Institutional accumulation continues to tighten Bitcoin’s available supply. BlackRock clients recently purchased $319.7 million worth of BTC.

At the same time, 635 BTC, valued at $60.53 million, moved from Coinbase to an unknown wallet. This transfer reduced exchange-side liquidity directly.

Additionally, spot Bitcoin ETFs accumulated approximately 17,700 BTC, equivalent to $1.68 billion, within a single week. That level of demand absorbed a meaningful share of the circulating supply.

However, the price did not react impulsively. Instead, Bitcoin consolidated above key levels. Therefore, large players appear focused on positioning rather than short-term distribution.

Consequently, sell-side pressure continues to weaken structurally, supporting price stability during consolidation.

Bitcoin holds above accumulation as momentum improves

At press time, Bitcoin [BTC] was trading above the accumulation range between roughly $84,600 and $94,000, a zone where buyers absorbed repeated sell-offs through December.

Price rebounded sharply from the lower boundary near $84,600, confirming strong demand.

Since then, Bitcoin reclaimed the $94,000 level, which now acts as immediate support. This reclaim matters because it marks a shift from absorption to expansion.

Meanwhile, RSI climbed from sub-40 readings to around 63, reflecting a decisive momentum recovery without entering extreme territory.

At the same time, Parabolic SAR flipped below the price near $91,800, signaling a trend shift in favor of buyers.

With price pressing above $95,500 and eyeing resistance near $106,600, structure favors continuation rather than a return into consolidation.

Source: TradingView

Profitability remains elevated without overheating

At press time, the MVRV ratio stood at 1.6909, after slipping 1.23%. This reading confirms that holders remain comfortably in profit. However, it does not reflect extreme unrealized gains.

Historically, heightened distribution risk emerges at much higher MVRV levels. Instead, the recent decline shows mild profit compression rather than aggressive selling.

Long-term holders continue absorbing volatility. Therefore, supply pressure remains contained. Moreover, the absence of sharp MVRV spikes suggests greed has not taken control.

This balance allows Bitcoin to consolidate while maintaining a constructive structure. Consequently, profitability supports stability rather than signaling exhaustion.

