Bitcoin’s [BTC] price action continues to reflect sustained weakness. Late Tuesday, the asset fell to a session low of $72,945 as selling pressure intensified across the market.

The move followed a clear shift in trader behavior. Whales scaled back their bullish bets, while retail traders largely held their ground, maintaining elevated optimism.

AMBCrypto assesses which side may be better positioned and outlines the conditions that could shape a potential Bitcoin reset.

Whales pull back as retail presses on

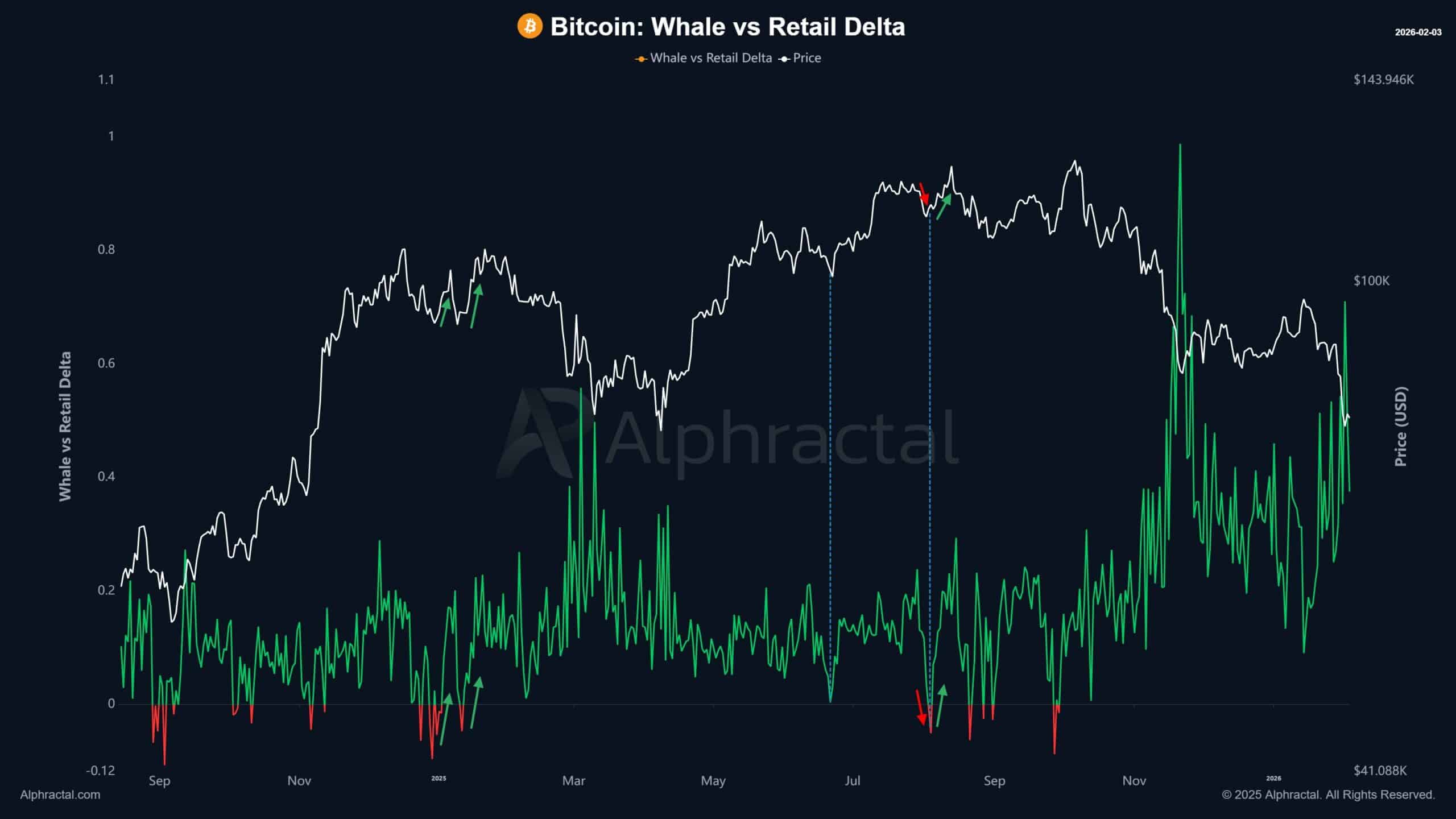

Recent data points to a changing dynamic in Bitcoin’s Perpetual Futures market, highlighting a widening gap between whale and retail trader behavior.

Whales—typically addresses with deep liquidity—tend to trade with greater flexibility than retail participants, who often rely on shorter time frames and more limited capital.

According to Whales vs. Retail data, whales reduced their long exposure over the past day, closing existing positions while opening new shorts.

Source: CryptoQuant

João Wedson, founder of Alphractal, described the shift as part of whales’ opportunistic trading approach.

“They hunt volatility, open longs and shorts aggressively, and later reduce exposure,” Wedson said.

Such repositioning often precedes one of two outcomes.

Bitcoin may enter a consolidation phase before committing to a clearer direction, or selling pressure could accelerate, dragging prices below the lower $70,000 range—similar to Tuesday’s move.

Historically, comparable whale-driven unwinds have preceded sharp declines. In a previous instance, Bitcoin experienced a steep drop that ultimately carried the price toward the $80,000 region at the time.

For now, however, derivatives data suggests longs still retain marginal control.

Bitcoin’s Funding Rate—used to determine whether long or short traders are paying to hold positions—remains slightly positive at roughly 0.0040%, according to CoinGlass.

Bearish pressure remains intact

Despite the positive Funding Rate, bearish forces remain active. A renewed push from sellers could set the stage for a bull trap, exposing late long positions to abrupt reversals.

Trading volume trends in Bitcoin’s perpetual market show a growing dominance of short volume over longs.

This shift indicates that cumulative activity continues to favor short contracts, with taker sell orders maintaining a strong presence.

Beyond derivatives, spot market indicators paint a less supportive picture.

The Coinbase Premium Index—which compares Bitcoin prices on Coinbase and Binance to gauge U.S.-based demand—signals a clear deterioration in buying interest.

Source: CryptoQuant

The index has trended lower over the past day, pointing to weakening demand from U.S. investors, even as long exposure in derivatives markets improves.

A similar signal emerges from the Fund Market Premium, which tracks the price difference between crypto investment products such as ETFs, trusts, and funds relative to spot Bitcoin.

The metric has slipped into negative territory, printing around -0.2. This suggests subdued institutional demand and reinforces the broader risk-off tone across the market.

Collapsing volume weighs on the outlook

Across the wider market, spot trading activity has declined sharply. Data indicates that hundreds of billions of dollars in volume have exited the market since October 2025, reflecting sustained caution among participants.

Demand that might otherwise support price stability has faded, as fewer spot investors remain active and available capital continues to thin.

The recent $10 billion contraction in stablecoin market capitalization has further deepened this demand shortfall.

Reduced stablecoin liquidity signals investor reluctance to deploy capital into digital assets. Given Bitcoin’s tendency to absorb returning liquidity first, this contraction could significantly influence its near-term price behavior.

Until spot demand and trading volume recover meaningfully, Bitcoin may struggle to deliver sustained gains capable of supporting a stronger upside trajectory.

Final Thoughts

- Whales are cutting back long exposure at a time when retail participation continues to rise, a divergence that could have material consequences for price direction.

- Retail investor positioning remains notably optimistic, even as broader market indicators point to declining U.S. participation and a pullback in overall trading volume.

Source: https://ambcrypto.com/bitcoin-whales-step-back-retail-pushes-on-is-btc-setting-a-bull-trap/