- Bitcoin has surged by 1.04% over the past day.

- The king coin must hold above $96k to reinforce bullish sentiments.

Over the past week, Bitcoin [BTC] remained stuck within a consolidation range, as the king coin failed to maintain an upward momentum and reclaim higher resistance.

As such, it has continued to hover around $96k, making it a critical point for STHs, according to CryptoQuant analyst Shayan.

Why $96k is key for Bitcoin

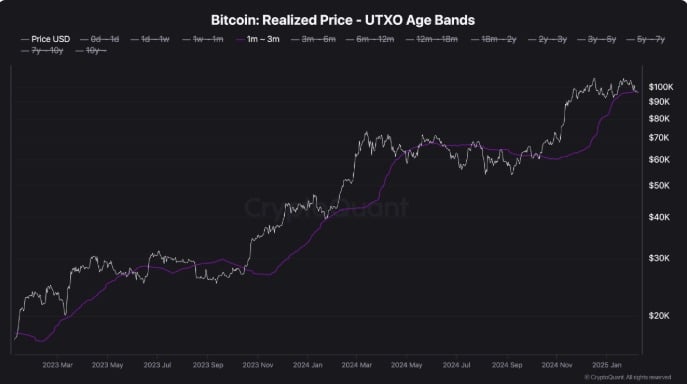

In his analysis, Shayan observed that Bitcoin’s realized price for the 1–3 month cohort sat at $96k.

Historically, when BTC declines to this level after an uptrend, it acts as critical support, suggesting that STHs are confident with their positions despite the surging prices.

Source: CryptoQuant

Holding above this key level is crucial as it reinforces bullish market sentiment, thus increasing the likelihood of an extended upward trend.

Conversely, if Bitcoin fails to hold this support at this critical threshold and breaks below, it could cause a shift in sentiment. As such, market sentiment will shift towards fear, potentially leading to a distribution phase.

Therefore, the next move around this point will play a key role in shaping Bitcoin’s short to mid-term trajectory.

Can BTC hold above $96k?

With Bitcoin remaining stuck around $96k, the question is whether the king coin can hold above it and reinforce bullish sentiment among short-term holders.

According to AMBCrypto’s analysis, although Bitcoin lacks upward momentum, investors are optimistic and believe another leg up is ahead.