Source: CryptoQuant

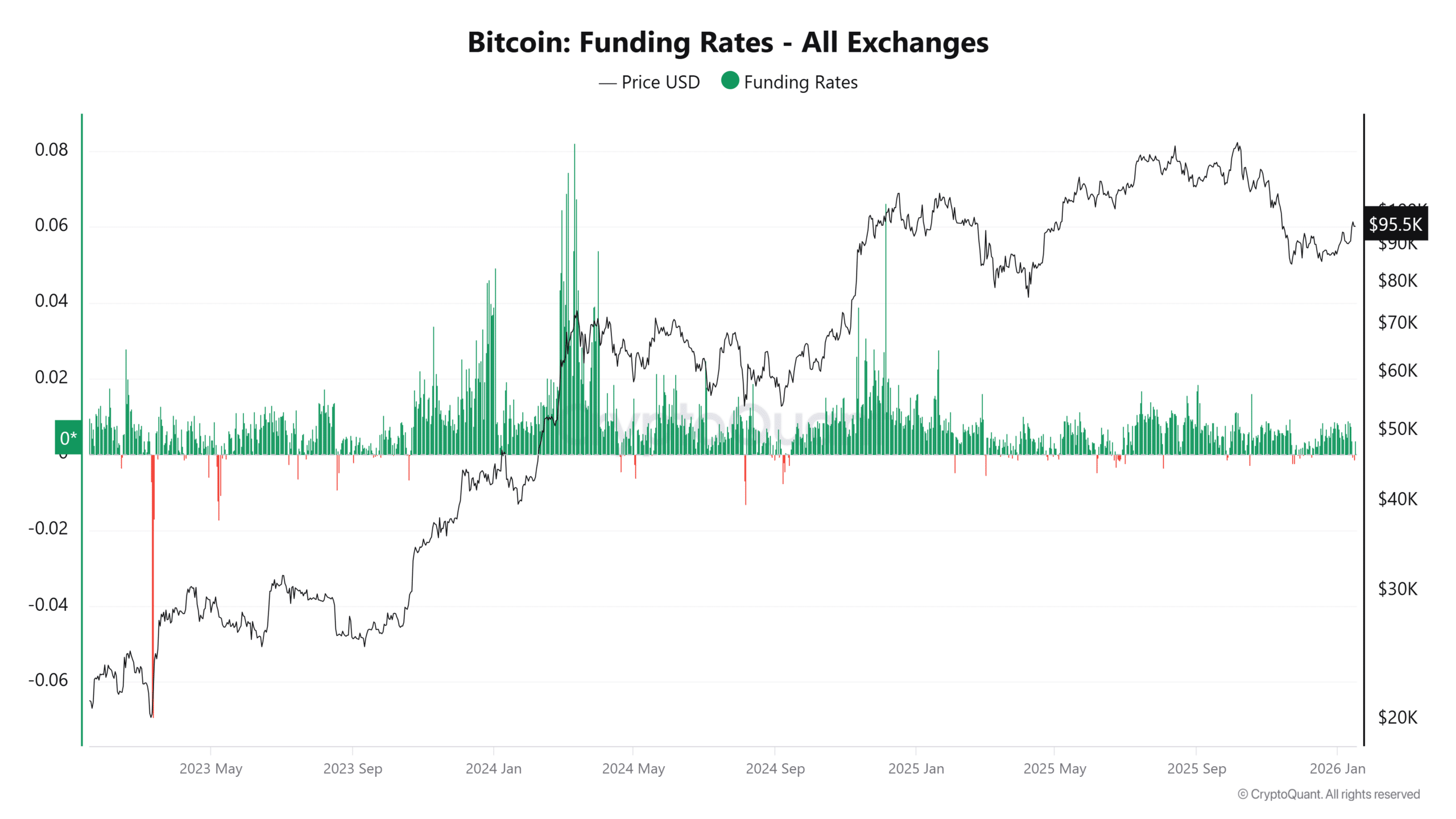

Leverage rebuilds as funding turns positive

At the time of writing, Funding Rates flipped decisively positive, surging by 1,047.79% to 0.002875. This rebound reflects renewed long-term confidence after prior deleveraging.

However, funding remains moderate in absolute terms. Traders avoid excessive leverage. This restraint reduces liquidation risk during pullbacks.

Moreover, funding adjusts quickly alongside price fluctuations. That behavior indicates disciplined positioning rather than speculative excess. At the same time, leverage rebuilds gradually, not aggressively.

Therefore, derivatives activity supports continuation instead of fragility. This environment contrasts sharply with overheated rallies. It favors persistence and controlled upside.

Source: CryptoQuant

Top traders lean long without crowding

Binance top trader data showed 57.11% of accounts were holding long positions, while 42.89% remained short, producing a Long/Short Ratio of 1.33 at press time.

This positioning reflects a clear bullish bias without crowding. Importantly, longs dominate without reaching extreme concentrations.

Shorts remain active, limiting one-sided risk. However, their presence also reduces downside acceleration. Therefore, positioning stays balanced. Traders express confidence while maintaining caution.

This alignment supports structural stability and lowers forced liquidation risk. Consequently, Bitcoin maintains flexibility as the price explores higher levels.

Source: CoinGlass

Conclusively, Bitcoin’s market structure signals strength built on control rather than speculation. Institutional accumulation continues to reduce available supply, while the price holds above key accumulation levels.

Momentum indicators support upside without overheating, and leverage rebuilds in a disciplined manner.

Meanwhile, top trader positioning remains constructive without crowding. If these dynamics remain intact, Bitcoin is more likely to extend its advance than revisit lower accumulation zones.

Final Thoughts

- Bitcoin appears to be transitioning from absorption to expansion, with downside risk increasingly constrained.

- Unless demand fades abruptly, the market structure favors continuation rather than a return to deeper accumulation.

Source: https://ambcrypto.com/bitcoin-sees-1-68b-in-weekly-buys-is-btc-supply-drying-up/