Key Highlights:

- Bitcoin price hovering around the $86,000 mark today, December 2, 2025.

- Institutions like Strategy, Metaplanet, Tesla and Marathon Digital are still holding on to the BTC positions.

- The company’s holding on to BTC indicates that they believe in the long-term potential of the token.

Bitcoin has hit a rough patch as the price of the token is hovering around the $86,000 mark, after enduring a steep sell-off that wiped out significant gains from prior months (including majority liquidity event on October 11). The cryptocurrency’s price fell sharply from highs above $91,000 in late November, dropping over 6% in a matter of hours as market fears increased ahead of crucial Federal Reserve policy decisions and a shock crypto incident involving Yearn Finance.

The Fear and Greed index is down to 23, which indicates extreme fear, but big institutions are not panicking or selling their Bitcoin holdings. They still plan to hold on, which indicates Bitcoin’s potential to be valuable in the long run, even though things do not look so promising at the moment.

Strategy Announces $1.44 Cash Reserve

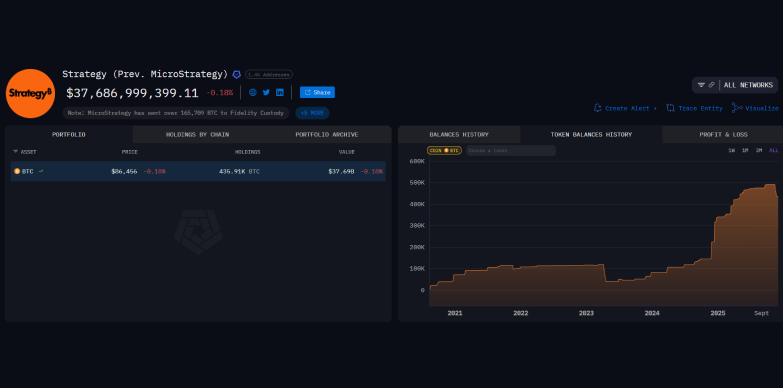

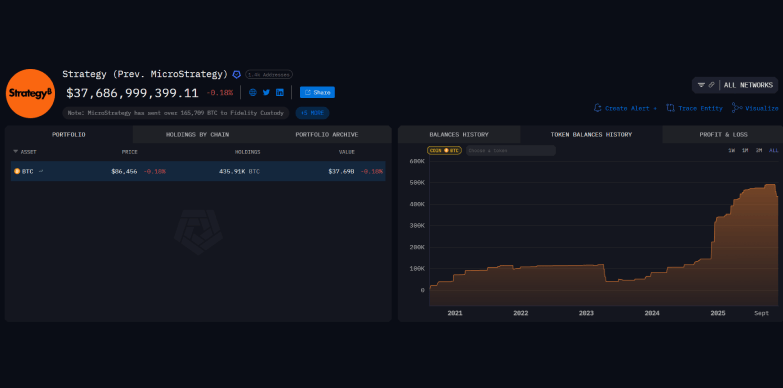

Strategy (formerly known as MicroStrategy) is still the biggest company in the world that owns Bitcoin. According to Arkham Intelligence, it currently holds around 435,909 BTC. Yesterday, Michael Saylor announced that the company’s BTC reserve has been increased to 650,000. The drop, however, indicates that there has been a shift in the custody and internal reallocation and not a sale. Over the past two months, Strategy has managed to move roughly 58,390 BTC from Coinbase to Fidelity custody, where assets are pooled in omnibus accounts.

According to the recent announcement on social media platform X, the company has also set aside a $1.44 billion cash reserve to navigate through these price swings. This again indicates that the company still remains bullish on Bitcoin despite volatility.

$MSTR announces the formation of a $1.44 billion USD Reserve and an increase in its BTC Reserve to 650,000 $BTC. pic.twitter.com/e1tAhDUo9G

— Michael Saylor (@saylor) December 1, 2025

Metaplanet Launching New Ways to Buy BTC

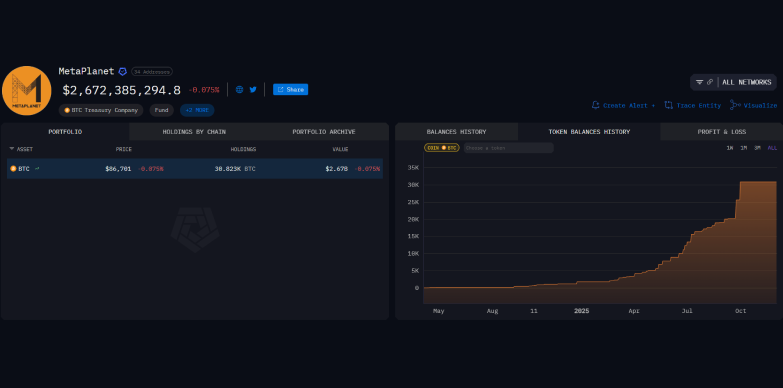

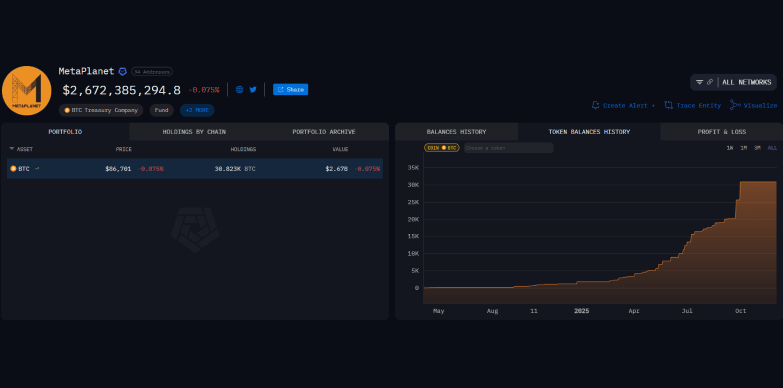

Japan’s Bitcoin Treasury company is also steadily accumulating Bitcoin as it aims to hold more than 210,000 BTC by 2027. As per Arkham, the company currently holds 30,823 BTC.

