- Bitcoin’s sharp decline to $88,000 ignited market-wide speculation among traders.

- Short-term holders exhibited panic-driven behavior during BTC’s decline.

Bitcoin’s[BTC] sharp decline to $88,000 ignited market-wide speculation among traders. Key metrics analysis has brought out mixed feelings in their current movement.

Understanding these trends offers insight into whether Bitcoin has reached a local bottom or if further downside risks persist.

Bitcoin: Is this a sign of market recovery?

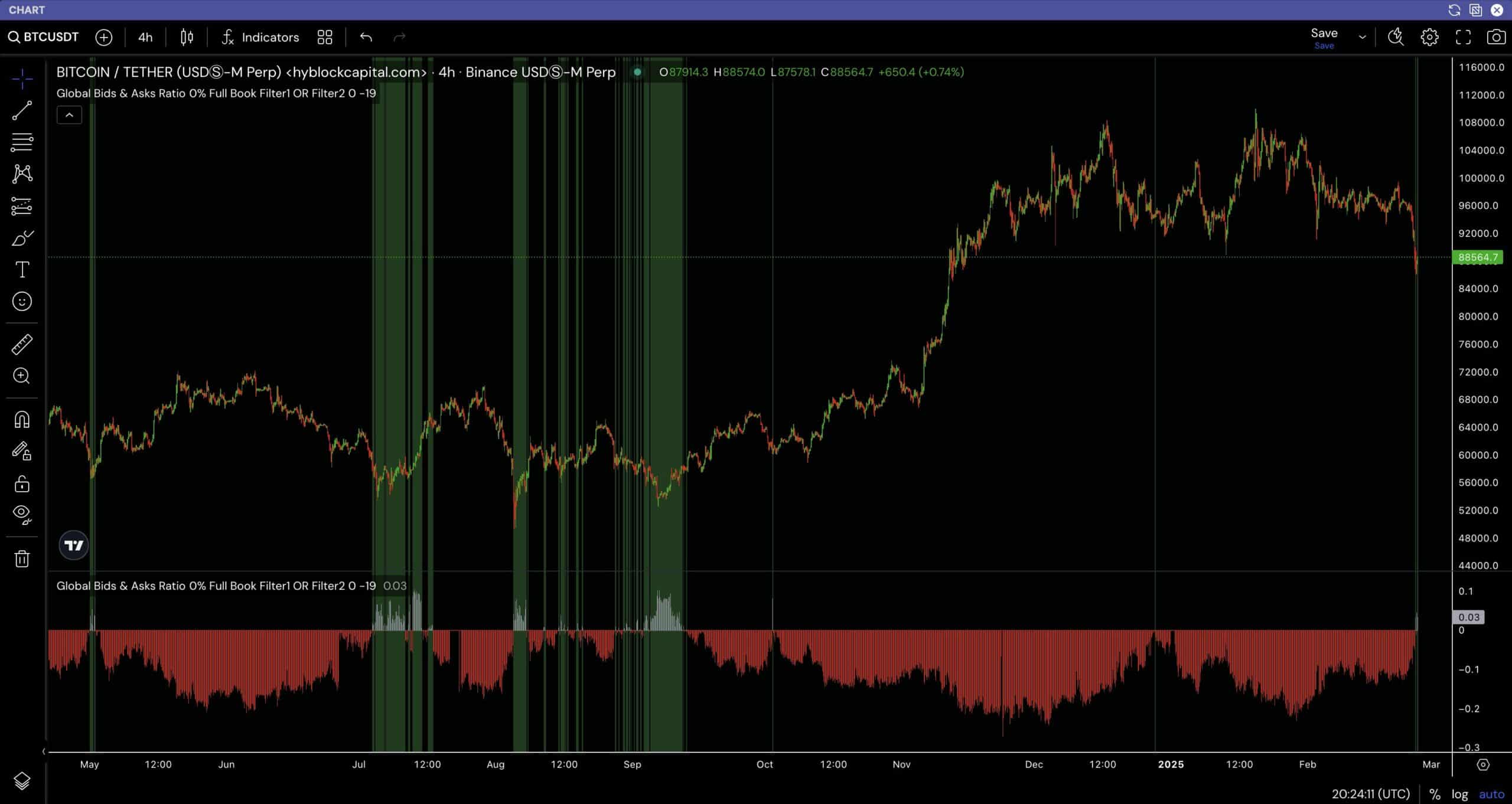

Analysis of the Global Bid & Ask Indicator, which is data aggregating from over 1,400 cryptocurrencies, provided a clear view of spot market sentiment.

Recent shifts in the Global Bid-Ask Ratio signaled a potential market bottom, which has historically preceded bullish price reversals.

Source: Hyblock.com

Additionally, the histogram indicated a spike in buying pressure, contrasting the previous bearish trend from May 2024 to October 2024.

This reversal suggested that Bitcoin might have reached a key support level, drawing increased demand.

Analysis showed this metric as a strong, manipulation-resistant gauge of true supply and demand. It hints at a possible recovery from recent losses.

Panic selling intensifies market volatility

Further, Short-term holders exhibited panic-driven behavior during BTC’s decline. The Short-Term Holder SOPR chart showed a steep drop below one, confirming widespread selling at a loss.

This suggested that investors who acquired Bitcoin at higher levels liquidated their holdings, fearing further declines.

Source: CryptoQuant

Bitcoin’s price drop to $88,000 intensified this reaction, aligning with previous sell-offs triggered by major price corrections. If Bitcoin experiences further downside, additional panic selling could emerge, exacerbating volatility.

