- Bitcoin’s price surpasses $100,000, driven by institutional interest.

- Spot Bitcoin ETFs approved, boost market liquidity.

- Gold prices and USD face pressure from Bitcoin surge.

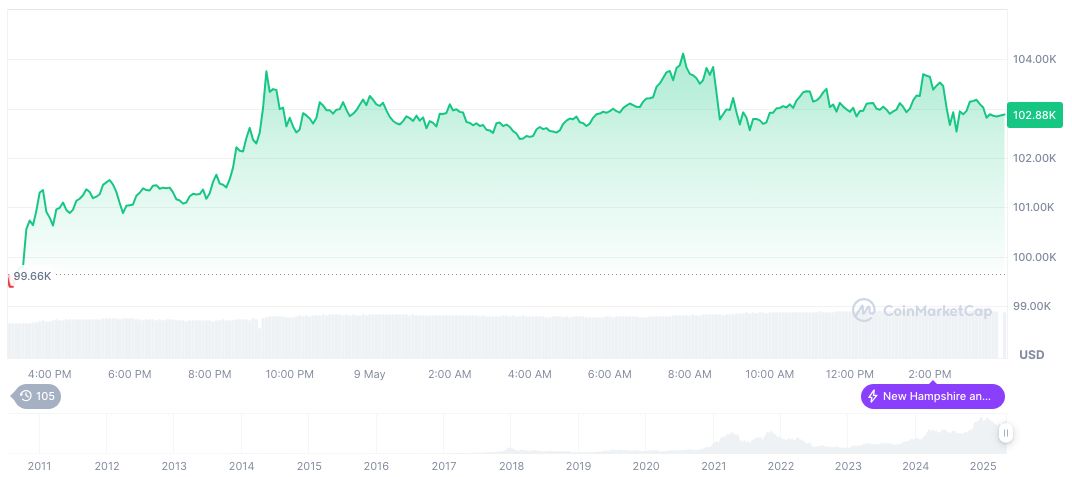

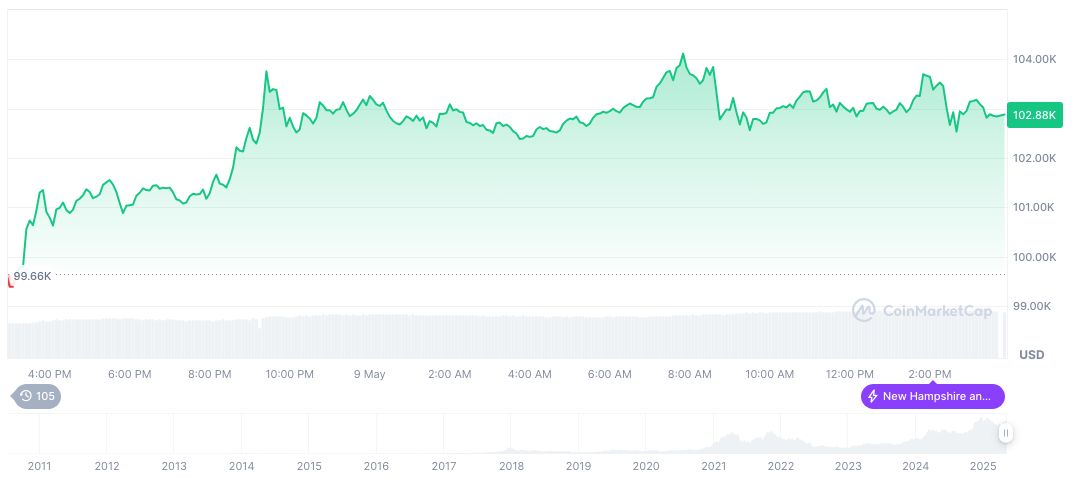

A major milestone has been achieved as Bitcoin eclipsed the $100,000 mark this week, driven by increased institutional involvement and ETF approvals.

This surge in Bitcoin’s value highlights significant changes in market investment patterns, with implications for broader financial markets and potential impacts on global economic indicators.

Bitcoin Achieves $100,000: Institutional Investment Soars

Bitcoin climbed above $100,000 this week, marking a significant achievement in its market journey. Institutional investment played a crucial role in this rally, fueled by the approval of Spot Bitcoin ETFs by the SEC in 2024. Analysts note this shift away from traditional market cyclicality, led by retail investors and whales, towards more institutionally driven dynamics.

The implications are notable, affecting gold and the US dollar among other assets. The gold market witnessed fluctuations, and experts suggest that investor focus may be shifting towards higher-yield risk assets such as Bitcoin. The institutional influx provides resilience against market sell-offs, ensuring stability and setting a precedent of confidence in Bitcoin’s future.

The cryptocurrency community has responded with optimism, echoed by industry leaders. Ki Young Ju, CEO of CryptoQuant, emphasized on social media that the market dynamics have evolved significantly since the advent of ETF investments.

Looking at market observations, it is evident that Bitcoin is better positioned for sustained growth.

Price Dynamics and Expert Analysis

Did you know? Historical Bitcoin price surges, like the one crossing $100,000, have often coincided with major global liquidity upticks. This aligns with the recent increase in global M2 money supply, enhancing Bitcoin’s growth potential.

According to CoinMarketCap, Bitcoin (BTC) recently traded at $103,456.41, establishing a stronghold in cryptocurrencies with a market dominance of 62.31%. Despite a decrease in 24-hour trading volume by 47.05%, it reflects consistent growth, with a 28.56% rise over 30 days.

The Coincu research team indicates that the approval of Bitcoin ETFs is starting to reshape market landscapes. Financial analysts suggest long-term stability for Bitcoin, pointing to its resilience and adaptability in the face of regulatory shifts. These factors, combined with broader economic strategies, fuel optimism for a sustained bullish market trajectory.

“The market is no longer reliant on old Bitcoin whales, retail investors, and miners to move the market… The advent of Spot Bitcoin ETFs… have opened up new avenues for liquidity. Now, it is not only new retail investors… but also institutional investors… with much larger pockets.” — Ki Young Ju, Founder & CEO, CryptoQuant

Source: https://coincu.com/336839-bitcoin-surpasses-100000-etf-institutional-inflows/