- Short-term Bitcoin holders are sitting at the highest profits since August after BTC broke above $63,000.

- The widespread profitability has seen market sentiment shift to positive, which could stir an extended rally.

Bitcoin [BTC] traded at $63,790 at press time, its highest price this month. Positive macro factors have seen BTC defy the typical September drop, and with “Uptober” in sight, bulls appear to be making their move.

However, given that this month’s positive macro narratives appear to be exhausted, traders who have held Bitcoin for less than 155 days hold the key to the next short-term price moves.

Surge in Bitcoin short-term holder gains

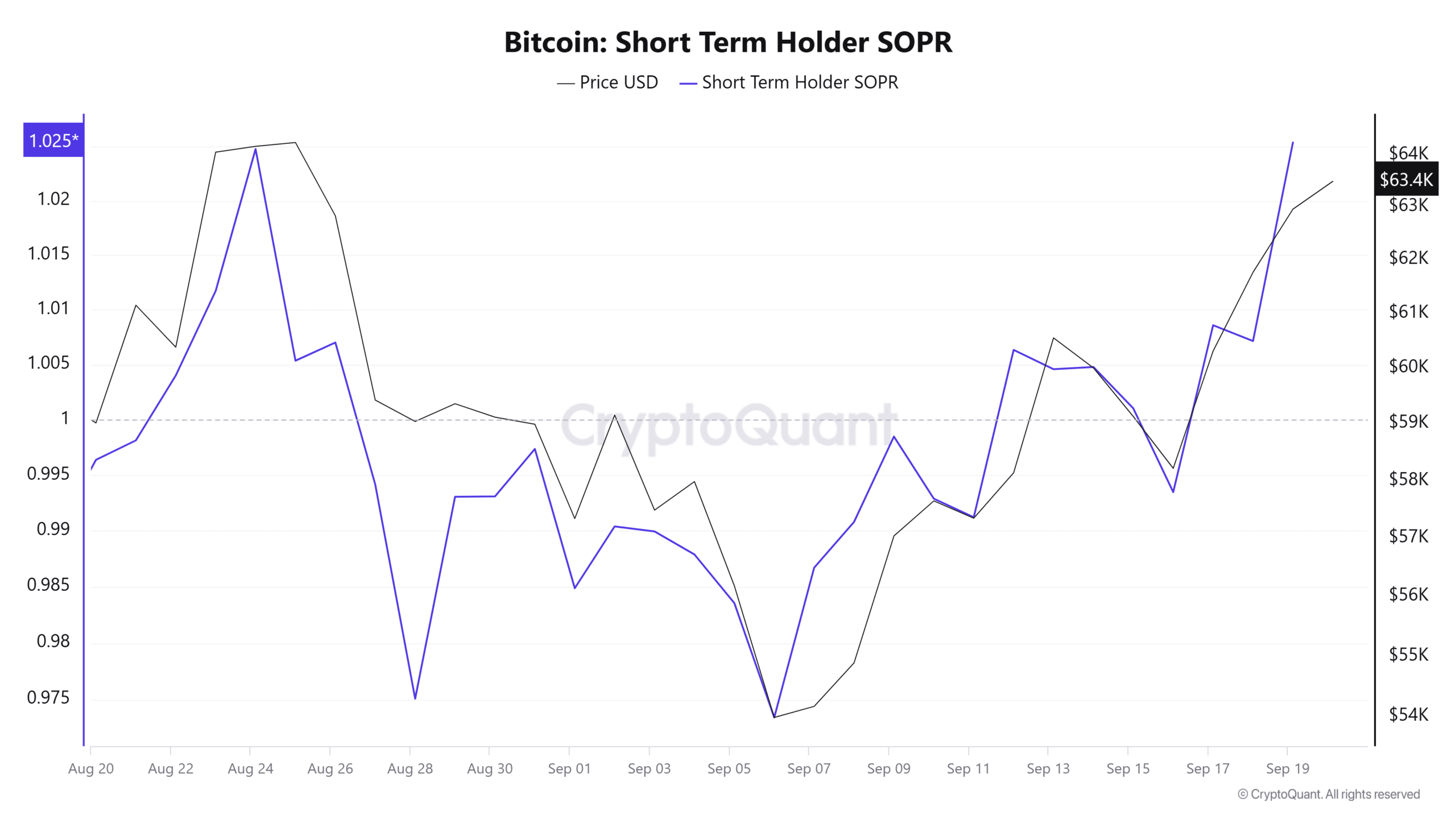

Data from CryptoQuant showed that after Bitcoin broke $60K earlier this week, short-term holders turned a profit. This cohort was previously underwater.

