- BTC has declined by 2.44% over the past 24 hours.

- Bitcoin’s NUPL suggest a potential to a record high of $130k-$160k.

Bitcoin [BTC] has struggled to maintain an upward momentum since hitting $108,364. Since then, the crypto has faced downward pressure hitting a low of $92,118. Thus, over the past weeks, BTC has consolidated between $92k and $107k.

In fact, as of this writing, Bitcoin was trading at $96,298. This marked a 2.44% decline on daily charts.

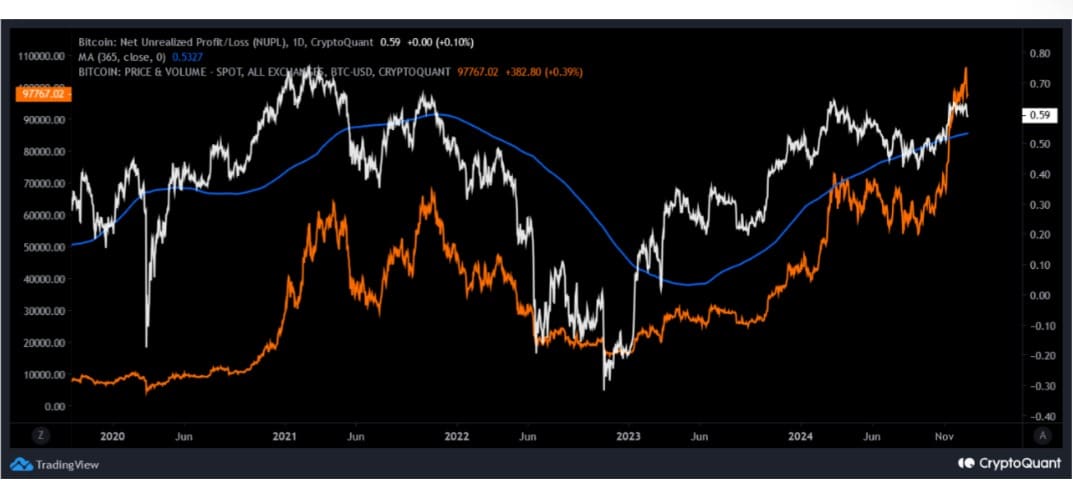

Despite the recent struggles, stakeholders remain optimistic and see the decline as a mere market correction before another uptrend. Inasmuch, Cryptoquant analysts have predicted a rally to between $130k to $160k citing Bitcoin’s NUPL.

Bitcoin NUPL indicates a sustained bull rally

In his analysis, Cryptoquant analyst Baro Virtual posited that the NUP indicates that Bitcoin is in its final stages, with a target range of $130k-$160k.

Source: Cryptoquant

This means that Bitcoin is nearing the top of its bullish cycle, where prices historically see a massive rally before peaking. In this phase, market participants are highly profitable, and speculative buying drives prices up.

According to him, the unrealized profit/loss index has formed a cup and handle pattern which is expected to push BTC into the target range of $130k to $160k.

When NUPL forms a cup and handle pattern, it implies that unrealized profits are consolidating with a slight dip suggesting a temporary slowdown in market sentiment before a strong continuation upward.

In addition, Bitcoin made a successful breakout through the NUPL index’s 365-day MA signaling a potential uptrend in both the medium and long term.

What BTC charts suggest

While Bitcoin has struggled to maintain, an upward momentum, long-term prospects are still in favor of a strong upswing.

