- Bitcoin Cycle Indicators (IBCI) have crossed a critical point on the chart, suggesting a fall could be on the horizon.

- BTC has developed strong support levels that could influence a price jump, should a price correction occur.

Bitcoin [BTC], in the past 24 hours, has seen a slight drop, falling by just 1.08%. However, it still trades above the $100,000 region.

Despite the bullish market sentiment, corrective phases are inevitable and form part of the broader market cycle.

AMBCrypto’s analysis found that a corrective phase could be approaching and has identified key regions that could support a bounce-back in price.

Distribution phase threatens BTC

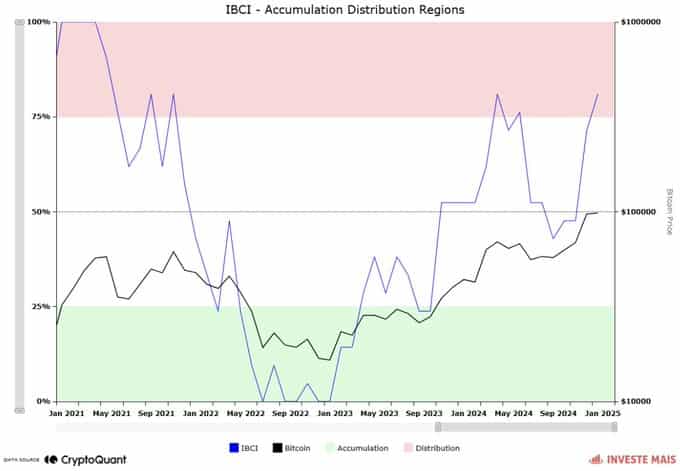

The Index of Bitcoin Cycle Indicators (IBCI) on CryptoQuant showed that the asset has entered a distribution zone, a level last reached eight months ago, in May 2024.

IBCI is a combination of several market indicators—seven in total—including Puell Multiple, MVRV, NUPL, and SOPR.

A distribution is indicated when the IBCI crosses into the red region on the chart, starting at 75%, meaning there’s still growth potential for BTC; however, selling activities have begun.

Source: CryptoQuant

Once IBCI hits the 100% zone—which occurs when all seven indicators enter their distribution phase—BTC would hit a market top, with its price forming lower highs and lows.

IBCI above 50%, where BTC currently lies, suggests a corrective phase is expected before BTC resumes its upward trajectory.

Further analysis from AMBCrypto identified a potential bounce-back level should a correction occur before the market top is reached.

A drop to mid-$90k before rally

Using the In/Out of Money Around Price, an on-chain metric to determine potential support and resistance zones on the chart, AMBCrypto determined where a potential BTC pullback would be met by demand for a continued move upward.

This demand zone lies between $94,800 and $97,000, with a mid-range of $96,500. Approximately 1.36 million BTC buy orders from 1.4 million addresses support this range.

Source: IntoTheBlock

A corrective phase into this region would be followed by a price surge back into the $100,000 region, with the possibility of BTC setting a new high from there.

Other market activities observed could also play in BTC’s favor for a move up, one being the creation of a stockpile including BTC.

U.S. stockpile could boost BTC

The creation of a U.S. digital assets stockpile, as announced in the recent executive order on January 23 by President Donald Trump, could favor BTC.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

A digital stockpile including BTC implies the U.S. government may hold the cryptocurrency as part of its reserves.

According to Arkham, the U.S. government already holds approximately 198,000 BTC, valued at $20.71 billion. If the government increases its holdings, it could drive demand and positively influence BTC’s price trajectory.

Source: https://ambcrypto.com/bitcoins-next-move-why-corrective-dip-before-new-highs-is-likely/