Key Takeaways

The market is driven by liquidity. After the bulls halted Bitcoin’s downtrend at $107k, the liquidity overhead meant that a move toward the $123.4k range highs was viable.

Bitcoin [BTC] is currently in a healthy consolidation phase, rather than a deep correction, according to a recent report.

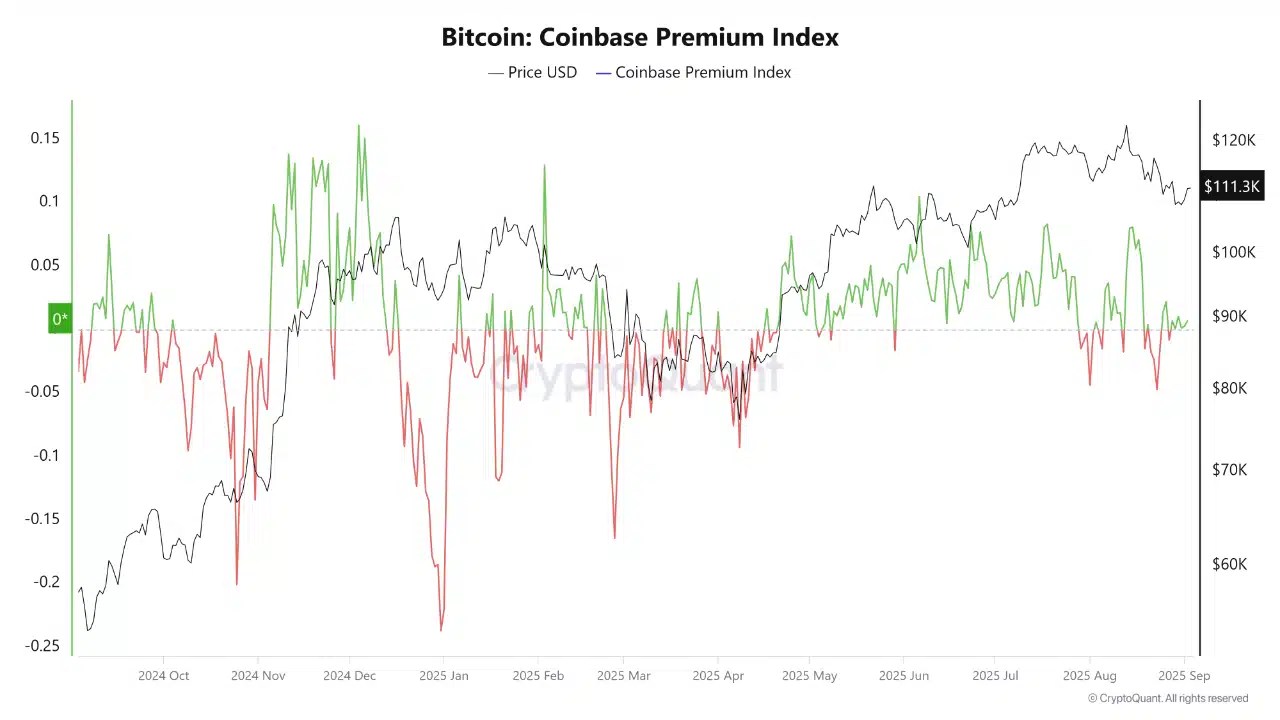

A drop in the Network Value to Transactions metric and the surge in the Coinbase Premium signaled resilience in the market.

Bitcoin has also decoupled from the S&P 500, and its capital inflows in 2025 could see the leading cryptocurrency outperform the stock market index for the remainder of the year.

This can also positively impact altcoins.

Source: CryptoQuant

In a post on CryptoQuant Insights, XWIN Research Japan pointed out that regional liquidity shaped Bitcoin price moves more than spot ETF flows did.

When the Coinbase and the Korea Premium Index flash green together, they would signal synchronized global demand.

Source: CryptoQuant

This can spark a lasting rally. However, recently, there has been volatility because of the tug of war between the Asia and U.S. premiums, as well as the netflows to or from regional exchanges.

To keep the next rally running, a positive Coinbase Premium Index should be combined with outflows from Binance. This would signal U.S. investor confidence and Asia absorbing the supply, the analyst wrote.

Liquidity can drive the next short-term Bitcoin rally

Source: CrypNuevo

In a post on X, analyst CrypNuevo outlined why Bitcoin might be headed for recovery next. The support zone from $106k-$107.2k has been respected, and the price had also reclaimed the $110k mark.

The analyst noted that a reclaim of the $112k level would represent a move back into the range established in recent weeks. If successful, Bitcoin bulls can mount a comeback toward the range highs at $123.4k.

Therefore, a reclaim of the $112k level would represent a good buying opportunity for swing traders.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Source: https://ambcrypto.com/bitcoins-112k-breakout-can-spark-a-run-to-123k-heres-how/