The shift in profitability is seen in the short-term Output Profit Ratio (SOPR), which has made a sharp increase from below 1 to its highest level since late August.

Source: CryptoQuant

This metric indicated a shift in market sentiment from negative to positive. The Bitcoin Fear and Greed Index confirmed this as it increased to 54, the highest level in more than three weeks.

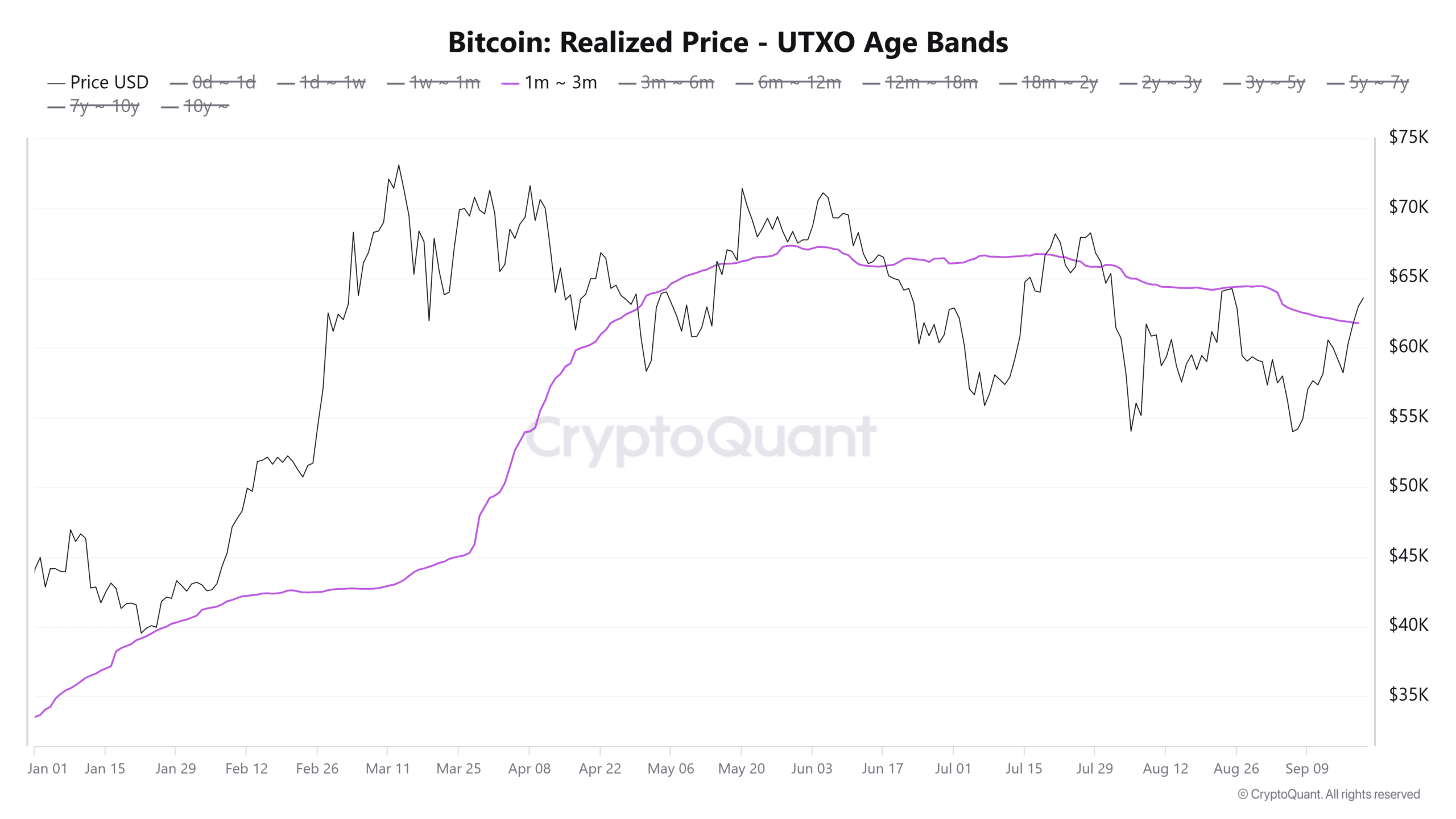

Short-term holder profitability is also seen in the Realized Price — UTXO Age Bands. Traders that have held BTC for one to three months have been below their average buy price since August.

These traders re-entered profitability on the 18th of September, after BTC rallied above $61,800.

Source: CryptoQuant

Per CryptoQuant analyst Avocado_onchain, the average buy price of short-term holders acts as a strong resistance level. With Bitcoin breaking above it, it suggests a strong bullish trend.

Risk of profit-taking

The widespread profitability among short-term Bitcoin holders shows bullish sentiment, but it also poses a risk to the short-term rally if they decide to sell.

