- Bitcoin ETFs faced significant outflows amid U.S election uncertainties and market volatility

- BlackRock’s IBIT defied trends, attracting inflows while cumulative BTC ETF stood with outflows

With the U.S Presidential election around the corner, the crypto market has seen a surge in volatility.

Bitcoin [BTC] exchange-traded funds (ETFs), in particular, have felt the impact, with notable outflows observed on 1st and 4th November.

With Election Day now here, uncertainty surrounding potential political shifts is continuing to add to the ups and downs of the Bitcoin ETF landscape.

Bitcoin ETF analyzed

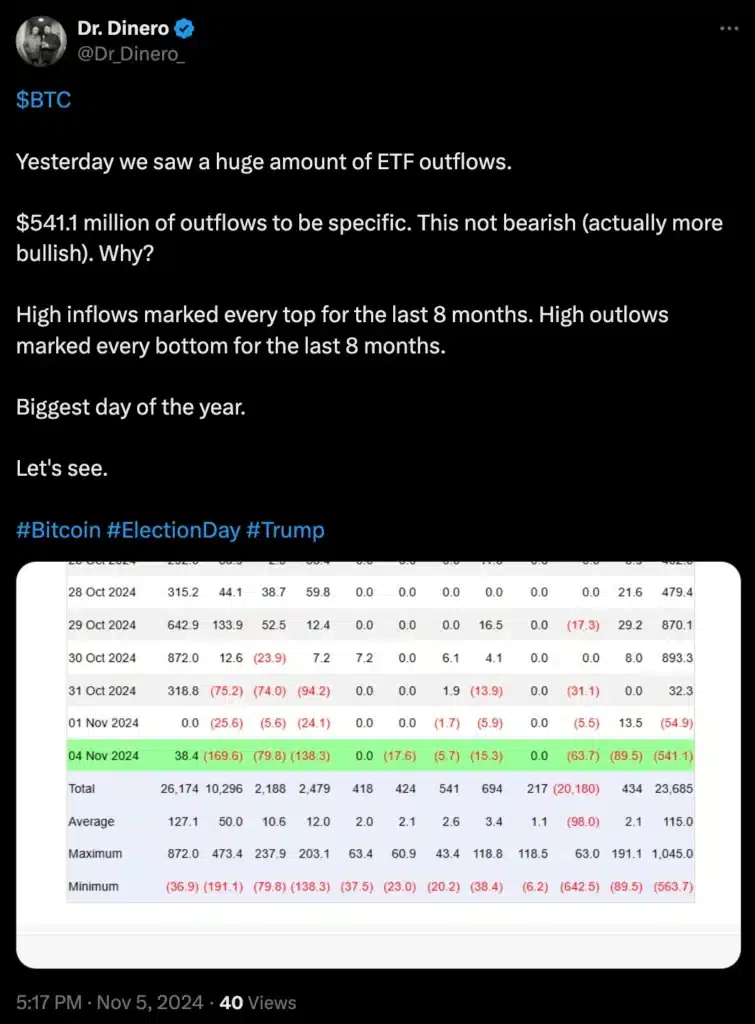

According to the latest data from Farside Investors on 4 November, Bitcoin ETFs recorded significant outflows – Totaling $541.1 million.

Fidelity’s FBTC led the trend, with outflows hitting $169.6 million, followed closely by Ark 21Shares’ ARKB which saw $138.3 million in outflows. Grayscale’s BTC and Bitwise’s BITB also faced declines, with outflows of $89.5 million and $79.8 million, respectively. Grayscale’s GBTC recorded $63.7 million outflows too.

Although most ETFs reported outflows, Invesco’s BTCO and WisdomTree’s BTCW stood out by maintaining stable flows without any outflows.

Despite the broader downturn, however, not all updates were negative.

BlackRock’s IBIT notably bucked the trend by attracting $38.4 million in inflows.

Community reaction

Reflecting this optimism within the crypto community, Dr. Dinero shared a positive perspective, highlighting hopeful sentiment despite recent market turbulence.