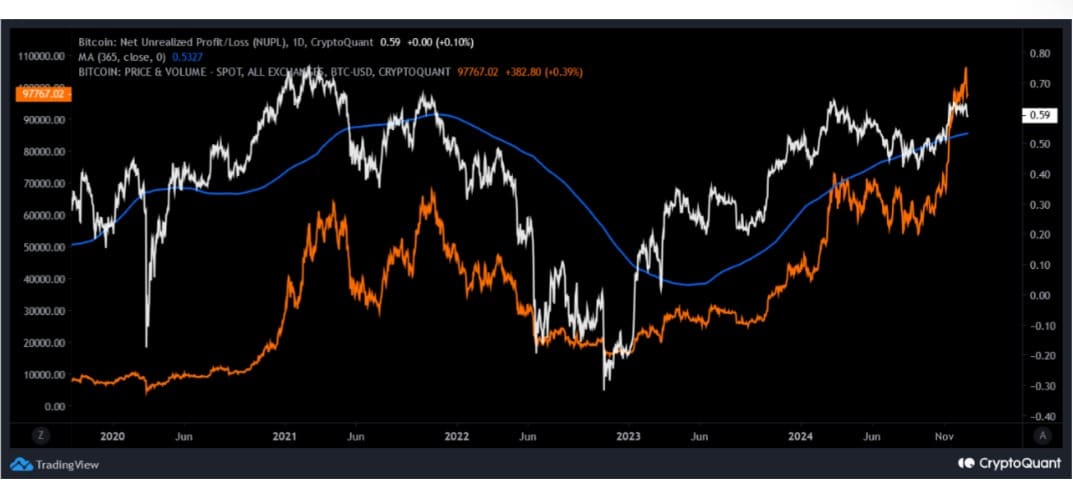

Source: Cryptoquant

For starters, Bitcoin’s MVRV ratio has dropped over the past week to 2.42. Historically, an MVRV ratio between 2-3 is considered bullish and neutral.

Thus, market is not overheated and buyers find a reasonable balance between risk and reward. This indicates market stabilization and potential price recovery.

