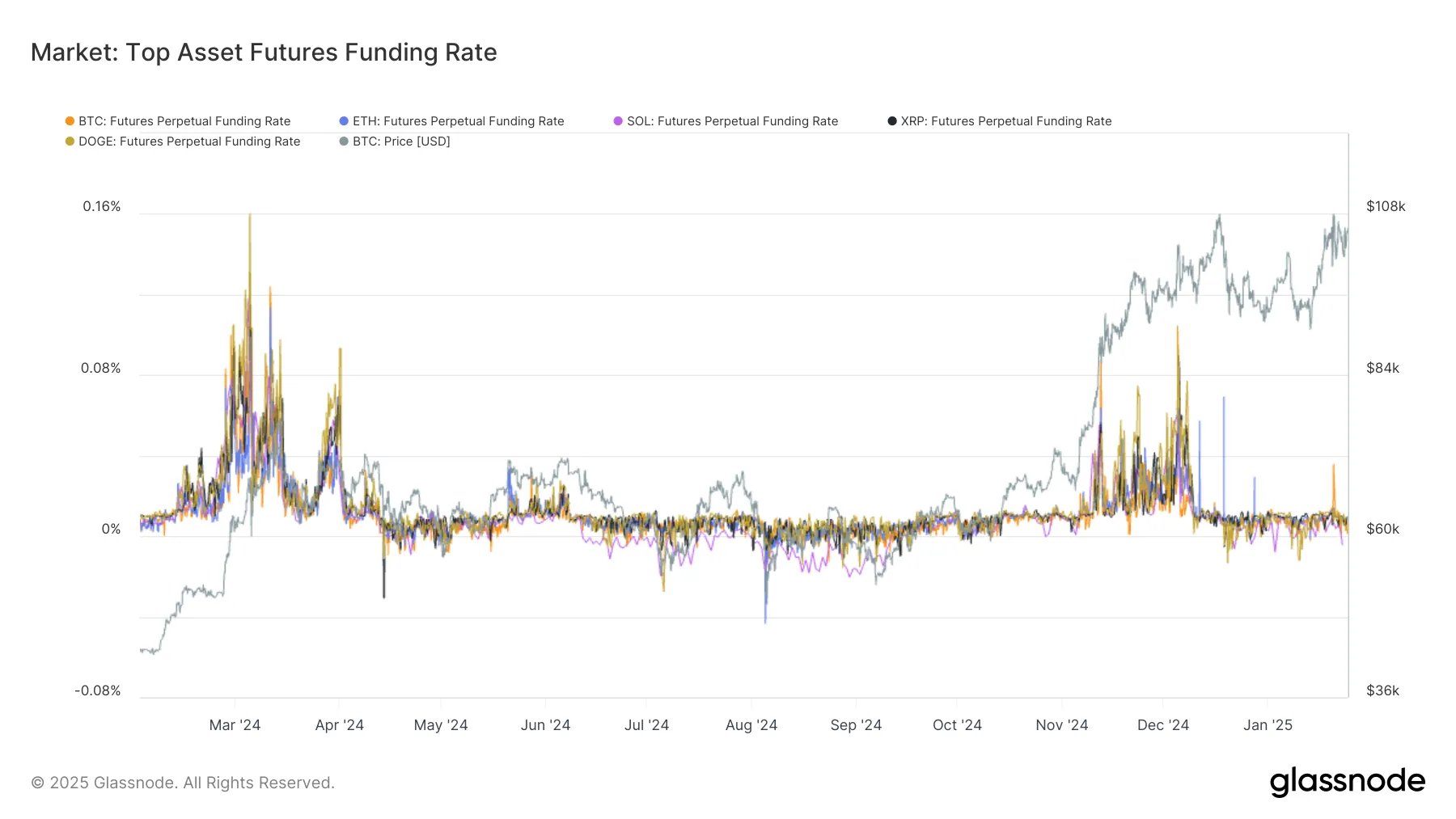

Bitcoin, XRP and Dogecoin funding rates suggest there is a lack of aggressive demand in the market despite recent rebound efforts.

