Bitcoin is on track to post the second-worst Q4 performance in history. So far in Q4 2025, the crypto asset has declined by 22.8%, reinforcing Christmas blues as it consolidates losses above $85k.

Source: CoinGlass

In fact, across broader asset categories, gold was the best performer, with 69% annual gains, while Bitcoin was the worst performer, with a 5% loss.

Which begs the question: What’s next for Bitcoin [BTC] into the end-of-year?

A potential BTC bounce post-Christmas?

According to the crypto trading desk, QCP, the Christmas holiday’s thin liquidity and the massive Options expiry on the 26th of December, would trigger volatility. But QCP analysts were slightly optimistic and added,

“Downside positioning has eased as 85k Put open interest drifts lower, while 100k Calls persist, pointing to tentative Santa rally optimism.”

The firm also highlighted that bearish sentiment has eased, but the markets could still remain range-bound until the 31st of December.

However, Options analyst David projected an explosive upside move after Christmas Day.

“Expect chop until Christmas, followed by a potential explosive move once the pin is released.”

Source: David/X

David highlighted that big players were pinning price between $85K-$90K via put wall (bearish bets) and call wall (bullish bets), translating to $300 million in gamma exposure.

However, after the expiry on Boxing Day, BTC could potentially break out of its range.

A similar positioning was painted by liquidation heatmaps. Upside liquidity pools (short positions) were concentrated at $90K and $95K, while downside positions were at $84K.

This suggested potential wild swings that could tag these levels.

Source: CoinAnk

BTC demand has evaporated

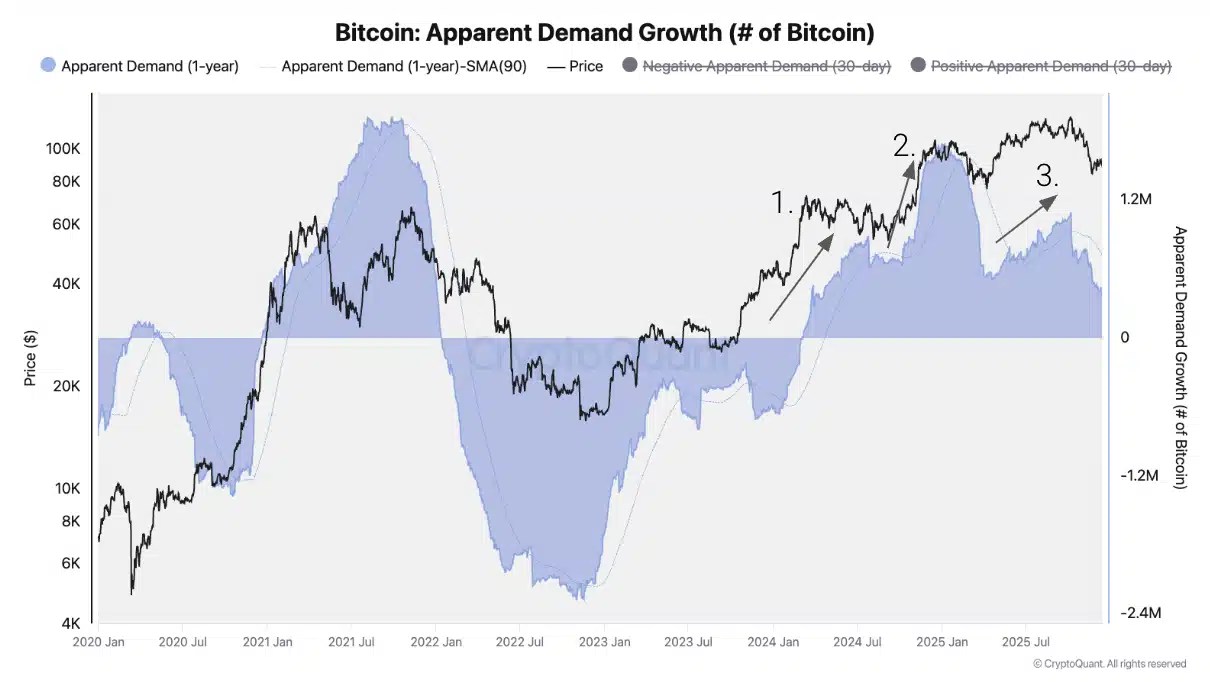

That being said, CryptoQuant cautioned that BTC’s demand has contracted and could usher in deeper bear market capitulation. Part of the analytics firm’s report read,

“The demand growth entered a slowdown period since early October and is now growing below trend. As such, we believe most of this cycle’s demand growth has passed, with the corresponding bearish effect on price.”

Source: CryptoQuant

CryptoQuant added that BTC’s bear market could bottom out at $56k with immediate support at $70K, citing historical data.

Final Thoughts

- BTC could front a bullish breakout of its $85K-$90K price range after Boxing Day.

- However, in the mid-term, the overall demand has contracted and could morph into a bear market.

Source: https://ambcrypto.com/bitcoins-christmas-blues-why-btcs-santa-rally-can-be-cancelled/