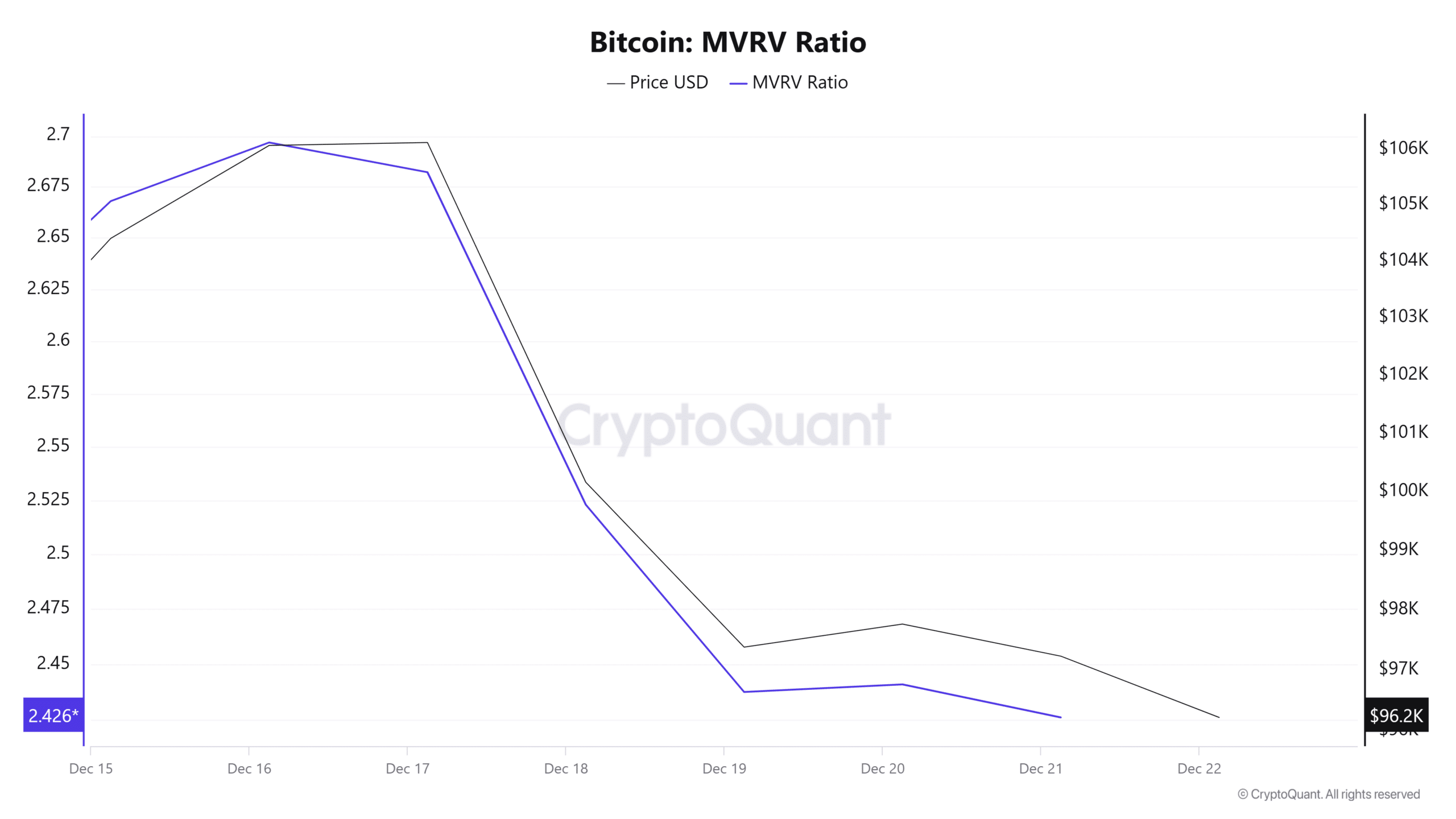

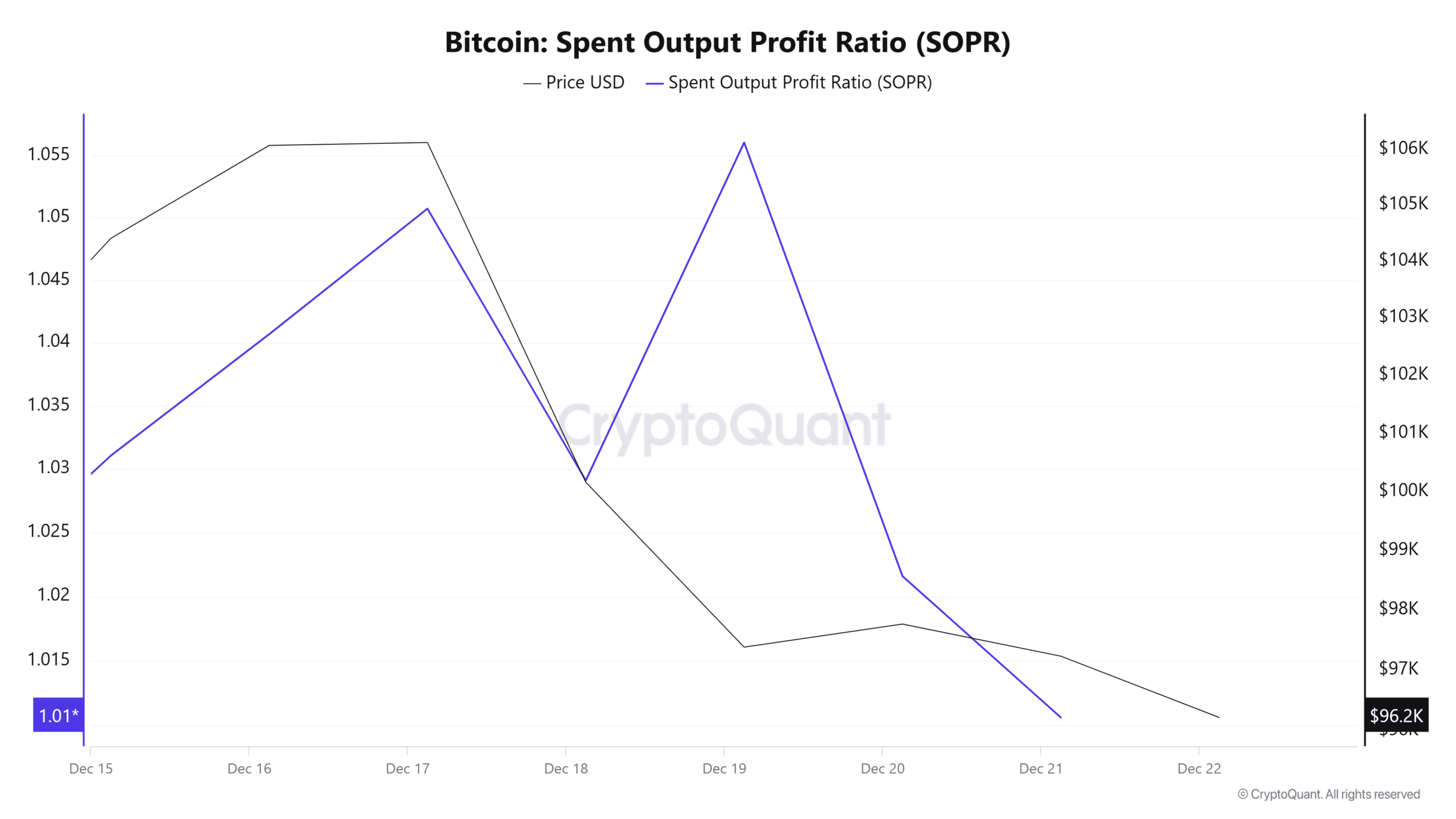

Source: Cryptoquant

Additionally, Bitcoin’s SOPR has declined but it has stabilized at 1.01. When SOPR stabilizes around 1, it suggests that BTC is testing a break-even point where the market is neutral. Thus, long-term holders see it as an opportunity to accumulate BTC sold by weaker hands.

