- Bitcoin’s demand has been gradually declining since May’s local top.

- Low profit-taking levels suggest that investors are still leaning toward holding.

Bitcoin’s [BTC] recent price movements show a market in balance, with neither bulls nor bears in control.

Most holders appear to be in no rush to exit their positions, signaling a continued sentiment of holding.

Despite this, Bitcoin is currently struggling to push higher. One key reason is the lack of strong buying demand. Without sufficient demand to match or exceed supply, upward momentum still remains limited.

Metrics indicates waning demand pressure

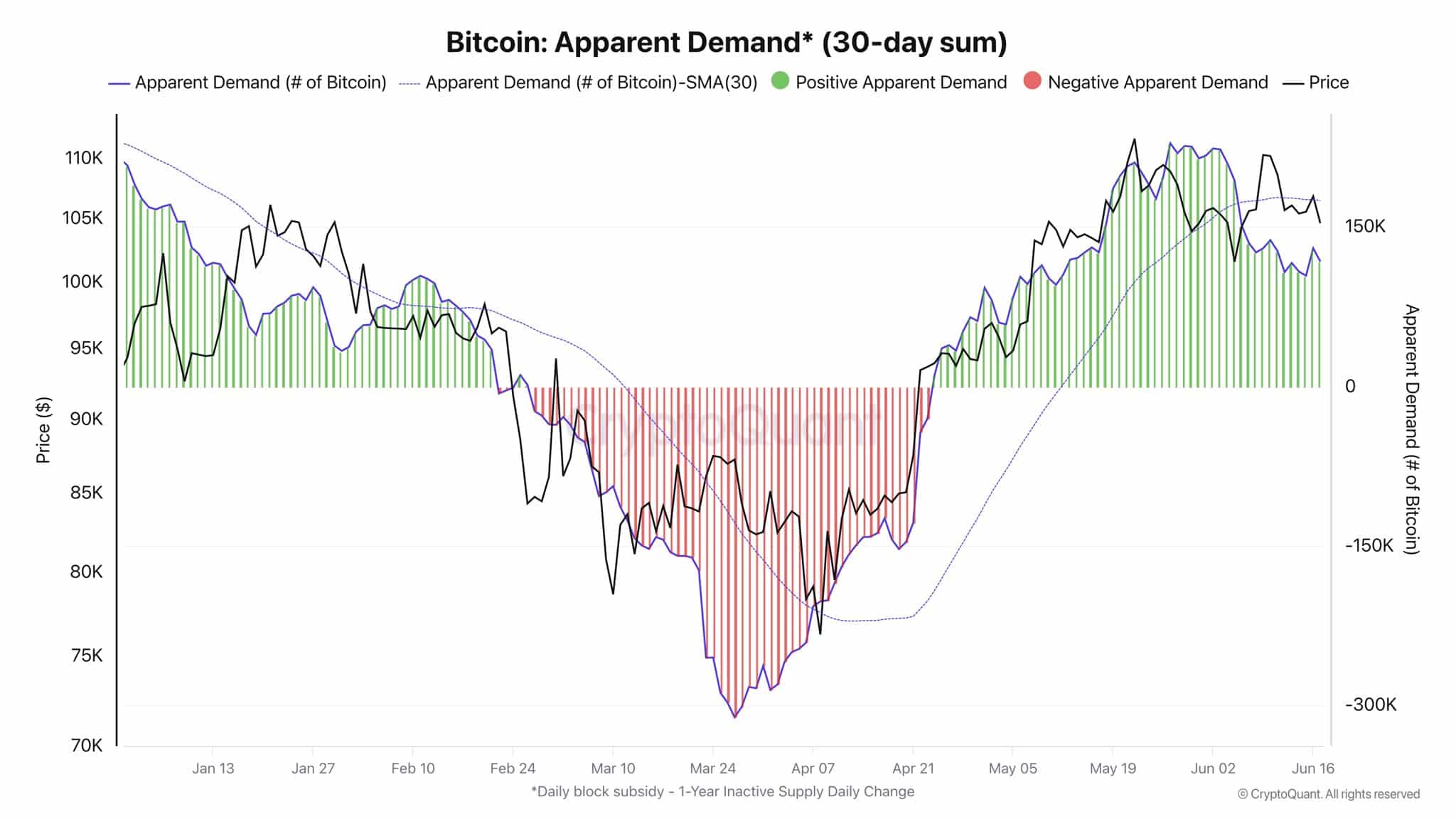

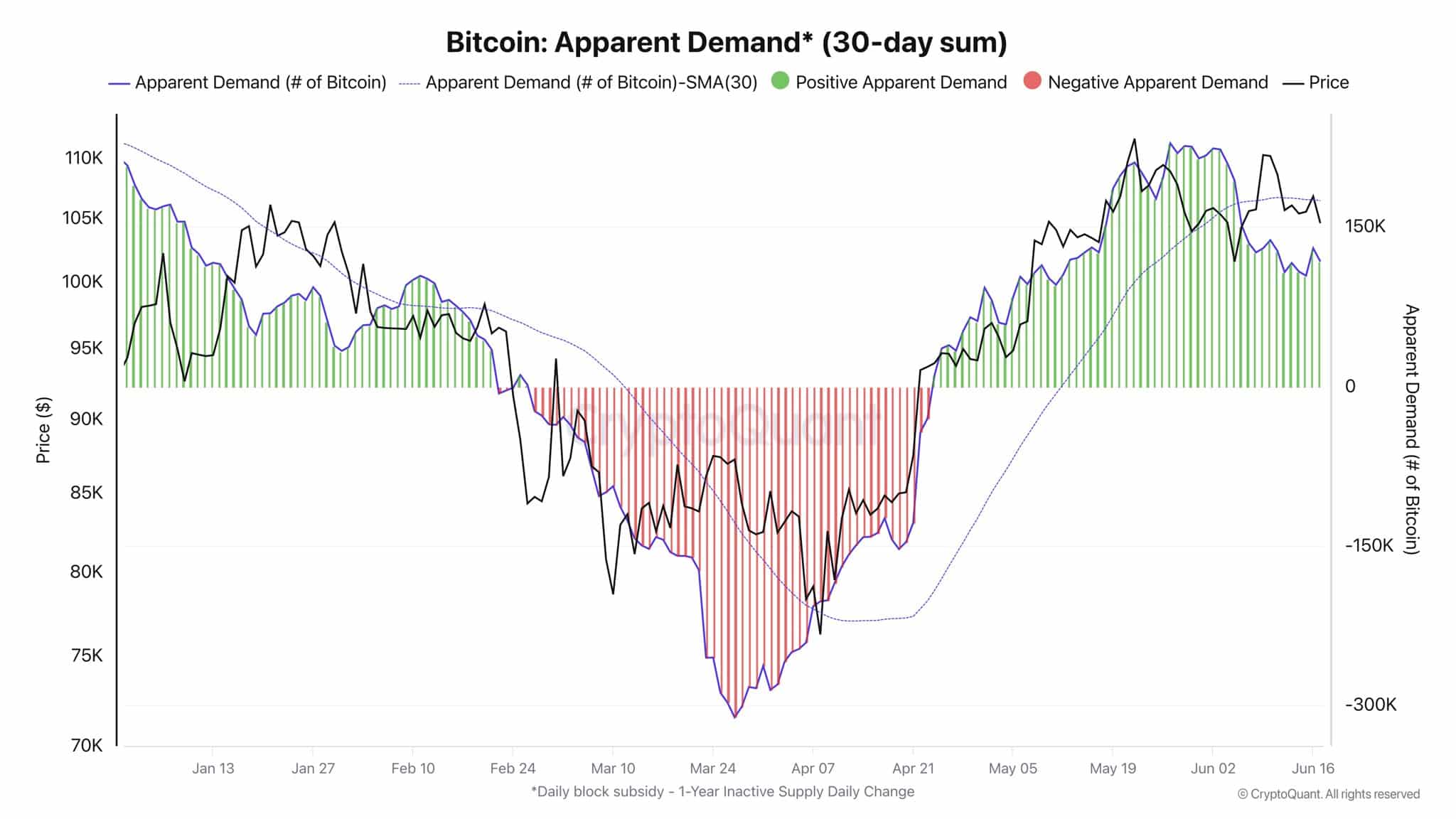

On-chain metrics support this view. AMBCrypto’s look at Bitcoin’s 30-day apparent demand indicated a slowly waning demand for the king coin.

The metric compares Bitcoin’s fresh supply with over 1-year dormant supply and ratio can serve as a proxy for market demand.

Since Bitcoin’s recent local top in early May, this ratio has been decreasing. Although it has not turned negative yet, the decline suggests that fresh BTC demand in the market has been fading over the recent few weeks.

Source: CryptoQuant

Support arises from holding behavior

Still, it is not all bearish. The steady decline in demand has failed to push the market into a sell-off. That is largely because of the firm holding action by the long-term holders.

Even as profit-taking crawl forward due to rising geopolitical tensions in the Middle East, HODLers refuse to budge.

The number of investors holding small coins, especially in the 10–100 BTC range, was approaching 32 million at press time.

This has kept the market in equilibrium. Selling pressure is present, but it is being mitigated by adequate buying interest to discourage sharp declines.

Source: IntoTheBlock

Market is balanced, but at a breaking point

Nothing holds forever. The current equilibrium courtesy, of the strong holders’ sentiment, could fade soon if the demand for BTC will not materialize.

Until then, Bitcoin’s price will likely remain at this spot of muted tension.

Source: https://ambcrypto.com/bitcoin-stalls-as-demand-wanes-what-this-means-for-btcs-next-steps/