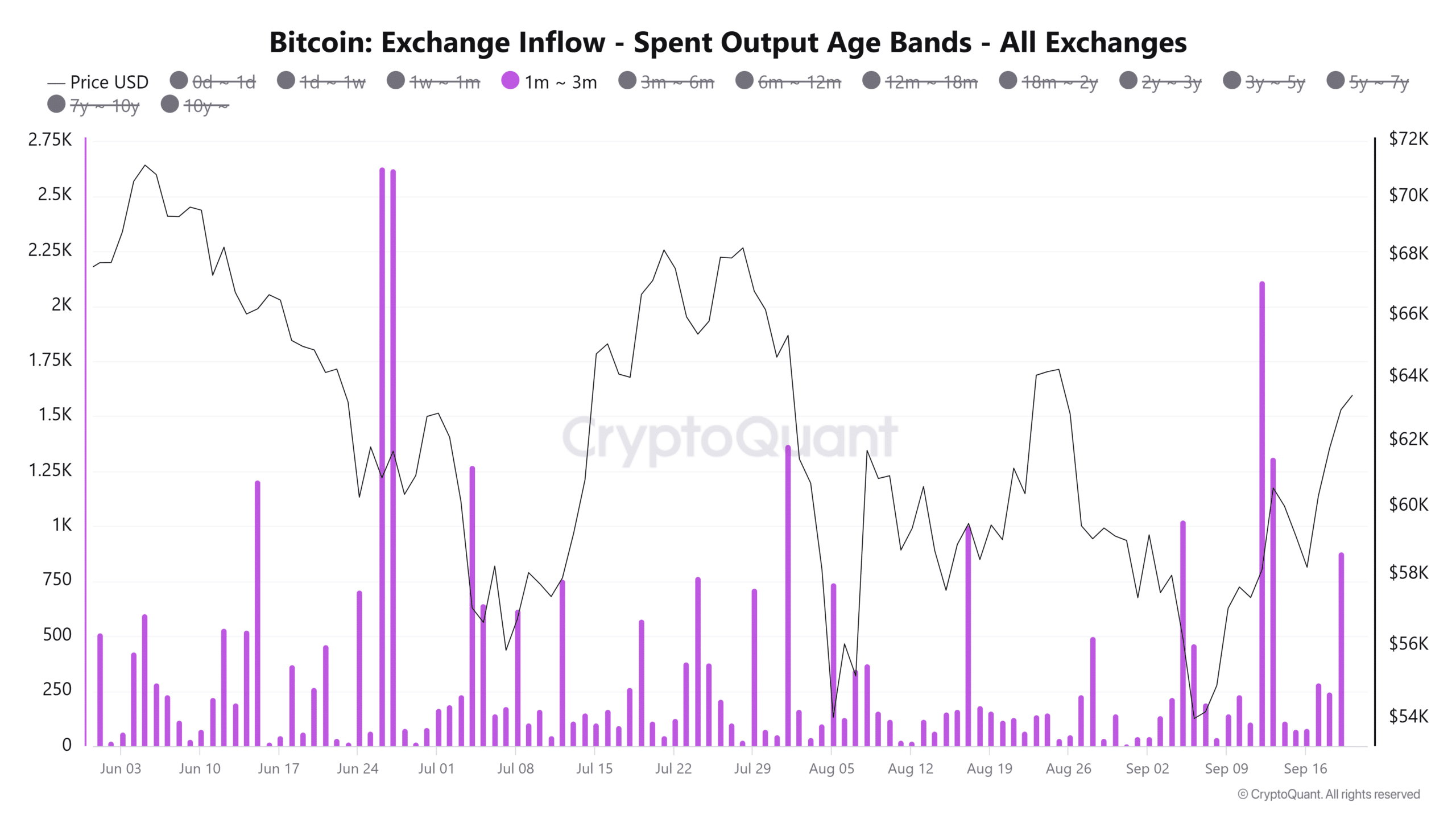

The coins distributed by these holders have reached a weekly high as seen in the Exchange Inflow — Spent Output Value Bands coinciding with the gain in price.

Source: CryptoQuant

This suggests that short-term holders could be taking profits after realizing gains.

However, given that the selling activity has not dampened the rally, a high number of short-term traders selling at profits could stir the interest of new buyers.

Traders should also watch out for the $64,000-$70,000 levels as 4.5M Bitcoin addresses that bought at these prices are still underwater per IntoTheBlock data.