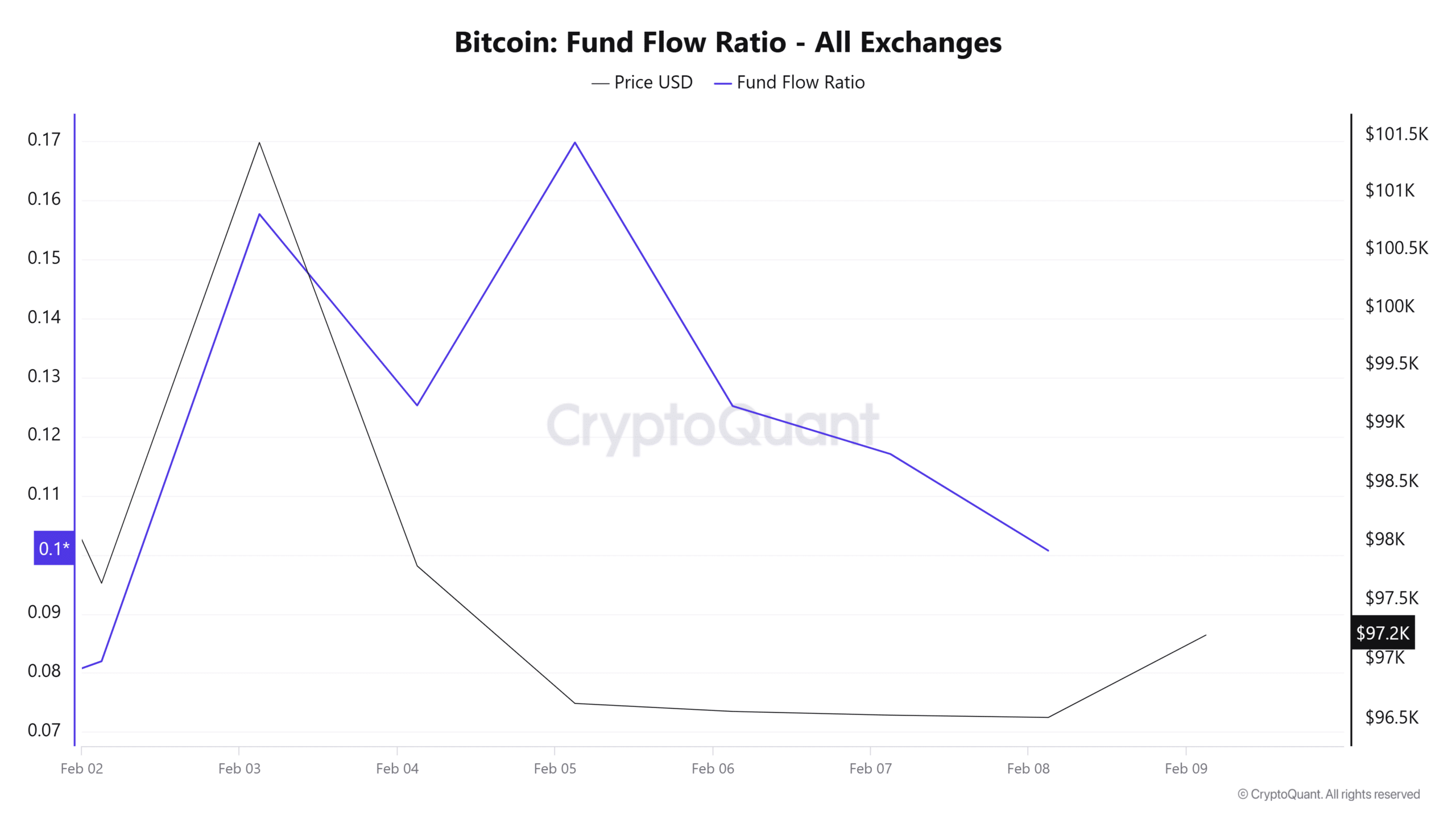

Source: CryptoQuant

For example, Bitcoin’s Fund Flow Ratio has declined for three consecutive days. This implied that a smaller portion of BTC transactions involve exchanges.

Such a trend suggests that investors are holding their assets rather than selling. This market behavior often aligns with the accumulation phase before prices rise.

