- AguilaTrades raised Bitcoin position to 20x leverage, profit $12.9 million.

- Position involves 3,000 BTC worth $340 million.

- No official comments from Hyperliquid or AguilaTrades about the trade.

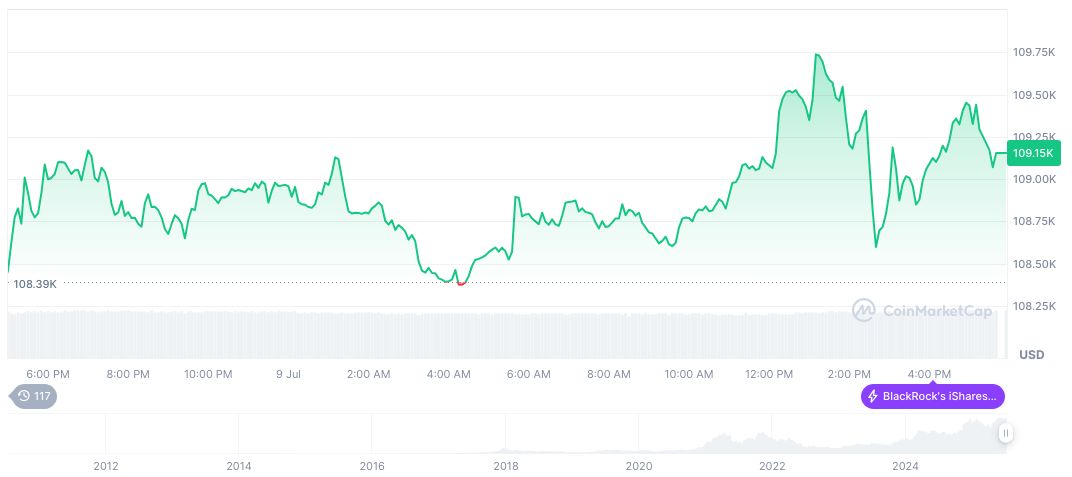

AguilaTrades, a notable trader on Hyperliquid, expanded his Bitcoin long position to 20x leverage, involving 3,000 BTC worth 340 million dollars. The entry price was 109,000.3 dollars while the liquidation point stood at 108,422.85 dollars, realizing a profit of over 12.9 million dollars.

The decision to significantly increase leverage on Bitcoin spotlights the ongoing engagement of prominent traders in high-risk strategies. The trade hasn’t prompted official statements from AguilaTrades or Hyperliquid, emphasizing results monitored through on-chain data alone.

AguilaTrades Amplifies Bitcoin Stake with $12.9M Profit

AguilaTrades, already recognized for high-leverage moves, raised his BTC long position to 20x leverage, involving a massive 3,000 BTC. Amid this, there’s an observable spike in market attention, given the high profit derived and possible implications for BTC derivatives markets on Hyperliquid.

Increased leverage highlights the potential for trader-driven volatility within the market. Such bold trading actions can provoke market shifts and, historically, have influenced trading platforms and funding rates, particularly impacting BTC.

Trader and community sentiment remains piqued, as seen through intensified activity on trader analytics forums. However, notable figures have abstained from public opinions, leaving market reactions to unfold organically, with on-chain observers closely tracking the ramifications.

Market Dynamics Shaped by High-Leverage Trading Strategies

Did you know? AguilaTrades previously experienced $15.4 million in losses over 10 days due to similar high-leverage BTC strategies, demonstrating the cyclical nature of high-risk trades in this sector.

Bitcoin (BTC) currently trades at $113,491.64 while holding a market cap of $2.26 trillion and a 24-hour trading volume of $66.05 billion, as per CoinMarketCap data. The 90-day price change stands at 36.74%, underpinning the asset’s current volatility levels and deriving substantial interest from traders.

Coincu’s research team suggests ongoing leverage adoption might influence regulatory discourse surrounding derivatives. These activities spotlight potential shifts in market dynamics, warranting increased scrutiny from stakeholders as technological advancements drive trading behavior.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347923-aguilatrades-20x-leverage-bitcoin/