Key Takeaways

Why is it likely that BTC is near a market bottom?

The severe losses the short-term holders were facing and the price drawdown from its all-time high mirrored the market bottoms over the past year.

Is this a clear buying opportunity?

Not a clear one, but a high-risk, high-reward one. Any recovery will not be sudden and explosive, either, given the market sentiment. This exposes bulls to more choppy price action and risk.

Bitcoin [BTC] faced selling pressure in recent weeks, and the latest piece of panic came in the form of rumors that Strategy [MSTR] was selling its Bitcoin.

What actually happened was that Strategy shuffled its holdings between custody providers for operational efficiency.

As Strategy continued to accumulate BTC, analysts pointed out that a price drop below $15k would be needed to bring liquidation pressure on the company.

Some of the onchain metrics suggested that you, too, might want to reassess Bitcoin as a buying opportunity right now.

Signals that we are close to a Bitcoin bottom

Source: CryptoQuant

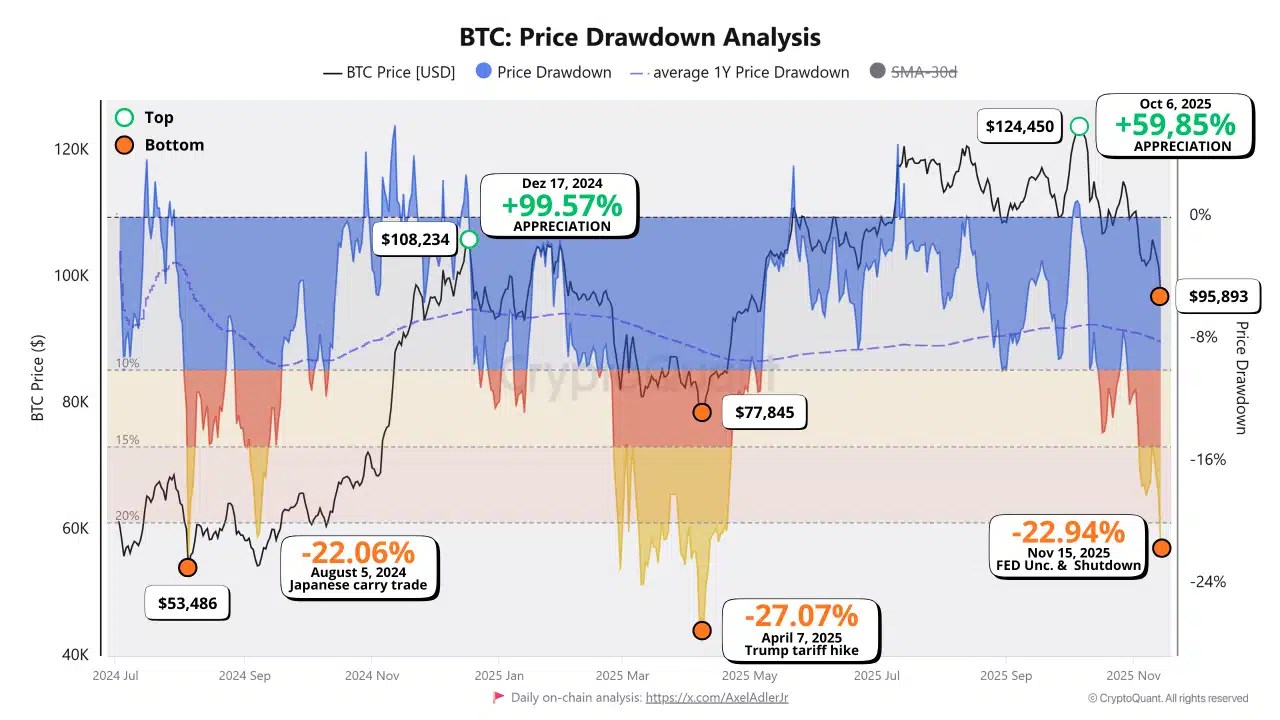

In a post on CryptoQuant Insights, analyst GugaOnChain analyzed Price Drawdown over the past year to assert why the current drawdown could be nearing its end. Earlier, the market had retraced by 22%-27% from the highs to mark the market bottom, then rallied 60% to 100%.

The low Stablecoin Supply Ratio also gave hope to bulls. It showed the high purchasing power of stablecoins and indicated more upside potential.

While it was similar to previous bottoms, high volatility could still catch traders and investors on the wrong side of a price move.

Source: CryptoQuant

The short-term holder MVRV ratio was at 0.86 at the time of writing.

A reading of 0.833 in August 2024 and 0.85 in April 2025 signaled a market bottom, and were followed by a rally to new all-time highs.

It was possible that a similar scenario could occur once again.

BTC bulls must not discount the bearish arguments

Source: Axel Adler Jr on X

However, in a post on X, crypto Axel Adler Jr warned that a bear market might be upon us.

Key metrics such as the SMA 200D, SMA 111D, and STH Realized Price have been flipped to resistance.

The 365-day moving average was the most recent support to be lost, and BTC’s decline below $100k was a psychological blow to the bulls. The next target was the $74k-$87k region.

It is still unclear whether BTC has reached a cyclical bottom or if the downtrend will extend into deeper support.

While similarity to past drawdown structures gave aggressive bulls a reason to consider the dip, trend-followers may wait for a reclaim of long-term averages before positioning.

For now, BTC remains a high-risk, high-reward accumulation case. Anyone buying into weakness should define invalidation levels clearly and exit if price breaks below them.

Source: https://ambcrypto.com/bitcoins-drawdown-resembles-past-recoveries-but-this-time-one-risk-stands-out/