Bitcoin is trading around $117,800, maintaining stability after a volatile summer rally.

Market data shows strong institutional inflows but also signs of retail overconfidence, raising questions about whether BTC can sustain its uptrend.

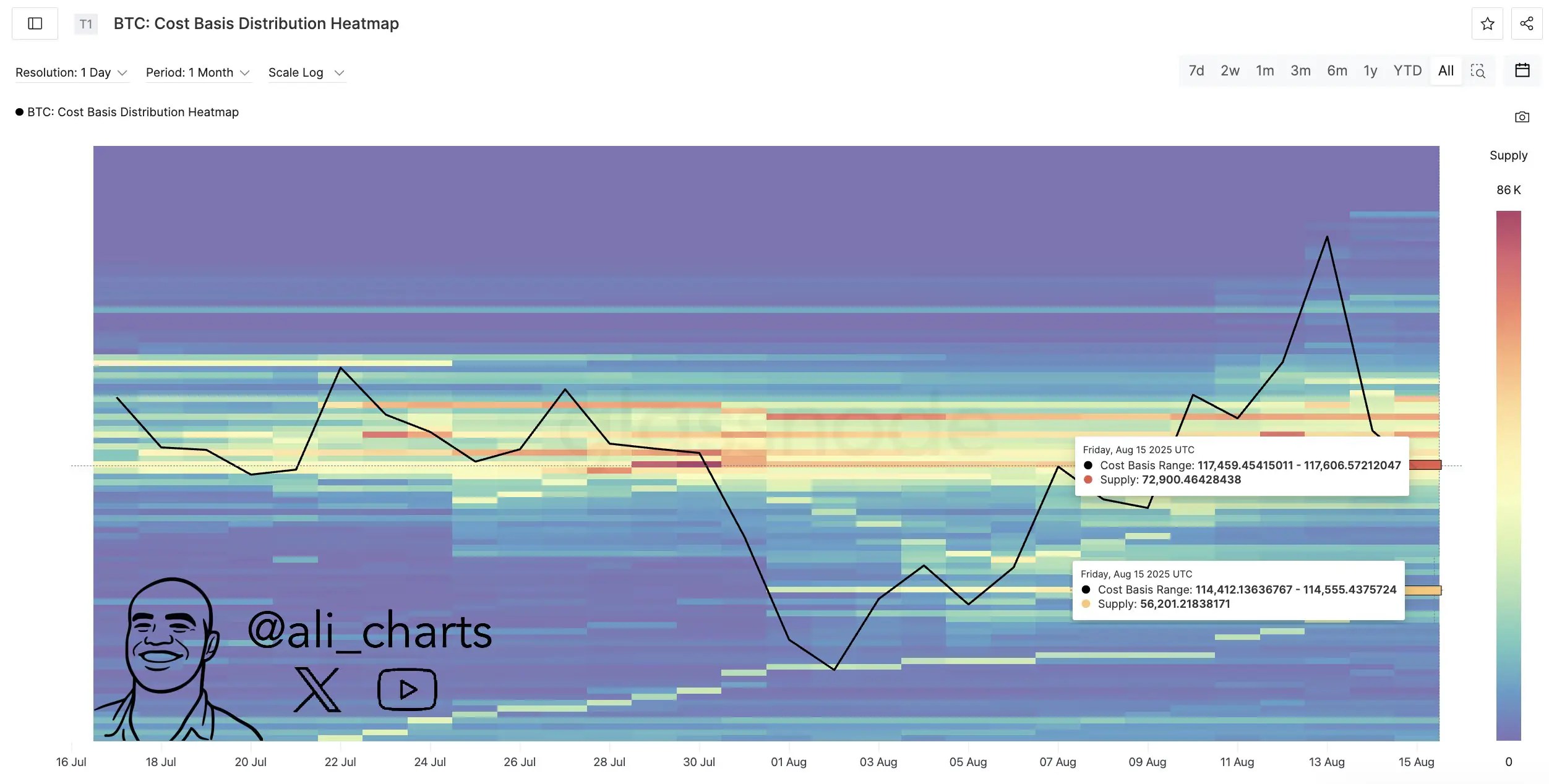

Key Support Levels at $117,500 and $114,500

On-chain analyst Ali highlighted two critical support zones for Bitcoin at $117,500 and $114,500. These ranges mark areas of heavy cost basis concentration, meaning a large number of traders bought Bitcoin in this price band. Holding above these levels is essential to prevent a deeper correction.

Miners Realize $37 Million in Profits

Data from CryptoQuant reveals that Bitcoin miners locked in over $37 million in realized profits this week. Historically, large miner sell-offs have been followed by short-term price pressure, though in many cases, demand from ETFs and whales has absorbed this supply without major drawdowns.

Institutional Accumulation Balances Retail FOMO

Institutional appetite remains a structural driver for Bitcoin. Spot ETFs now command over $250 billion in assets under management, and public companies collectively hold more than 800,000 BTC.

MicroStrategy alone accounts for 200,000 BTC. This sticky institutional demand contrasts sharply with retail behavior, which has shown sharp bursts of FOMO at recent highs.

In June, Santiment flagged the second-largest retail optimism spike in two weeks as Bitcoin reclaimed $108K, a pattern historically followed by corrections. A similar wave of retail enthusiasm could create short-term downside risk.

Whales Accumulate While Small Holders Exit

Recent wallet data shows 231 new addresses holding over 10 BTC, while more than 37,000 smaller addresses exited in just 10 days. This divergence suggests retail profit-taking while large holders continue to accumulate, a setup that often precedes rallies but may still encounter resistance near $122,000.

What to Watch Next

Bitcoin’s trajectory will likely hinge on whether support at $114K holds. A breakdown could spark liquidations, while a bounce above $117K keeps the bullish structure intact.

Investors should monitor two near-term catalysts:

CME open interest, which sits at $737 billion, indicating leveraged positioning.

The upcoming U.S. CPI release, which could sway risk appetite across both traditional and crypto markets.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Source: https://coindoo.com/market/bitcoin-steadies-at-117k-as-miners-cash-out-and-whales-accumulate/