- Bitcoin prices fell by 3.2% to $67,500.

- Ethereum saw a 2.9% drop in June 2025.

- Institutional investments spurring crypto market volatility.

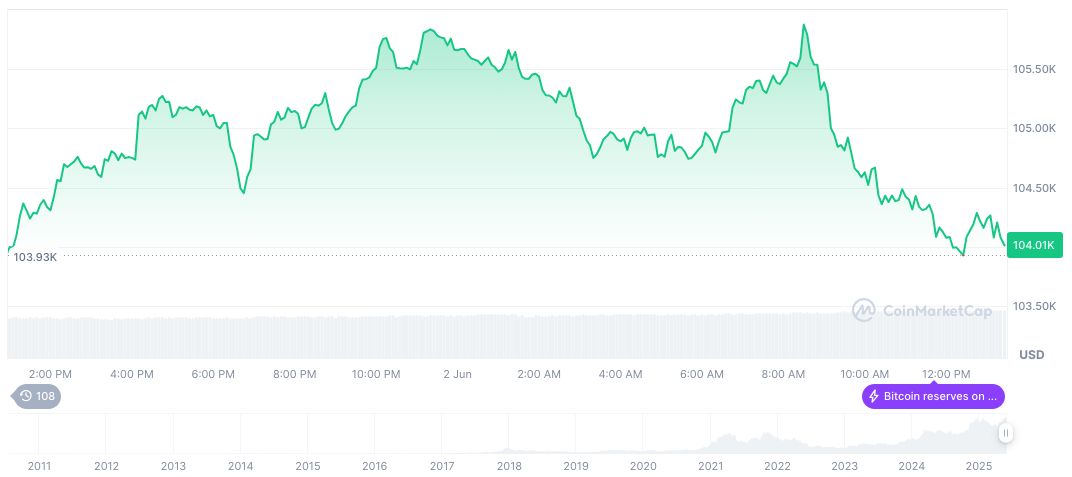

Bitcoin prices fell by 3.2% to $67,500 on June 2, 2025, following an all-time high in May. Ethereum saw a 2.9% drop, trading at $3,400, as market volatility impacted major cryptocurrencies.

These changes highlight growing institutional interest in crypto, seen from a 15 million USD inflow into Grayscale’s $GBTC$ while major financial entities increase BTC holdings. Currently, a major $3.3 billion token unlock event is set to influence liquidity.

Institutional Investment Spurs Crypto Volatility

Increased trading volumes on exchanges like Binance reflect a strong correlation with traditional markets, reinforcing crypto’s integration into broader financial systems. Analysts expect continuing volatility due to upcoming liquidity events, further influencing market dynamics.

A major token unlock event in June 2025 is set to release over $3.3 billion in tokens, likely impacting liquidity and volatility. Projects like Metars Genesis and Sui are involved in this release, introducing potential shifts in market dynamics.

Market reactions have varied; traditional financial institutions remain confident in crypto’s future, evidenced by recent investments. They continue to invest in digital assets despite potential fluctuations, viewing crypto as a crucial asset class. No official statements from key figures like CZ or Vitalik Buterin have emerged yet.

Bitcoin Volatility Mirrors 2021 Market Trends

Did you know? The current Bitcoin volatility is comparable to early 2021, marked by major institutional interest despite market fluctuations, showcasing a recurring trend in crypto market cycles.

Bitcoin’s current price is $106,341.62 with a market cap of $2.11 trillion and volume of $46.07 billion, as per CoinMarketCap. The price shows a 0.71% daily rise, but a 2.84% decline over the past week. In the last 60 days, it has increased by 27.82%, reflecting significant short-term upward movement.

The Coincu research team anticipates potential volatility in crypto markets due to large token unlock events. The team notes that historical trends in liquidity shifts often coincide with rapid price developments. Strong market participant engagement could mitigate effects, indicating a strategic approach by investors.

“Bitcoin’s strong correlation with the Nasdaq 100 index, currently at 0.78, illustrates the intertwined relationship between crypto and traditional financial markets during this volatile period.” – IFB Podcast Insights

Source: https://coincu.com/341272-bitcoin-volatility-june-2025/