However, experienced traders saw this as a potential accumulation zone, capitalizing on market fear to establish long-term positions.

Long-term holders’ moves suggest…

Deep analysis shows that while short-term holders sold in panic, long-term investors remained resilient.

The Long-Term Holder SOPR chart reflected minimal selling pressure, suggesting strong conviction among holders with a 155-day+ investment horizon.

Source: CryptoQuant

These investors, who acquired Bitcoin for around $60,000 in September 2024, chose to hold through the downturn, reinforcing market stability. Their lack of reaction to short-term fluctuations suggested that Bitcoin’s long-term fundamentals remained intact.

Normally, such behavior precedes recoveries, as long-term holder confidence serves as a foundation for future price rebounds.

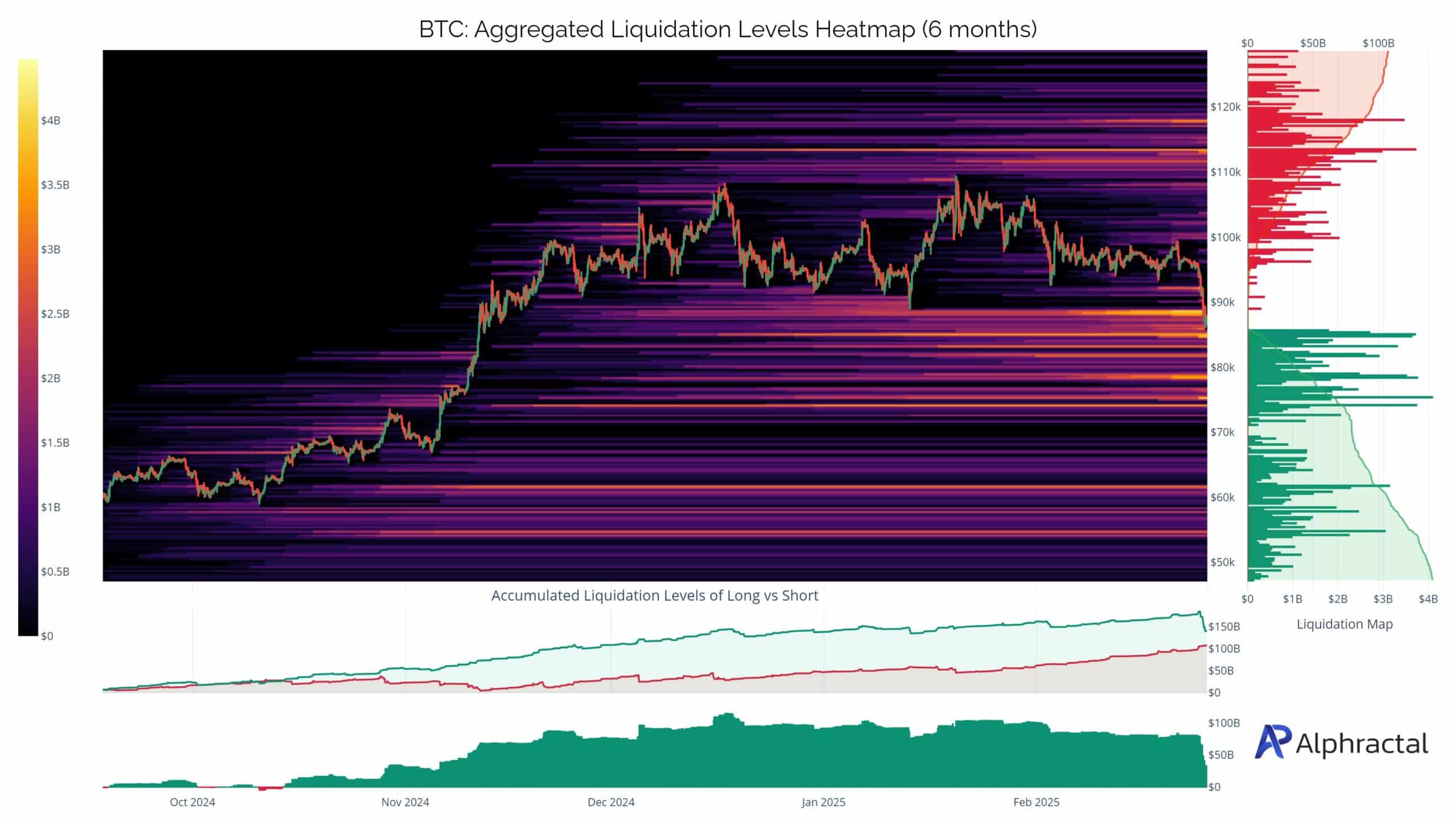

Bitcoin’s liquidation landscape: Risk and opportunity

Finally, BTC’s high leverage levels fueled volatility, leading to massive long position liquidations, particularly on Bybit. The Aggregated Liquidation Levels Heatmap revealed that Bitcoin’s decline to $88,000 triggered significant forced sell-offs.

Source: Alphacratal

The heatmap highlighted a major short position liquidation zone above $113,000. This suggested that if Bitcoin reversed momentum, it could target this level, driven by forced short liquidations.

Traders recognized this setup as a double-edged signal, presenting downside risks but also a potential short squeeze if Bitcoin’s price stabilizes and rebounds.

In conclusion, Bitcoin’s drop to $88,000 reflected a complex mix of market forces. The Global Bid & Ask shift suggested a potential bottom, while short-term holders’ panic selling and long-term holders’ stability provided a contrast in market sentiment.

Source: https://ambcrypto.com/bitcoin-fall-triggers-panic-but-this-indicator-hints-at-a-recovery-how/