- Bitcoin’s decline, driven by Fed speculation, lacks fundamental market issues.

- Rate cut expectations drive market reactions.

- Market remains under influence of macroeconomic factors.

Wintermute assesses the recent cryptocurrency market decline was largely driven by changes in Federal Reserve rate cut expectations, not fundamental issues, affecting major assets like Bitcoin and Ethereum.

Market sentiment hinges on macroeconomic factors and policy shifts, with potential recovery contingent on improved global economic conditions and mainstream asset performance.

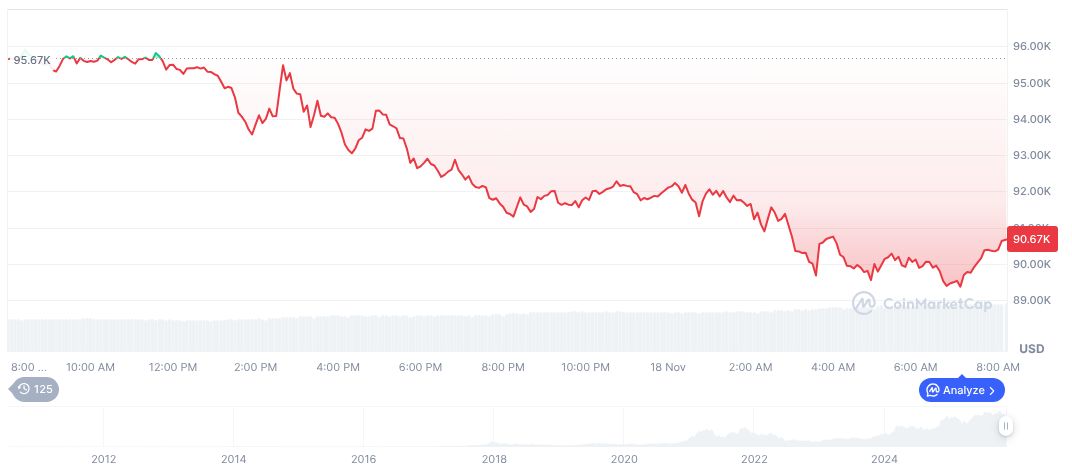

Fed Rate Speculation Triggers Bitcoin Volatility

Wintermute noted that last week’s cryptocurrency market downturn was due to revised expectations for a December rate cut by the Federal Reserve. Large holders were reported to have reduced positions, amplifying market volatility and risk aversion among investors.

The adjustment in interest rate expectations has influenced cryptocurrency prices, triggering a sell-off. With macroeconomic factors dominating market sentiment, Bitcoin is urged to regain its trading range to improve sentiment and stability.

Reactions from industry figures have highlighted the anomaly of this trend that usually aligns with seasonal Q4 to Q1 sell-offs. Notably, Evgeny Gaevoy, Wintermute’s CEO, reiterated his support for ongoing liquidity efforts amidst this volatility.

Evgeny Gaevoy, Founder & CEO, Wintermute, said, “Wintermute makes digital asset markets liquid and efficient.”

Macroeconomic Factors Dominate Bitcoin’s Current Price Trends

Did you know? Bitcoin’s price behavior, typically shaped by halving cycles, is now largely influenced by macroeconomic shifts, as evidenced by the recent market decline driven by Federal Reserve rate speculation.

Bitcoin’s current price is $90,911.23, with a market cap of $1.81 trillion and a dominance of 58.10%. Over the past 24 hours, its trading volume stands at $113.61 billion, a change of 45.88%. The price has decreased by 4.63% in this timeframe. [Data: CoinMarketCap; Last Updated: 09:08 UTC, Nov 18, 2025]

Insights from the Coincu research team suggest ongoing liquidity provisioning, significant [rate cut speculations](https://twitter.com/MaxTakeda91/status/1896934722535924078) affecting the financial environment, and potential policy shifts from G7 countries as pivotal future catalysts in the cryptocurrency landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/bitcoin-market-decline-fed-speculation/