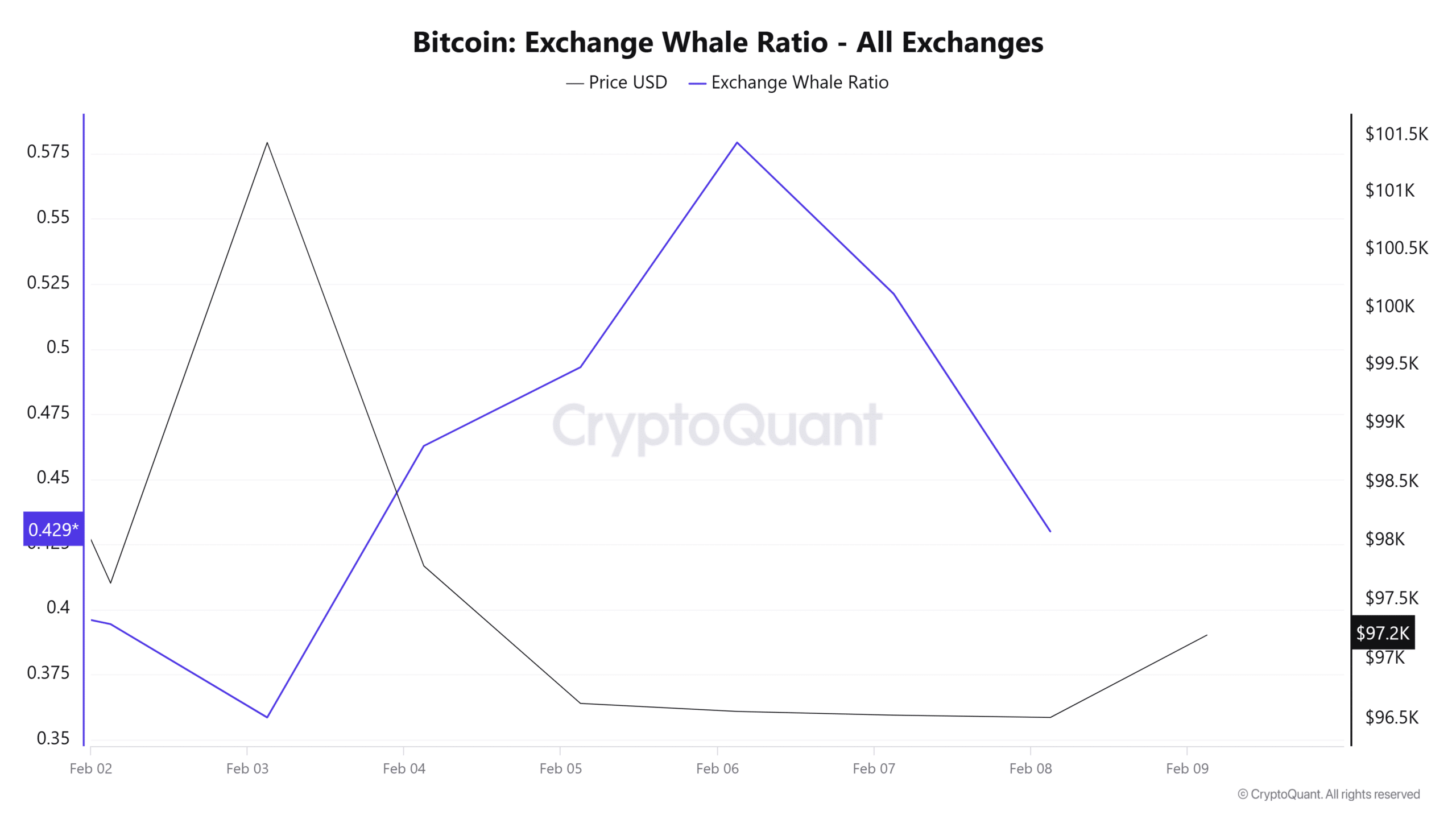

Source: CryptoQuant

This accumulation also appears to be strong among whales. This is confirmed by the declining Wxchange Whale Ratio, which has dropped over the past three days.

Such a decline implied that whales continued to hold BTC as they anticipated further price gains.

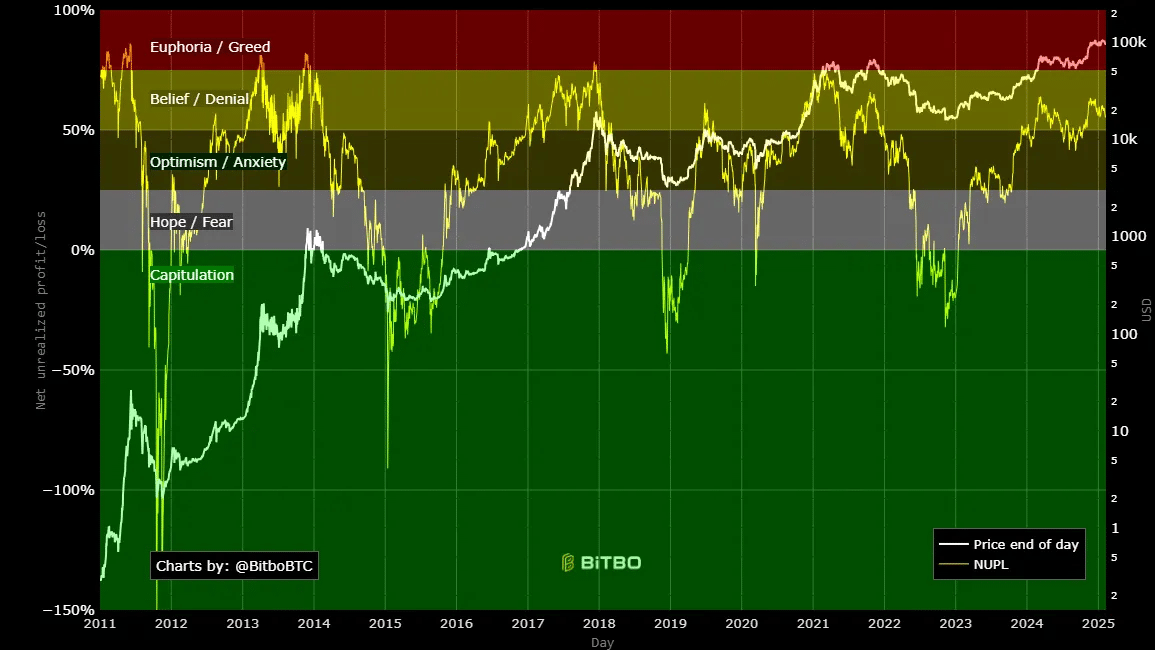

Source: Bitbo

Finally, Bitcoin’s NUPL still remained within the belief/denial zone. At this level, BTC was still in a bullish phase, climbing towards cycle highs.

With NUPL at 58%, the uptrend still has room for growth before reaching the market top.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Simply put, although Bitcoin has struggled to hold above $96k, the crypto still has room for growth. With more gains, STHs confidence will be reinforced, further strengthening bullish sentiments.

With investors still optimistic, BTC could make a move above this level, attempt $98900, and then face $100k resistance. However, if it fails to hold above this level, BTC could drop to $94k, risking further decline.

Source: https://ambcrypto.com/bitcoin-why-96k-is-key-for-btc-to-remain-bullish/