On November 20, 2025, Metaplanet announced the launch of MERCURY, a fundraising product to raise about $150 million. It offers a 4.9% yearly dividend with the option to convert into common shares. This move will help the company keep building its Bitcoin holdings.

Today we announced MERCURY, our new Class B perpetual preferred equity. 4.9% fixed dividend. ¥1,000 conversion price. A new step in scaling Metaplanet’s Bitcoin treasury strategy. pic.twitter.com/UtnHA2lPRE

— Simon Gerovich (@gerovich) November 20, 2025

Tesla Moving Ahead with Caution

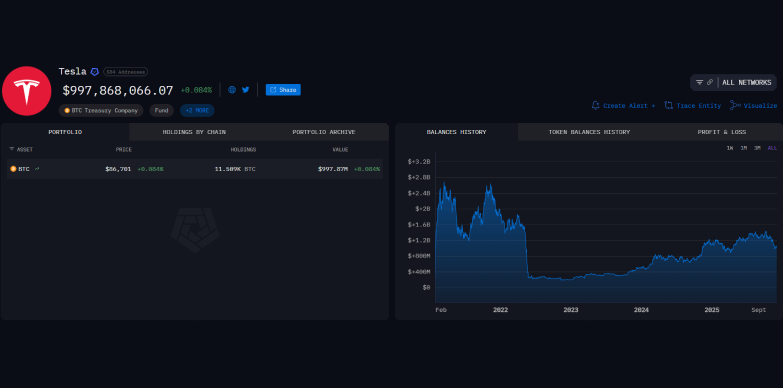

Tesla is also known to be holding a good amount of Bitcoin. According to Arkham, at press time, Tesla holds 115,09 BTC reserves but added slowly and cautiously.

However, in a recent interview with host Nikhil Kamath, Elon Musk commented about Bitcoin. He says that Bitcoin is valuable because it takes real energy to create as it cannot be made out of thin air. Governments can print more money whenever they want, but they cannot print energy. Hence, as Bitcoin is tied to energy and effort, one cannot cheat or inflate.

“Energy is the true currency. Bitcoin is based on energy.” – @ElonMuskpic.twitter.com/BXsGZtBSO0

— Michael Saylor (@saylor) November 30, 2025

MARA Digital Holdings opts for a Sustainable Option

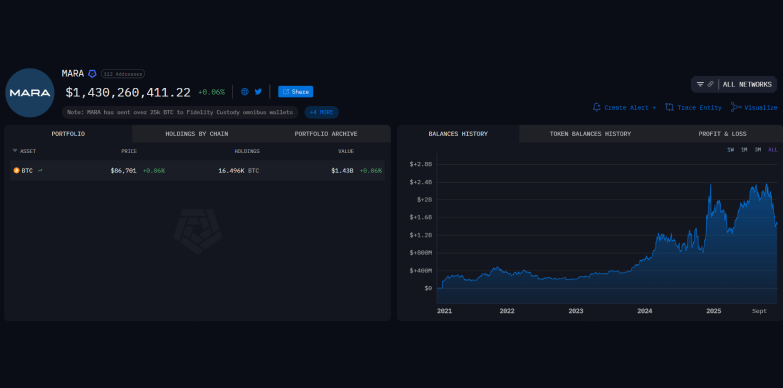

Similarly MARA Digital Holdings (MARA), a leading Bitcoin miner, combines mining operations with strategic accumulation. The company’s holdings keep on fluctuating on the basis of mining output and occasional market sales, but it has maintained a substantial BTC as a treasury reserve. As of press time, according to Arkham Intelligence, MARA holds 164,96 BTC as a treasury reserve.

Recently MARA teamed up with MPLX LP, which is a part of Marathon Petroleum, so that it could use MPLX’s energy infrastructure to get cleaner and more reliable power for Marathon’s mining facilities. This partnership is a part of Marathon’s push to reduce carbon emissions and make Bitcoin operations more friendly.

Final Thoughts

Bitcoin price has dropped down from $125,000 to $85,000 in just two months, which is a clear indication of bearish momentum and there are technical signs of further momentum.

Institutions on the other hand are calm and are holding on to their accumulated BTC positions. Strategy maintains about 435,000 BTC, Metaplanet is expanding its BTC treasury with its new MERCURY offering, Tesla is holding on to its reserves but is buying cautiously and Marathon Digital is growing its mining operation sustainably. These moves are indicating that the big holders remain committed to the cryptocurrency for the long-run.

Also Read: Here’s Why Bitcoin Price Could Plunge Another 20%

Source: https://www.cryptonewsz.com/bitcoin-struggles-institutions-still-hold-btc/