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As such, Bitcoin will face resistance as it approaches this zone.

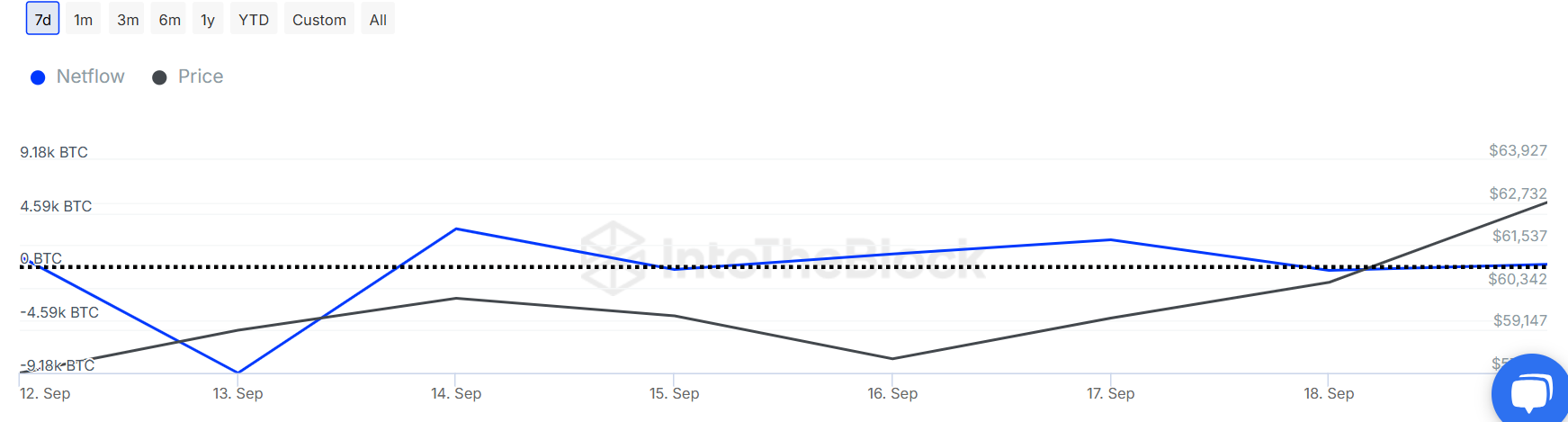

Nevertheless, whales are yet to interact with BTC amid the recent gains. Large holder netflow has been predominantly flat in the last two days after a period of accumulation. This reduces the risk of large sell-offs.

Source: IntoTheBlock

Source: https://ambcrypto.com/bitcoin-short-term-holders-hold-the-key-to-70k-heres-why/