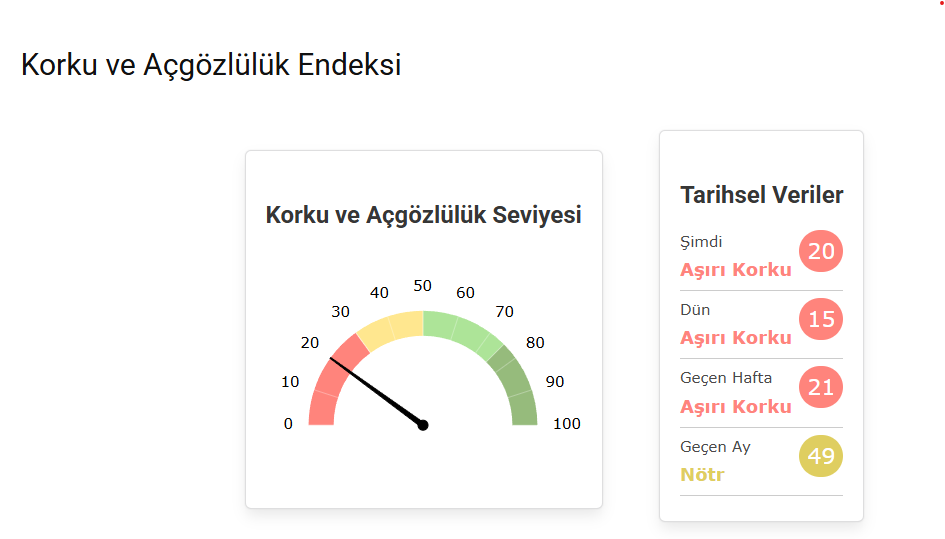

While Bitcoin has been experiencing a Trump-induced pump dump wave in recent days, the Crypto Fear & Greed Index, a key index that tracks Bitcoin and cryptocurrency sentiment, remains in extreme fear.

The Fear and Greed Index has been at extreme fear levels for a long time, which is interpreted by analysts as a possible bottom signal.

Speaking to Coindesk, Kronos Research CIO Vincent Liu said that a prolonged period of extreme fear reading on the Fear & Greed Index could indicate a potential increase in Bitcoin prices.

The celebrity previously noted that a similar prolonged period of extreme fear reading subsequently led to a 200% increase in BTC.

Kronos Research CIO stated that Bitcoin fell to “extreme fear” levels when it was at $53,000 in September 2024 and then BTC doubled in about three months, arguing that the extreme fear reading could be a harbinger of a new rise.

“Bitcoin’s drop to ‘Extreme Fear’ on the Fear & Greed Index reflects a significant historical low, its first decline since September 2024 when BTC was trading at $53,000.

At the time, Bitcoin’s value doubled in the following three months, signaling a potential buying opportunity for savvy investors.

“This could now be a possible signal that prices have bottomed out before a recovery.”

*This is not investment advice.

Source: https://en.bitcoinsistemi.com/bitcoins-long-awaited-bottom-signal-may-have-arrived-the-price-had-previously-increased-by-200-percent/