Key Takeaways

What levels are crucial for a potential Bitcoin rebound?

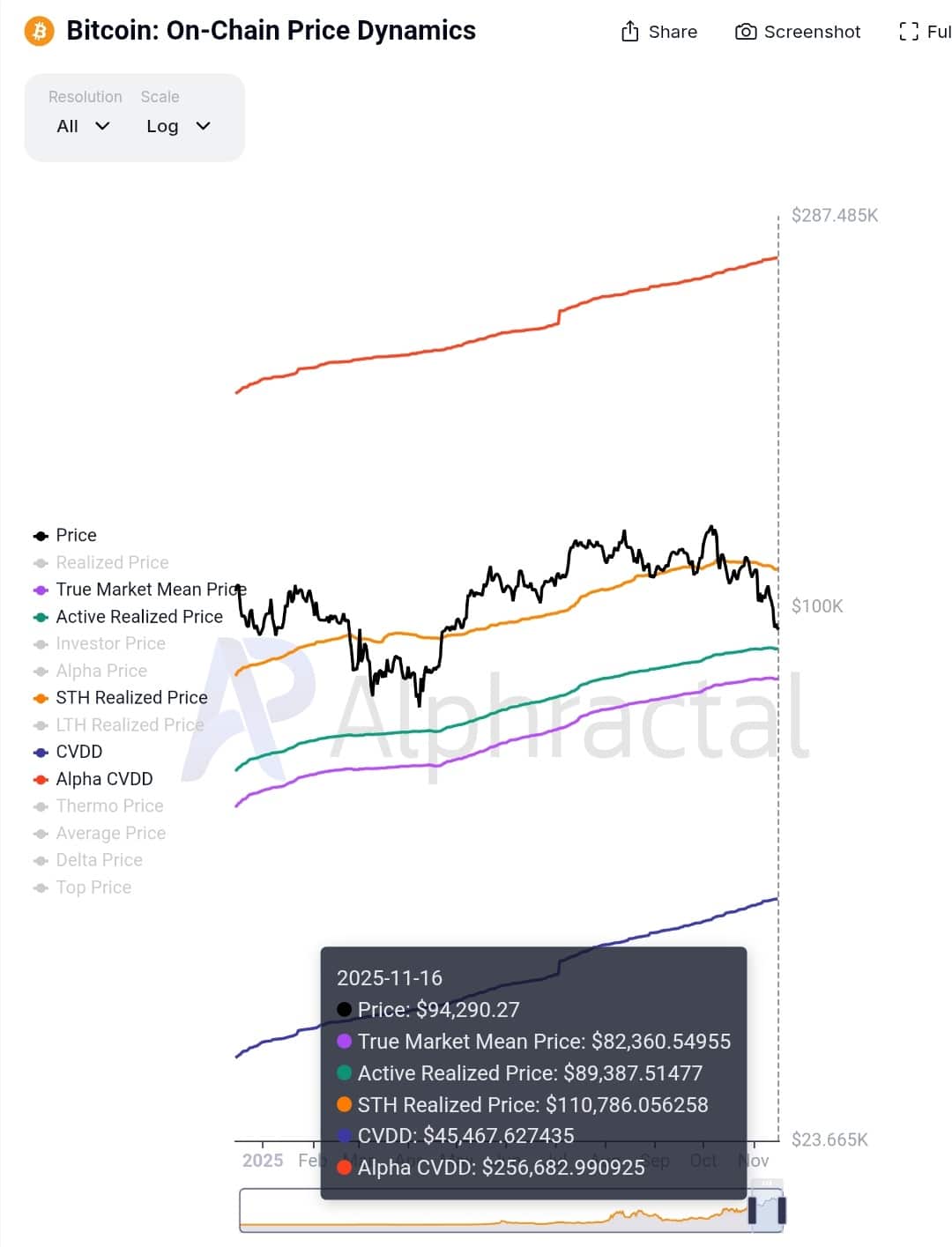

On-chain metrics highlight $89,400 and $82,400 as key support zones that could trigger a rebound.

Is there any bullish activity despite the market fear?

Yes—Spot retail investors bought $668 million on Monday, the largest single-day buy of the year.

Bitcoin [BTC] has suffered one of its steepest losses, with its press-time value around $89,000, marking a significant year-to-date decline.

This drop has intensified market fear, pushing the Fear & Greed Index to 15—the lowest since the 9th of September.

Recent analysis suggests that despite widespread talk of a bear market, Bitcoin still retains the potential for a rebound.

The asset’s fall below the $92,000 threshold has reignited discussions that the market may now be in a bearish phase.

A bullish recovery in place?

Contrary to prevailing bearish sentiment, new market insights provide a glimmer of hope for a possible recovery.

Using the Active Realized Price and True Mean Value—$82,400 and $89,400 respectively—crypto analyst Joao Wedson identifies these as key levels to monitor.

According to Wedson, these levels could be the last line of defense for a rebound. He notes that in 2021, Bitcoin found support at similar levels before reclaiming new highs.

Source: Alphracatal

Ideally, Bitcoin should respect one of these thresholds. With the price trading around $89,000, a potential rebound may soon become evident.

Wedson also warned that “the current setup is far more fragile” and requires calculated risk-taking before placing a bid.

Market requires liquidity

The potential for a rebound depends on market volatility and liquidity, which could shift at any moment.

Broader public interest in Bitcoin has waned, which historically has helped the asset by attracting liquidity from dedicated investors.

Current Google Trends data shows interest at its lowest point since June, suggesting minimal inflow from new investors.

Source: Alphracatal

However, an interesting dynamic has emerged. Existing Bitcoin holders are re-entering the market. Since Monday, Spot investors have accumulated $1.119 billion in Bitcoin.

Notably, they spent $668.72 million on Bitcoin on Monday alone—the largest single-day buy of the year—signaling a positive start to the week.

While Spot buying increases positions, liquidity from the derivatives market also serves as a key price catalyst.

A path to rally

The liquidation heat map identifies potential price levels that act as magnets, pulling Bitcoin toward areas with significant orders.

The heatmap indicates a high probability of an upswing, with the asset trending upward toward clusters of large liquidity.

Source: CoinGlass

The short-term outlook appears bullish, with a target near the $96,000 region where millions in orders are lined up.

If bullish momentum persists, Bitcoin could reclaim the $100,000 threshold and potentially establish new all-time highs.

Source: https://ambcrypto.com/bitcoins-drop-deepens-but-2025s-largest-monday-buy-sparks-hope/