CEXs) dropped sharply too. At the time of writing, the amount of Bitcoin available on exchanges had fallen to 2.38 million – An all-time low.

A sharp decline in exchange reserves usually means that investors are moving their Bitcoin into private wallets for long-term holding, while reducing the supply available for selling.

Source: CryptoQuant

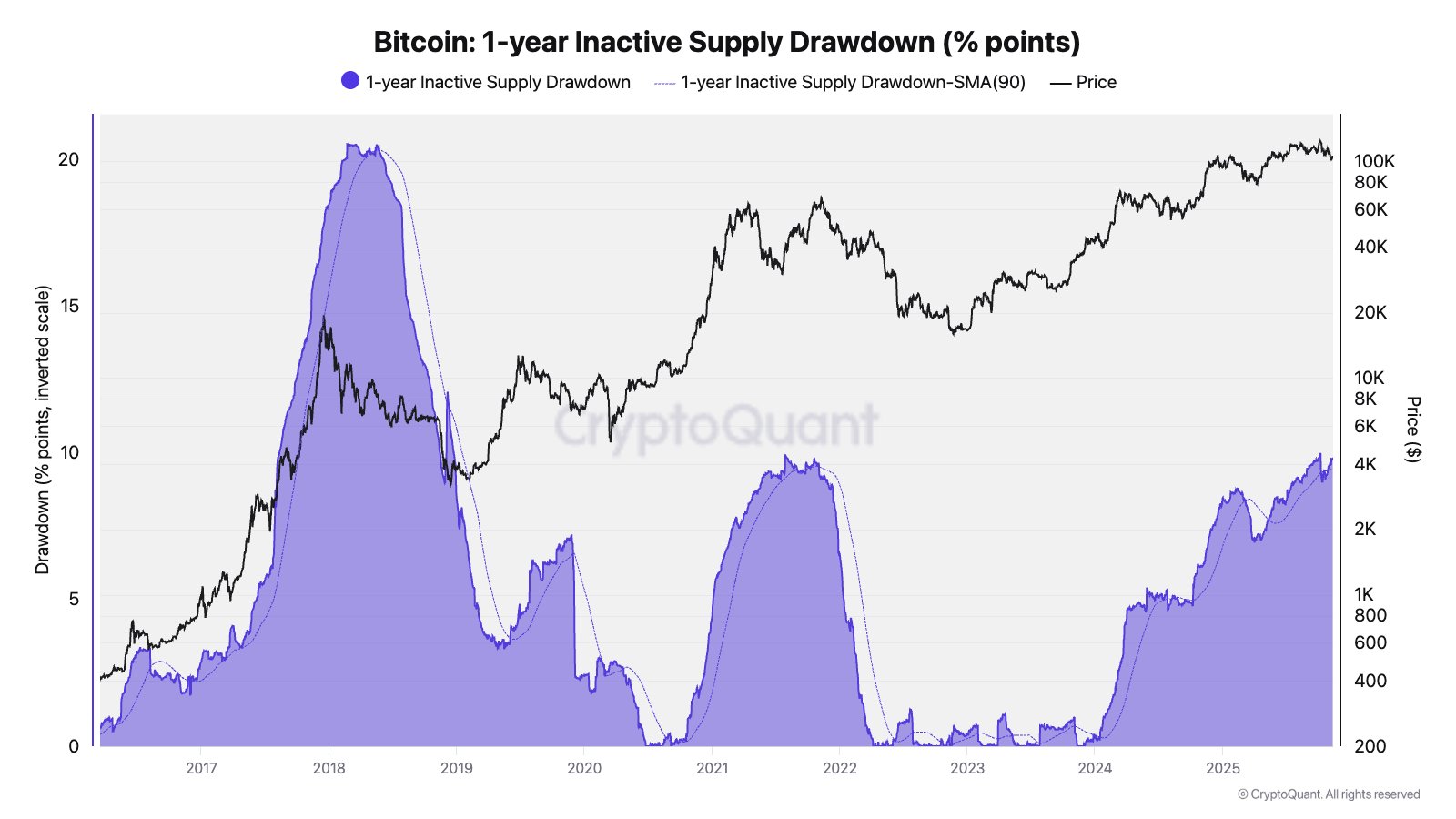

Bitcoin’s one-year inactive supply data also revealed a pattern – Every time the market goes parabolic, inactive supply increases notably.

In 2017 and 2021, during major rallies, the inactive supply rose by 20% and 10%, respectively. Between 2024 and 2025, inactive Bitcoin supply climbed by another 10%, with the same continuing to trend upwards now.

What this means is that more investors are holding onto their Bitcoin, a trend that could tighten supply and drive the price higher.

What are long-term holders doing?

Finally, market data revealed that long-term holders have been gradually offloading some of their assets.

This trend was confirmed by the high Coin Days Destroyed (CDD) value, indicating that long-term holders are moving their coins – Often a sign of selling.

Source: CryptoQuant

Chris Kuiper, Vice President of Research at Fidelity Digital Assets, acknowledged this in a recent post. He noted,

“October’s strong seasonal pattern didn’t hold up, and as the calendar year closes, long-term holders are making year-end tax and positional changes, taking profits where they can.”

However, this might not necessarily spell trouble for Bitcoin. Jeff Park, an investment advisor at Bitwise, is urging investors to see volatility as an opportunity. According to the exec,

“Volatility is coming. Buy Bitcoin.”

Large price swings are often influenced by macro and institutional factors. Maria Carola, CEO of StealthEx, told AMBCrypto,

“The crypto market’s rebound reflects traders positioning for a more normalized macro environment after several weeks of liquidity stress.”

To put it simply, for many investors, the sentiment remains bullish – With a potential rally in sight.

Source: https://ambcrypto.com/bitcoins-price-falls-below-100k-but-a-major-rally-could-be-next-reasons/