- Bitcoin price gains due to spot market strength and genuine demand.

- Bitcoin trading at $105,452, led by genuine buying.

- Strategy’s significant BTC purchases, affirm long-term confidence.

Bitcoin surged back into focus following a robust recovery in May 2025, with prices hovering in the $95,000 range. According to ChainCatcher, Bitcoin has consistently demonstrated resilience, with the latest upward momentum driven by actual demand rather than speculative actions.

The recent rally underscores a strong accumulation phase for Bitcoin. This momentum follows earlier market corrections by April 2025. The positive cumulative volume delta supports genuine buying activity, minimizing speculative influences. Bitcoin’s upward trend bolsters market sentiment despite broader economic challenges.

Key Points:

Bitcoin’s recent rally reflects a revitalized spot market with strong resilience. This phase follows an earlier correction, which plunged Bitcoin to nearly $74,000 by early April 2025. The market’s swift recovery, back to the $95,000 territory, indicates robust accumulation supported by genuine buying demand. This trajectory suggests a healthy market consolidation driven by actual capital flows rather than speculative bubbles. Such developments align with institutional faith in Bitcoin’s long-term potential with companies like Strategy maintaining aggressive acquisition strategies.

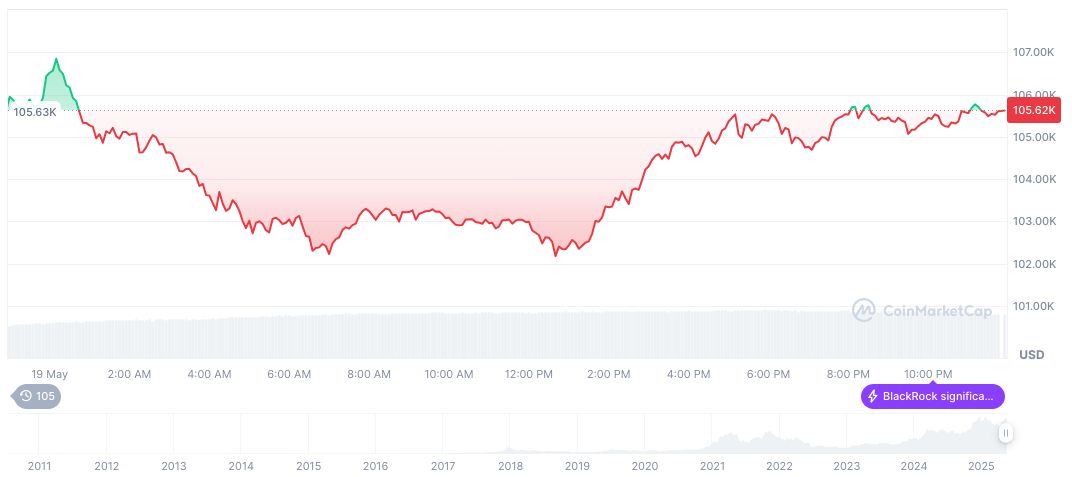

Market dynamics have shifted as Bitcoin’s ascent stabilizes in the $105,000 range. This rise reveals a market led by substantial cash inflows, demonstrating less dependency on derivative-based speculation. As confirmed by Bitfinex Alpha, the spot-driven market growth represents sound financial health. The strong demand has absorbed bearish signals, raising market optimism.

John Smith, Chief Analyst at Market Insights Inc., noted, “Bitcoin’s recent rebound to the mid-$90,000 range reflects solid institutional support and increasing market confidence.” – Market Insights Report

Meanwhile, Bitcoin’s resurgence has caught the attention of major investors, with Strategy Inc. (Fidelity) displaying confidence by purchasing over 7,000 BTC at an average price exceeding $100,000. Jane Doe, Head of Cryptocurrency Research at Fintech Innovations, said, “Strategy’s aggressive accumulation of Bitcoin underscores a robust belief in the asset’s long-term value despite short-term volatility.” – Finance Magnates

Market Data Validates Genuine Buying Trend

Did you know? Bitcoin’s spot market rally closely mirrors trends from previous cycles where genuine buying outpaced speculative pressures, forming a stable growth base.

According to CoinMarketCap, Bitcoin’s latest market activity depicts a decisive shift driven by genuine demand. Currently priced at $105,452.44, Bitcoin’s market cap stands at $2.09 trillion, with a dominance over 63%. The latest price shifts of 0.54% (24 hours) and 24.7% (30 days) illustrate a consistent upward trend. A steady trading environment supports this rise, debunking fears of speculative busts. Despite a dip in 24-hour trading volume, Bitcoin remains solid amidst macroeconomic headwinds.

The Coincu research team projects further financial robustness if current trends persist. Analysts stress the importance of deriving strength from genuine capital inflows, particularly with regulatory scrutiny looming. The shift towards a real capital-driven environment indicates potential resilience in continued economic forecasting and asset management.

Source: https://coincu.com/338722-bitcoin-price-spot-market-reaction/