A recent analysis by crypto analyst Joao Wedson, shared via CryptoQuant, highlights a sharp divergence in liquidation trends between Bitcoin and altcoins following the launch of U.S. spot BTC ETFs.

Since ETF approval, Bitcoin’s trading activity has been marked by a dominance of short liquidations, while altcoins have suffered a wave of long liquidations, signaling distinct risk dynamics between the two segments of the market.

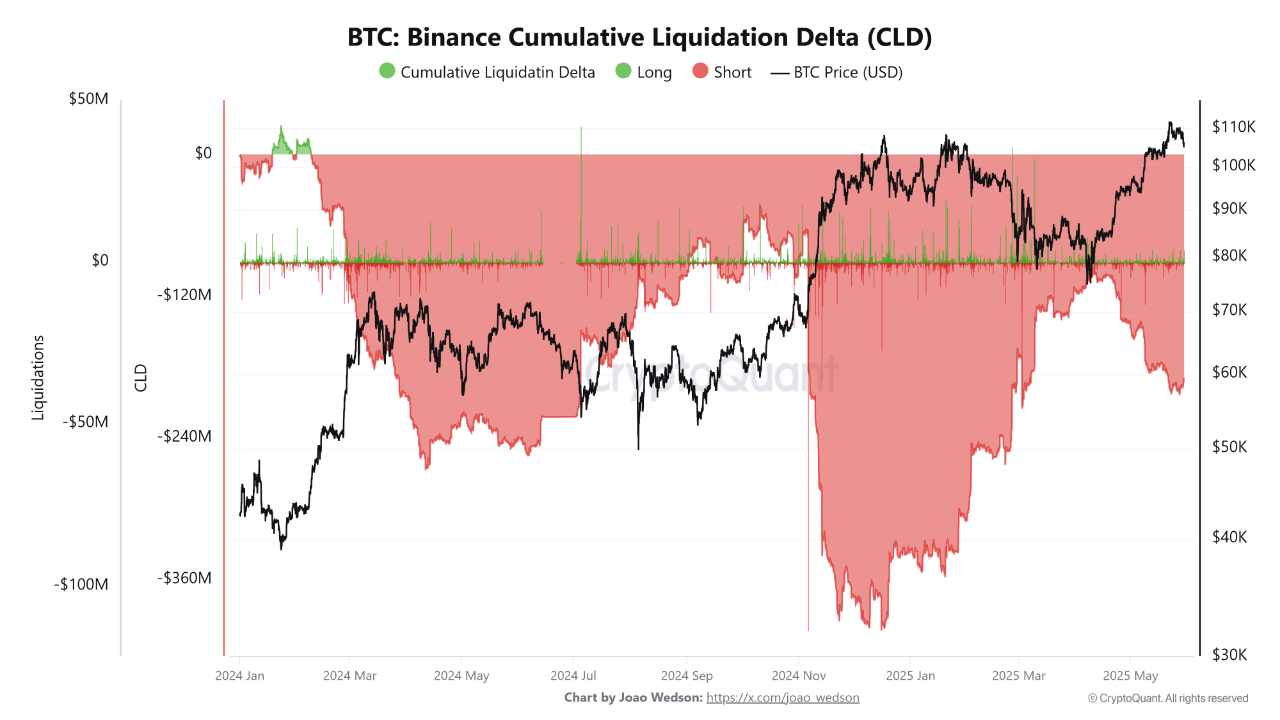

According to Binance data, Bitcoin’s Cumulative Liquidation Delta (CLD) shows that short liquidations have outpaced longs by approximately $190 million. This trend reflects a period of upward BTC momentum, where bearish traders betting against price increases were systematically liquidated as the market moved against them.

Altcoin Pain: $1 Billion in Long Liquidations

In stark contrast, altcoins experienced nearly $1 billion more in long liquidations than shorts over the same period. The data suggests traders aggressively positioned for an altcoin rebound — often referred to as “Altseason” — only to be caught on the wrong side of continued price weakness.

Key Takeaways

- Bitcoin: The strong rally post-ETF launch triggered widespread short squeezes, validating bullish sentiment and forcing bearish positions to close at a loss.

- Altcoins: Traders anticipating a broader market rally were met with persistent downtrends, leading to a cascade of liquidated long positions.

Since December 2024, the liquidation gap between BTC and altcoins has widened, exposing the vulnerabilities of overleveraged altcoin positions amid a risk-off environment.

Market Implications

- Bitcoin’s strength reinforced investor confidence, rewarding bullish positioning.

- Altcoin traders, driven by misplaced optimism, faced heavy losses as prices failed to follow BTC’s lead.

The data underscores a clear dislocation in market sentiment: while Bitcoin has become a magnet for institutional confidence post-ETF, altcoins remain highly speculative and vulnerable to sharp deleveraging.

Source: https://coindoo.com/market/crypto-market-sees-liquidation-split-bitcoin-shorts-crushed-while-altcoin-longs-wiped-out/