- Bank of Japan’s potential rate hike impacts Bitcoin, causing price drop.

- Bitcoin sees a steep decline amid global market liquidity concerns.

- Arthur Hayes cites significant pressure on cryptocurrency market valuations.

Arthur Hayes attributes the recent Bitcoin crash to the Bank of Japan’s potential interest rate hike, affecting global liquidity, as communicated via his Twitter and podcast platforms.

The Bank of Japan’s shift impacts cryptocurrency markets, causing Bitcoin’s decline amid global liquidity concerns, highlighted by the USD/JPY fluctuating between 155-160, signaling a broader financial shift.

Bank of Japan Rate Hike: Impact on Global Liquidity and Bitcoin

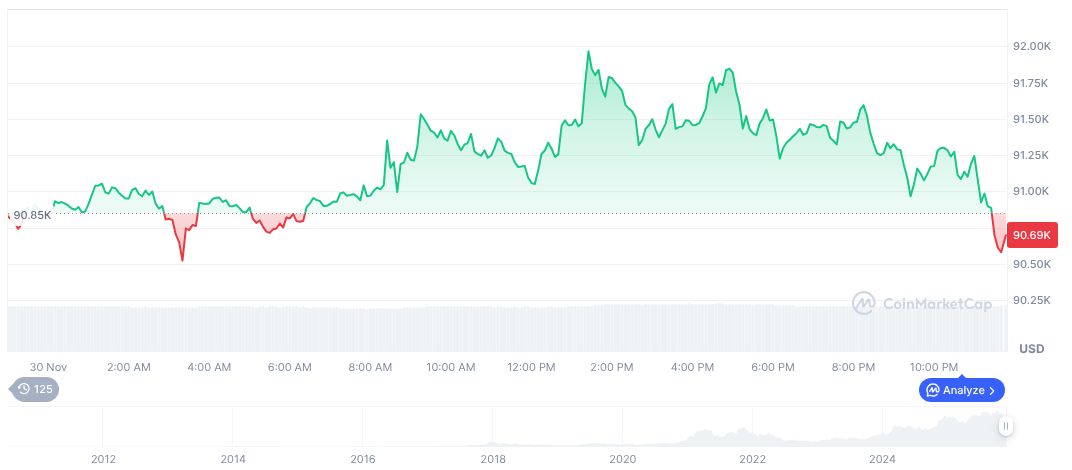

Bitcoin experienced a notable price drop following Arthur Hayes’ remarks about the Bank of Japan’s (BoJ) potential shift in monetary policy. On November 12, 2025, Hayes identified the BoJ’s hawkish hint as a significant factor behind the depreciation, suggesting it signals a shift away from Japan being the primary buyer of global risk assets.

This change is pivotal, as it may lead to a prolonged period of market liquidity squeeze. Hayes emphasized that the “global carry trades” supported by Japan’s previous monetary policies now face pressure. Bitcoin, Ethereum, and related cryptocurrencies, hence, have started a substantial downward trajectory due to shrinking liquidity.

“The BoJ’s hint at a rate hike is the first real crack in the global liquidity dam. USD/JPY holding above 155 is a signal that Japan is no longer the marginal buyer of global risk assets. This is why BTC corrected hard. Watch for more pain if the BoJ stays hawkish.” – Arthur Hayes, Former CEO, BitMEX

In response, the market has seen considerable volatility with major cryptocurrencies feeling the downward heat. Key stakeholders, including cryptocurrency investors, pointed out the importance of monitoring the BoJ closely. Crypto insights from Hayes on Twitter have garnered attention, as discussions revolve around interpreting further BoJ actions and their implications.

Bitcoin Historical Trends and Current Market Reaction

Did you know? In 2013, a Bank of Japan quantitative easing announcement led to a 300% surge in Bitcoin over the subsequent 12 months, showcasing Japan’s significant impact on global cryptocurrency markets.

According to CoinMarketCap, Bitcoin (BTC) currently trades at $86,170.00, with a market cap of $1.72 trillion. Despite a 24-hour trading volume of $60.19 billion, Bitcoin has fallen by 5.29% over the past 24 hours and 21.69% over 30 days, reflecting wider market reactions.

Insights from Coincu’s research indicate that this market movement could further affect financial regulatory perspectives and initiate technological adaptations among market participants. Historical risk trends and liquidity outcomes provide crucial context for what’s anticipated if the BoJ continues a hawkish approach.

Japan’s significant impact on global cryptocurrency markets is a focal point for investors navigating current challenges. Meanwhile, broader discussions about the potential for a prolonged market liquidity squeeze have further emphasized the importance of understanding Asian market influences.

Further market developments should be observed with regard to potential liquidity shifts. Stakeholders should keep a close eye on these dynamics, as Bitcoin and other significant cryptocurrencies continue to navigate the volatile market landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/bitcoin-japan-interest-rate-impact/