- BTC bulls are targeting $64K, eyeing $68K as the next resistance level.

- Can they overcome four days of failed attempts to push BTC above this key target?

Bitcoin [BTC] bulls are targeting the $64K mark, a key level last reached during the late August rally, making it a critical turning point.

To avoid repeating past downturns, bulls must counter any bearish pressure. If successful, the next resistance could materialize around $68K.

Bitcoin: Bull run hinges on $64K

Source : Coinalyze

The current cycle closely resembles the early August trend, with BTC rising to $64K after retracing below $55K. However, the 18-day surge then was marked by inconsistent bearish pressure.

In contrast, while this cycle shows more consistent green candles, the growth rate is less steady, causing volatility among stakeholders.

As a result, instead of rate cuts boosting bullish sentiment, ongoing volatility has kept BTC from retesting $64K, currently trading at $63,543 – marking the fourth straight day below this benchmark.

Additionally, this benchmark has been tested five times since March, when BTC reached its ATH of $73K. Notably, it was only in July that bulls prevented a pullback, pushing BTC to $68K.

Simply put, the $64K mark has been a crucial turning point for Bitcoin.

While volume indicators point to a bullish trend, the real challenge is whether other investors will back a breakout or if bears will once again block BTC’s ascent.

Current price may be out of reach

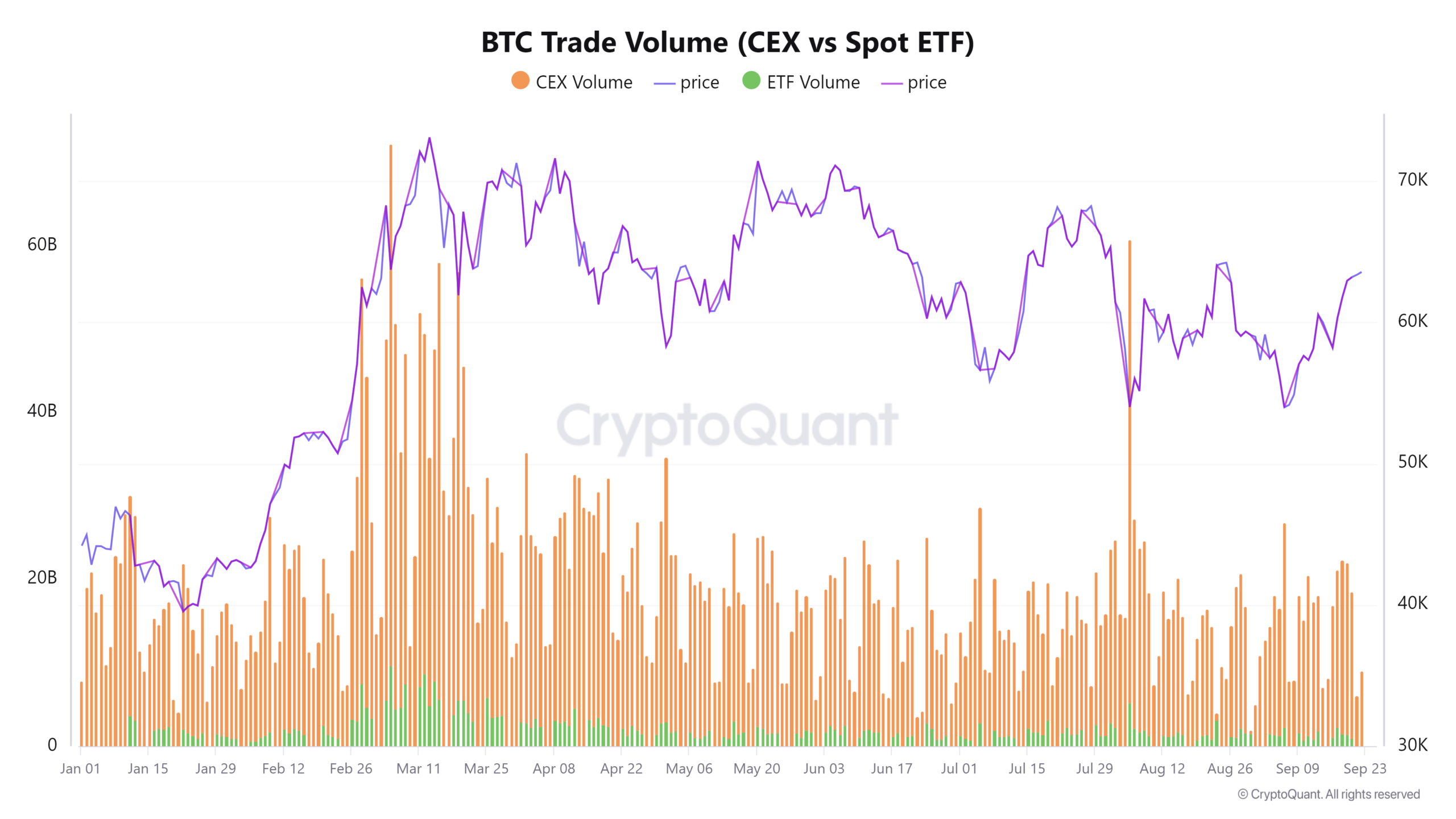

Over the past two days, BTC trading volume on CEXes has plunged from $17B to $6B. This sharp drop could amplify volatility, shaking investor confidence in a potential trend reversal.

