- Steven McClurg forecasts potential Bitcoin surge due to institutional demand.

- BTC may reach $150,000 before entering a bear market.

- Ethereum could face competition from newer, faster blockchains.

Canary Capital CEO Steven McClurg predicts Bitcoin could hit $140,000–$150,000 in 2023, citing growing ETF demand and institutional investments, according to an August 17 report.

As Bitcoin’s potential surge draws attention, concerns arise for Ethereum’s future, which McClurg views as outdated amid competition from newer blockchains like Solana and Sui.

Bitcoin Trends and Market Dynamics

Did you know? Bitcoin’s potential rise to $150,000 this year would mirror patterns seen during prior ETF booms, sparking similar historical momentum followed by corrections.

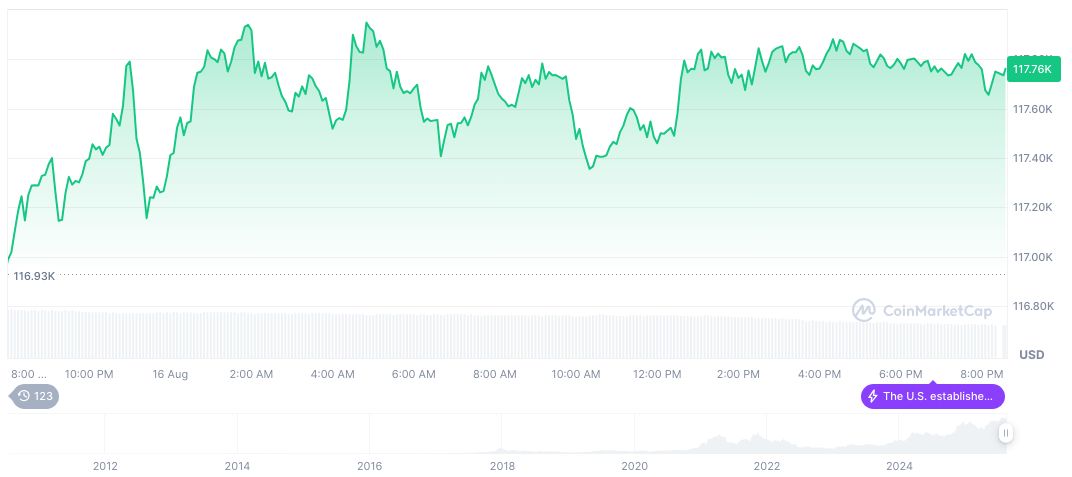

CoinMarketCap indicates Bitcoin’s current price at $117,390.96, with a market cap of $2.34 trillion. Over the last 60 days, Bitcoin saw a 12.41% rise, despite a recent 0.20% daily dip. The circulating supply stands at 19,907,381 BTC, updated Aug 17, 2025.

Insights from the Coincu research team suggest potential regulatory pressures as government bodies adjust to the evolving crypto landscape. Technological advancements in newer blockchains might challenge Ethereum, precipitating shifts in market dynamics. McClurg’s stance on Ethereum is clear: “I don’t like Ethereum simply because it’s an old technology…new blockchains like Solana and Sui have surpassed it. I expect Ethereum to gradually decline and not reach new all-time highs.”

Market Insights

Did you know? Bitcoin’s potential rise to $150,000 this year would mirror patterns seen during prior ETF booms, sparking similar historical momentum followed by corrections.

CoinMarketCap indicates Bitcoin’s current price at $117,390.96, with a market cap of $2.34 trillion. Over the last 60 days, Bitcoin saw a 12.41% rise, despite a recent 0.20% daily dip. The circulating supply stands at 19,907,381 BTC, updated Aug 17, 2025.

Insights from the Coincu research team suggest potential regulatory pressures as government bodies adjust to the evolving crypto landscape. Technological advancements in newer blockchains might challenge Ethereum, precipitating shifts in market dynamics. McClurg’s stance on Ethereum is clear: “I don’t like Ethereum simply because it’s an old technology…new blockchains like Solana and Sui have surpassed it. I expect Ethereum to gradually decline and not reach new all-time highs.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitcoin-potential-rise-to-150k/