Source: Dr. Dinero/X

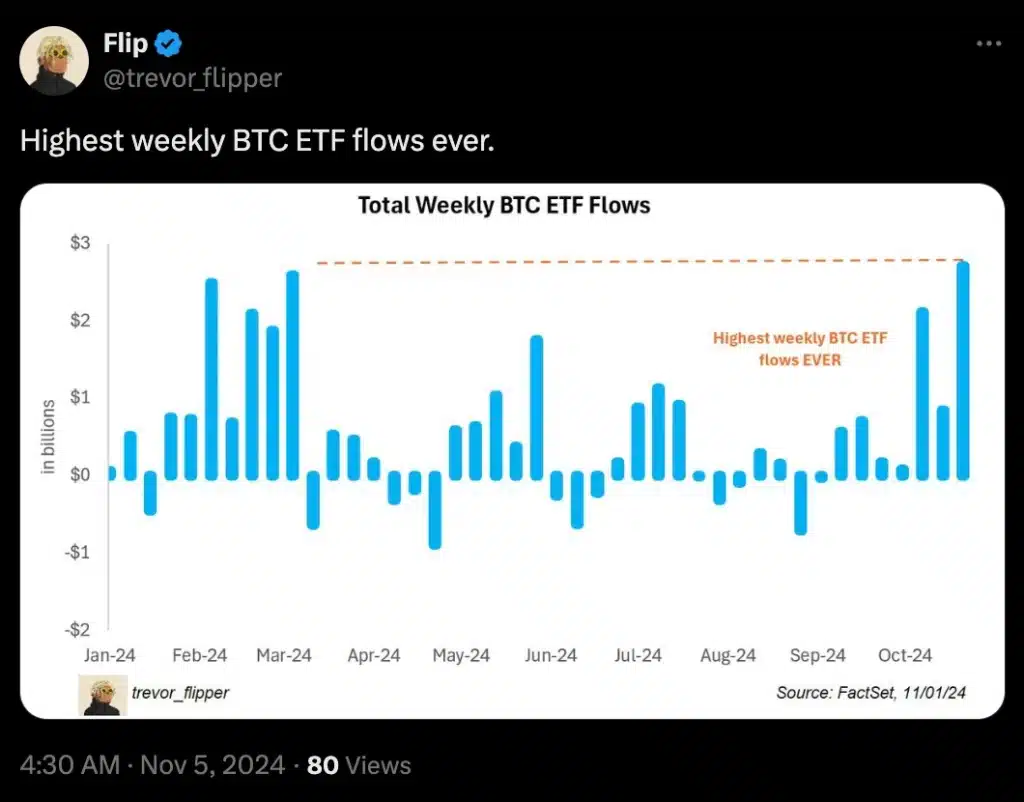

Another X user noted,

Source: Flip/X

Looking at the cumulative data though, BTC ETFs have generated significant inflows since their launch, with volumes of $23 billion. Notably, BlackRock’s IBIT alone recorded $26 billion in inflows.

Will Bitcoin ETFs cross Satoshi’s holdings?

Eric Balchunas, Bloomberg’s Senior ETF analyst, had previously forecasted that BTC ETFs might soon exceed the holdings attributed to Bitcoin’s creator, Satoshi Nakamoto. It was expected that these ETFs will reach this milestone by mid-December.

However, a recent single-day purchase by BlackRock, totaling 12,127 BTC, has accelerated this timeline.

In response to this significant accumulation, Balchunas shared his insights on X. He highlighted the swift momentum ETFs have gained in Bitcoin’s space.

“At this rate, they’ll pass Satoshi in less than two weeks. Altho they can’t keep up this Joey Chestnut-level pace, can they?”

Bitcoin’s price action

This recent surge in Bitcoin ETF activity has coincided with notable price volatility in BTC itself. After touching $73,000 just days ago, Bitcoin has now dipped below the $70,000-threshold.

At the time of writing, Bitcoin was trading at $68,807.31, following a slight 0.10% drop over the last 24 hours. On the weekly charts, it fell by over 3%.

Thus, as election season adds an extra layer of uncertainty, the crypto market might be gearing up for further volatility in the coming days.

Source: https://ambcrypto.com/bitcoin-volatility-reigns-as-election-uncertainty-spurs-541m-in-btc-etf-outflows/