- Bitcoin’s Short-Term Holders (STHs) are currently holding at an average unrealized loss of 6%.

- A move above their cost basis could shift sentiment. What are the odds?

Bitcoin [BTC] has surged past four key resistance levels in the last two weeks, pushing previously underwater holders back into profit.

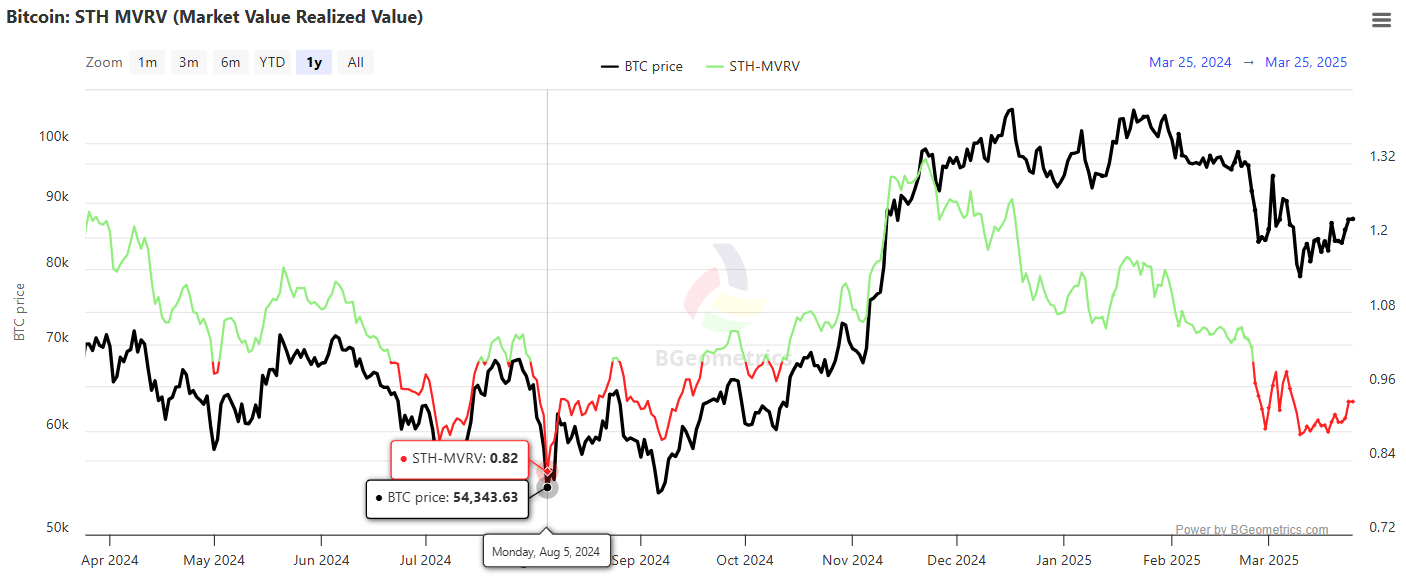

However, the Short-Term Holder Market Value to Realized Value (STH MVRV) ratio remained in negative territory, signaling that short-term holders are still at an aggregate unrealized loss.

A sustained move above their cost basis is required to drive FOMO and unlock further upside potential. On-chain data from Glassnode pinpointed $93.5k as the critical breakeven threshold, marking a major resistance cluster.

For Bitcoin to maintain its current market value of $88,041 and extend the rally, bulls must prevent forced liquidations among short-term holders, which could induce distribution-driven sell pressure.

A failure to do so risks a repeat of the early August 2024-style capitulation event, where a negative STH MVRV reading preceded BTC’s sharp drawdown from $68,525 to $54,343 in under two weeks.

Source: BGeometrics

The immediate objective for bulls, therefore, is to flip the $93.5k resistance into support, a move that would drive the STH MVRV ratio into positive territory.

Consequently, it would bring short-term holders (>155 days) into unrealized profits, alleviating sell-side pressure.

This breakout is particularly crucial as Q2 approaches, with macroeconomic shifts poised to introduce liquidity fluctuations. So, to prevent forced liquidations, Bitcoin must confirm this as a demand zone.

A critical week ahead

Bitcoin’s retracement to its pre-election low of $78k on the 10th of March triggered “extreme fear,” historically marking a strong accumulation zone.

Since then, BTC has climbed 12.82%, restoring a significant share of stakeholders to net unrealized profit.

This shift has pushed market sentiment into the “belief” phase, as indicated by the Net Unrealized Profit/Loss (NUPL) metric.

Source: CryptoQuant

Put simply, this signals a preference for HODLing over distribution at key resistance levels.

Furthermore, Open Interest (OI) has surged back to its November peak of $57 billion, with $12 billion in new leveraged positions in the past two weeks, underscoring strong speculative demand.

However, Bitcoin’s reclaim of $93.5k, a key Short-Term Holder (STH) breakeven level, remains uncertain. A sustained rejection here could trigger selling pressure, raising the risk of liquidations.

A deeper downturn in STH MVRV would then confirm capitulation among weak hands, potentially accelerating a broader distribution phase.

With macroeconomic uncertainty ahead, Q2 could introduce fresh volatility – A factor to watch before trading purely on bullish metrics.

Source: https://ambcrypto.com/bitcoin-traders-watch-out-btc-wont-see-a-real-breakout-unless/