Notably, the crypto market remains in flux as recent data shows a lack of strong appetite for long positions. While Bitcoin and other major cryptocurrencies, such as XRP and Dogecoin, have shown signs of recovery, funding rates indicate muted enthusiasm compared to previous rally levels.

Funding Rates Signal Low Demand

According to data from Glassnode, the hourly funding rates for leading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and Dogecoin (DOGE) reveal subdued demand for long positions. The enthusiasm observed during the rally from November to early December has not returned.

In addition, Glassnode confirmed that the 168-hour moving average of funding rates suggests that although Bitcoin showed positive momentum early last week, Solana continues to face declining funding rates—a trend persisting since December.

Looking at the 168 HR moving average of funding rates, all top assets, particularly #Bitcoin, showed positive momentum early last week. In contrast, #Solana continues to experience a diminishing funding rate regime, which has been persisting since December: pic.twitter.com/Kslelfr0l5

— glassnode (@glassnode) January 27, 2025

Open Interest Cools as Market Slumps

Notably, data from Coinglass shows this current market condition. Specifically, Bitcoin Open Interest has since dropped to $65.14 billion since the $69.57 billion top days back.

While this decline isn’t drastic, it indicates a market cooling off slightly after recent highs. However, despite the dip, Open Interest remains above levels seen between Jan. 8 and 17, indicating that the market has maintained levels above previous lows.

Moreover, Bitcoin derivatives trading has seen a major surge, with volumes rising 167.26% in the past 24 hours to reach $110.25 billion. However, the long/short ratio over the same period sits at 0.9194, suggesting that bearish sentiment is still influencing traders.

Amid the market uncertainty, as investors await U.S. economic data, experts remained optimistic. In particular, pseudonymous analyst Moustache noted that Bitcoin is only currently shaking out weak hands.

As BTC dropped below $100K, Moustache maintained that the firstborn crypto remains in an uptrend as long as it stays above the Gaussian Channel baseline, currently at $96,126. He reassured traders that the macro picture for Bitcoin remains unchanged despite short-term volatility.

Looks like the market isn’t done shaking out weak hands yet. Macro picture does not change.

Don’t forget that the base-line in the Gaussian Channel is the most important line for $BTC.

As long as it is above it, the market will remain in an uptrend. pic.twitter.com/dAgYIxSlvn

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) January 27, 2025

Meanwhile, veteran trader Michaël van de Poppe advised against panic despite the market shocks causing crypto prices to drop as the selloff in the AI sector spilled to crypto. He identified Bitcoin’s price range between $95,000 and $98,000 as a key entry zone and predicted a rebound after the retest.

Bitcoin Recovers Above $100,000

Interestingly, Bitcoin has since climbed back above $100,000 after retesting this zone. The crypto asset is now changing hands at $101,150, up 2.4% within the past four hours. Notably, as this rebound picks up, van de Poppe expects further gains.

There we go.

The real stories surrounding DeepSeek start to come out about the governmental money that has been spend on it.

Markets bouncing back quickly, including $TAO and #Altcoins.

I think that this will continue. $ETH/BTC to rotate up.

Don’t worry.

— Michaël van de Poppe (@CryptoMichNL) January 27, 2025

In another bullish outlook, Burakkesmeci, an analyst at CryptoQuant, pointed out that the selling pressure on Binance should be easing. He highlighted an increase in Taker Sell Volume in recent hours, which historically precedes the completion of seller orders and the entry of buyers.

Additionally, he observed that the Taker Sell Volume is forming lower highs on hourly data, signaling a potential local bottom as selling pressure diminishes.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/01/27/bitcoin-xrp-dogecoin-funding-rates-show-lack-of-aggressive-demand-despite-recent-rebound/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-xrp-dogecoin-funding-rates-show-lack-of-aggressive-demand-despite-recent-rebound