Source: Cryptoquant

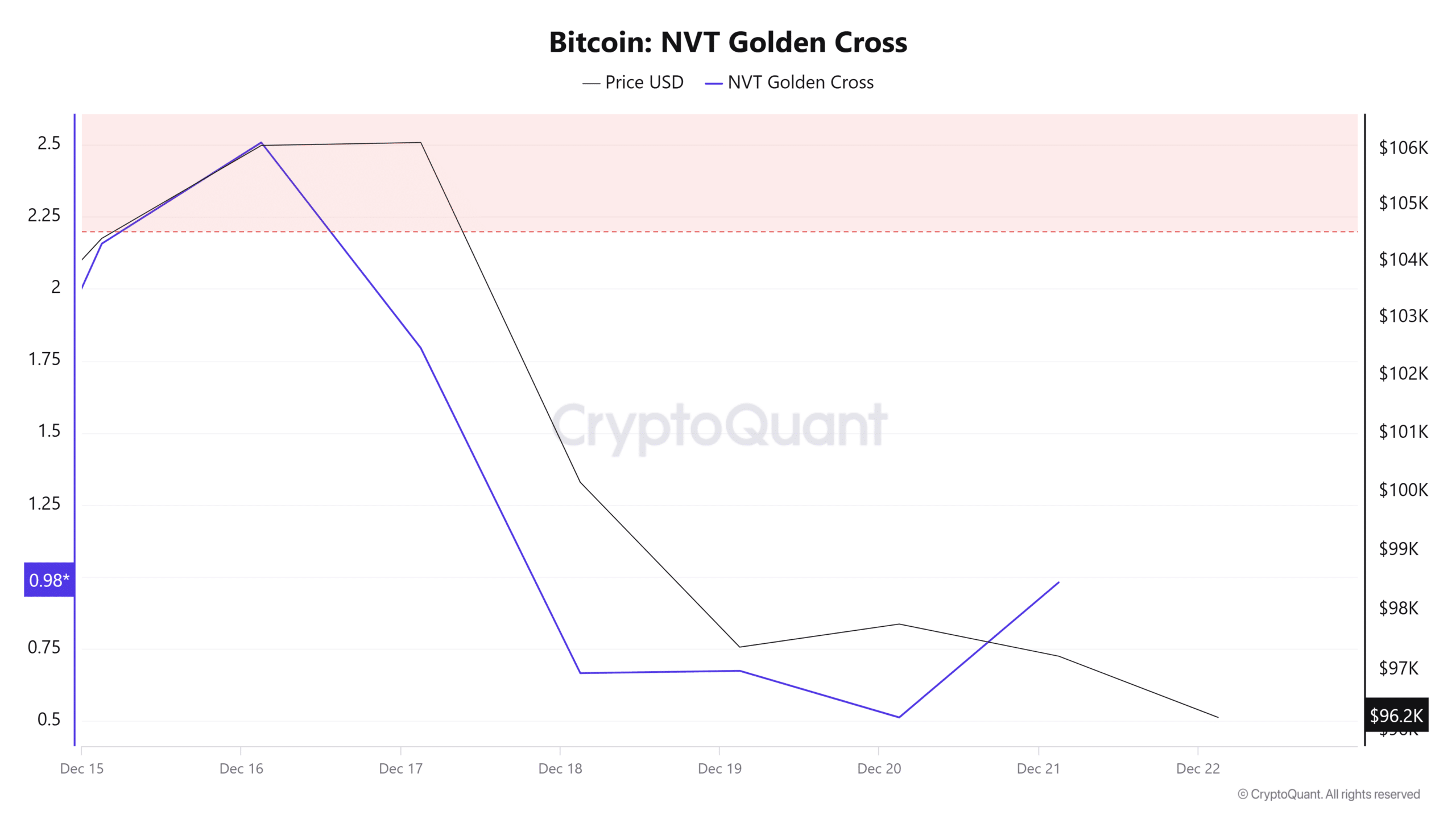

Finally, Bitcoin’s NVT Golden Cross has declined to 0.98 indicating a bullish divergence where increasing transaction activity reflects growing confidence in the network activity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Simply put, although Bitcoin has retraced over the past week, long-term fundamentals signal a potential recovery after the correction.

Therefore, these conditions point towards a potential trend reversal. If it happens so, we could see BTC reclaim $99790 resistance. However, if bears continue to strengthen, Bitcoin will drop to $95600.

Source: https://ambcrypto.com/could-bitcoin-skyrocket-to-160k-btcs-nupl-hints-at/