In a recent post that stirred both reflection and reality among Bitcoin believers, on-chain analyst Willy Woo challenged the common perception that Bitcoin (BTC) is an endlessly exponential asset.

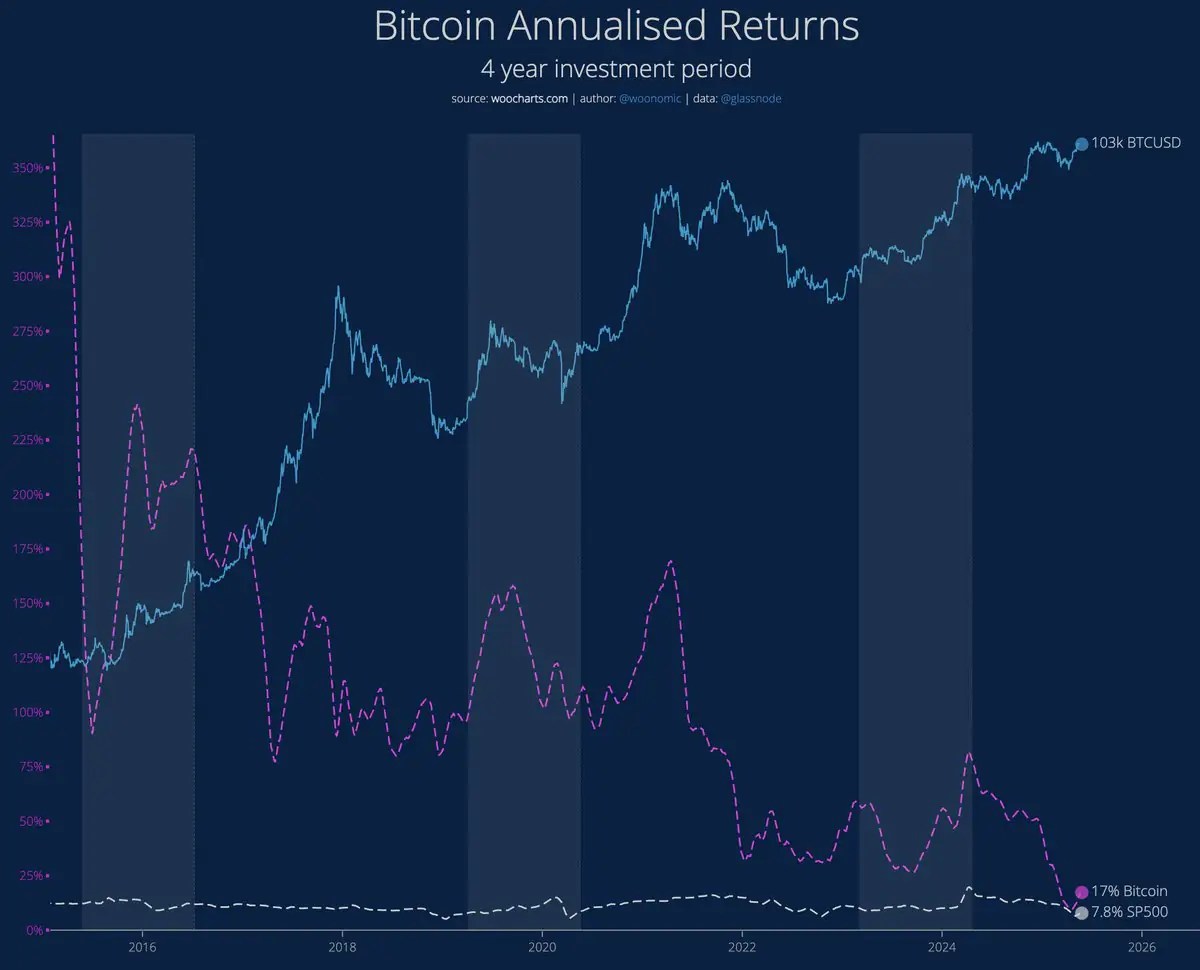

Woo shared updated CAGR (Compound Annual Growth Rate) insights, pointing to a long-term trend of declining returns — and a maturation process that may be necessary for Bitcoin’s next evolution.

From Moonshots to Macro Maturity

Woo notes that while Bitcoin’s CAGR once exceeded 100% annually — especially during the explosive growth phase leading up to and following 2017 — those days are long gone.

“We are well past the 2017 year where we’d see many 100s of percent growth,” Woo stated.

The key inflection point, according to Woo, was 2020, when institutional investors, corporations, and sovereign entities began accumulating BTC. This marked a shift from retail-driven hype cycles to a more macroeconomic-driven adoption phase.

CAGR Compressing: From 100%+ to 30–40%, Heading to 8%?

As shown in Woo’s Bitcoin Annualised Returns chart, Bitcoin’s 4-year average annual return has steadily declined. While still vastly outperforming traditional assets like the S&P 500 (7.8%), BTC’s annualized return now sits around 17% and continues to trend downward.

Woo predicts that Bitcoin’s CAGR may ultimately settle around 8%, aligning more closely with traditional capital markets — combining:

- 5% from long-term monetary expansion

- 3% from GDP growth

“BTC is now traded as the newest macro asset in 150 years,” Woo explained. “It’ll continue to absorb capital until it reaches equilibrium.”

Bitcoin Still Outpaces Everything — For Now

Even with declining growth, Woo reminds investors that no other public asset offers the long-term performance BTC has demonstrated. The implication? Investors should enjoy the ride, even if it’s no longer turbocharged.

Final Thoughts

Bitcoin’s transition from a hyper-growth asset to a globally recognized macro store of value might reduce volatility and speculative frenzy — but that’s exactly what long-term capital prefers.

“Maybe 15–20 years away, almost no publicly investable product can match BTC performance,” Woo concludes.

In a world of institutional capital, macro trends, and digital monetary policy, Bitcoin may be slowing down — but it’s also growing up.

Source: https://coindoo.com/bitcoins-growth-is-slowing-and-thats-a-good-thing-says-willy-woo/