Key Takeaways

What did Bitcoin’s STH-NUPL signal?

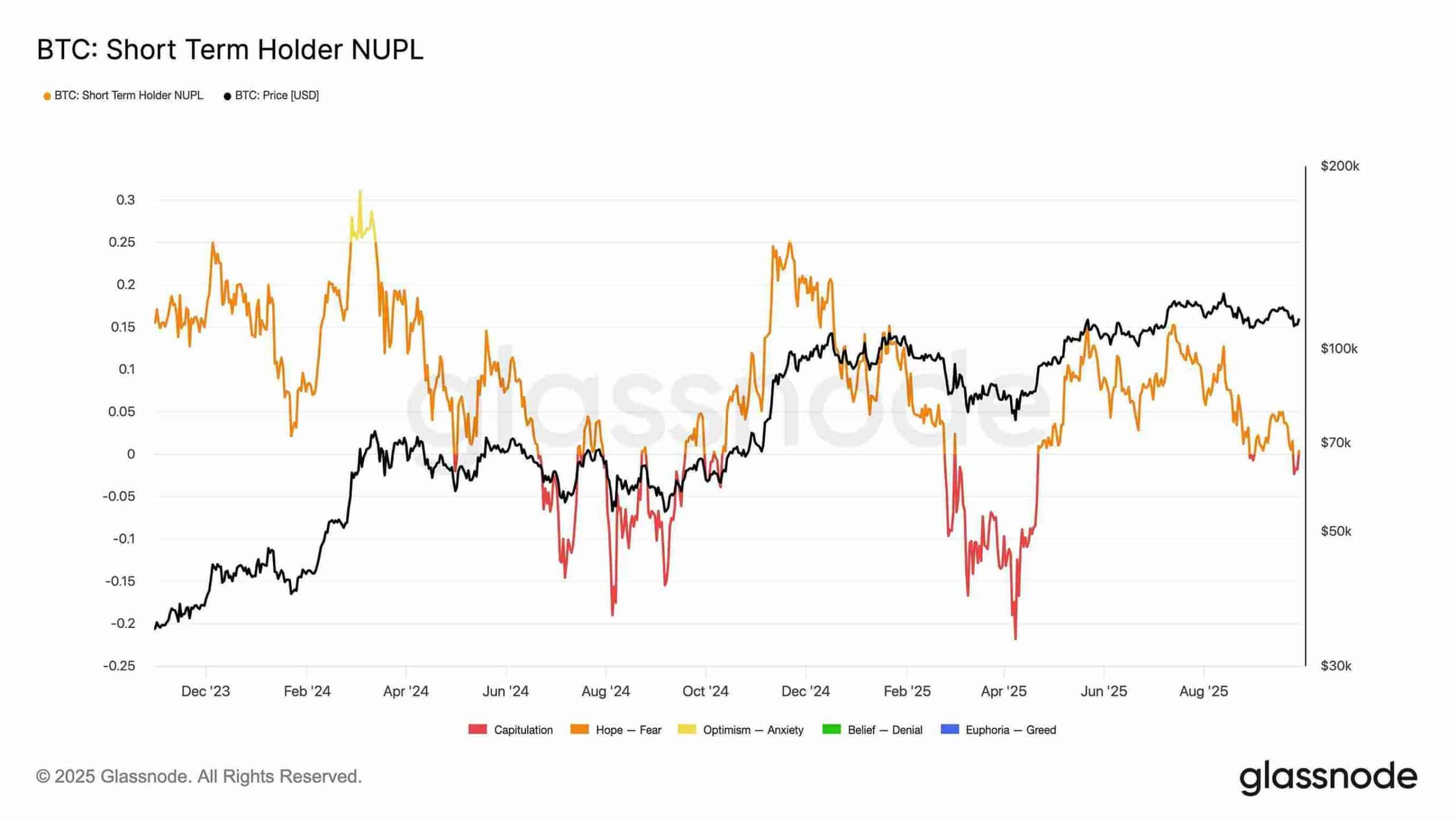

It flipped negative, showing many recent buyers in loss — a condition often linked with local market resets.

Which metrics support BTC accumulation potential?

Realized Price at $53.7K and over 300 short liquidations suggested BTC stayed resilient, keeping accumulation hopes alive despite short-term stress.

Bitcoin’s [BTC] Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) flipped into loss territory this week, suggesting many recent buyers held coins below the entry price.

It was not unusual to see nerves fade at this stage of the cycle. In fact, past resets often began when these holders capitulated.

Source: Glassnode

Break-even zone for short-term buyers

That was not all. Another metric that deserved attention was the Short-Term Holder Market Value to Realized Value (STH-MVRV) ratio.

As of writing, STH-MVRV stood near 1.0, meaning the most recent buyers were breaking even. Historically, whenever this metric hovered around the break-even line, Bitcoin traded near a local price bottom.

Source: CoinGlass

Derivatives inject resilience

While the Bitcoin spot market reflected stress, the derivatives side showed a different picture.

Over the past few days, Short Liquidations picked up sharply. Traders betting on further price drops were forced to cover positions. BTC Short Liquidations surged past 300, hitting a weekly high.

The liquidations often sparked a short squeeze, pushing prices upward as bearish pressure shrank and movements flipped direction.

If this trend persisted, it could help Bitcoin stabilize and possibly open the door for a bullish run despite retail-driven weakness.

Source: CryptoQuant

Bitcoin trading price still above its realized value

Even after the recent correction, Bitcoin still traded above its Realized Price — the average cost at which existing coins last changed hands. This meant most holders remained in profit despite recent corrections.

The metric lowered the risk of widespread panic selling and suggested that the market could be closer to accumulation than a deeper drawdown.

Source: CryptoQuant

Accumulation could be taking shape

Putting these signals together, capitulation risk among short-term holders, the rise in liquidations, the price above Realized Price, and institutional flows, suggested Bitcoin may be entering early accumulation.

Of course, Bitcoin bulls still needed to defend key support levels for this outlook to hold. A decisive break lower could shift the market structure.

Even so, most metrics leaned toward a quiet reset rather than a full breakdown.

Source: https://ambcrypto.com/bitcoin-sths-hit-break-even-is-a-btc-price-bottom-close/