The top digital asset, Bitcoin (BTC), has recently struggled to maintain a bullish outlook following a profitable Q1 for the miners and holders. Trading around $27.36k on Thursday, up 2.1 percent in the past 24 hours, Bitcoin price is on the cusp of dropping further toward $24k. Furthermore, technical analysis on the higher time charts shows Bitcoin price is trading below the neck of a head and shoulder candlestick pattern.

Additionally, the daily 50 MA has been acting as a resistance level for the past two weeks, which indicates the sellers are slowly overtaking the buyers. The rise of BRC-20 tokens has briefly increased Bitcoin’s on-chain activity, including the daily average transactions that recently spiked to ATH.

Bitcoin Unique Addresses: What Does It Tell Us?

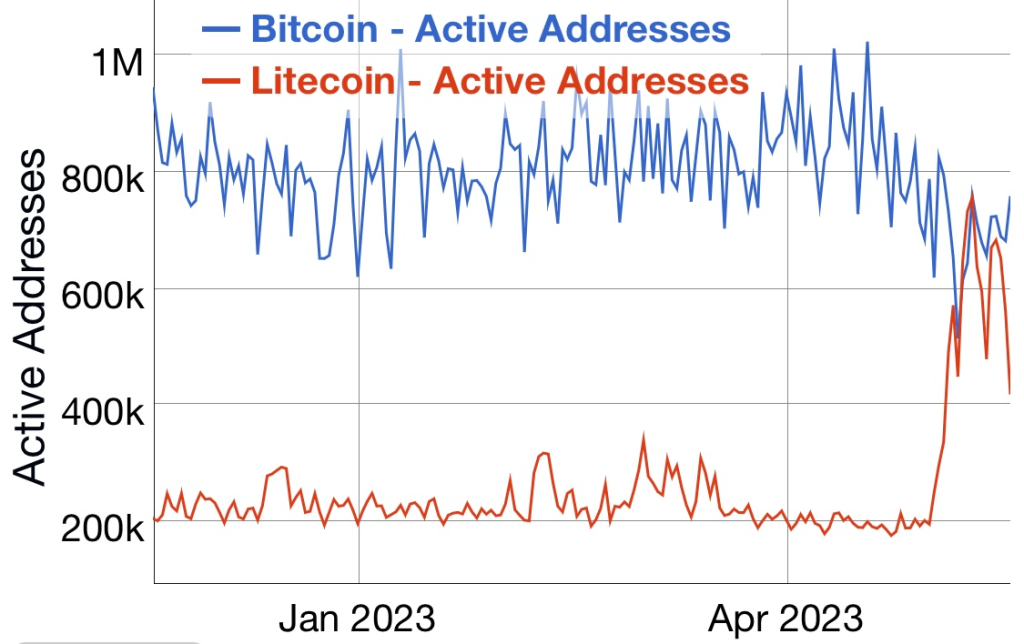

The number of Bitcoin unique addresses is a major factor when analyzing the overall demand for Bitcoin in the global market. According to a report by market intelligence platform Santiment, the number of unique Bitcoin addresses has been on a decline in the recent past to hit a 22-month low.

Interestingly, the total number of unique Bitcoin addresses dropped significantly in May below 800k amid the rise of BRC-20 tokens.

Litecoin Gains Traction

As the number of active addresses on the Bitcoin network diminishes, the third largest PoW ecosystem, Litecoin, posted an increase in the overall active address. The spike in demand for Litecoin amid the upcoming halving has also increased its daily traded volume and underlying value.

Related: Top Reasons Why Litecoin (LTC) Price Will Go Parabolic Soon – Coinpedia Fintech News

Bitcoin Market Analysis & Future Outlook

The liquidity in the Bitcoin market has thinned in the recent past caused by global geopolitical differences. For instance, the crypto crackdown in the United States has reduced USD on/off ramp services. According to market aggregate data from Kaiko, the altcoin liquidity has fallen by about 17 percent over the last month, compared with 4 percent and 2 percent for Bitcoin and Ethereum respectively.

Source: https://coinpedia.org/bitcoin/bitcoin-unique-addresses-plunge-btc-price-at-risk-of-dropping-below-24k/