The chart below might indicate a potential market top, often coinciding with reduced trading activity on CEXs.

Conversely, when exchange volumes spike during sharp BTC declines, it frequently presents an ideal dip-buying opportunity.

Source : CryptoQuant

Per AMBCrypto, reduced exchange activity might suggest two possibilities: either investors are cashing in on gains from the September cycle, or they are waiting for a dip to buy BTC at a lower price.

If this trend holds, it could certainly set the stage for a resurgence of positions shorting Bitcoin. Consequently, a chance at a breakout may falter. However,

There might still be hope

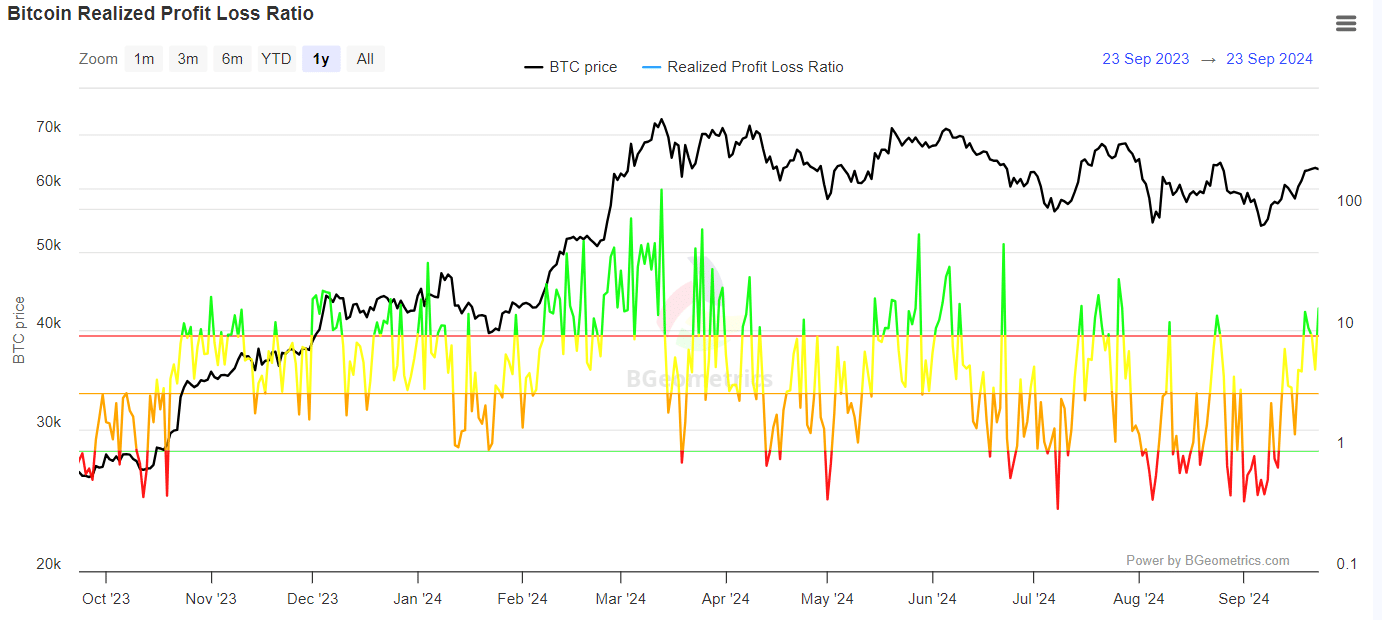

As the most volatile month comes to a close, the potential for “Uptober” could signal a bullish turning point for the market, a glimmer of hope illustrated in the chart below.

On the day Bitcoin experienced a minor 0.37% decline, the RPL ratio dropped, indicating losses. However, since then, a majority of transactions have occurred higher than the original acquisition price.

Source : BGeometrics

Adding to this analysis, large transaction volumes have surged, with transactions exceeding $100K seeing significant activity.

Clearly, bulls are pushing against the resistance that has held Bitcoin below the $64K benchmark. Currently, the sharp decline in CEX volume is reinforcing short dominance, acting as a barrier.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, if the market stabilizes, as evidenced by sellers realizing profits, FOMO could incentivize a longer-term commitment.

Ultimately, monitoring CEX volume alongside speculative market activity is crucial. Their dominance may push BTC back below $60K if unchecked.

Source: https://ambcrypto.com/bitcoins-bull-run-will-uptober-turn-things-around-for-btc/