- Bitcoin matches gold price, analysts foresee potential market surges.

- Significant alignment between digital and physical assets.

- Increased speculation on Bitcoin’s long-term investment hedge status.

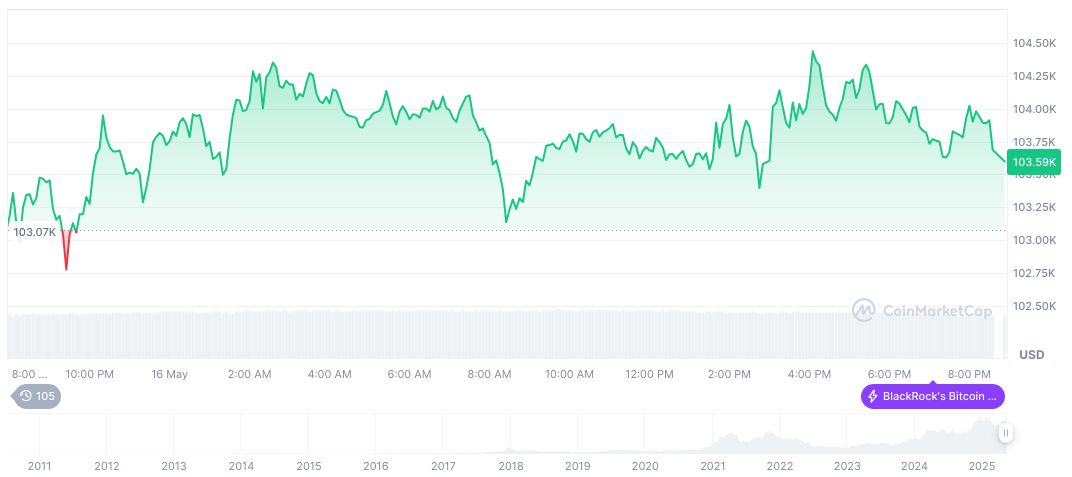

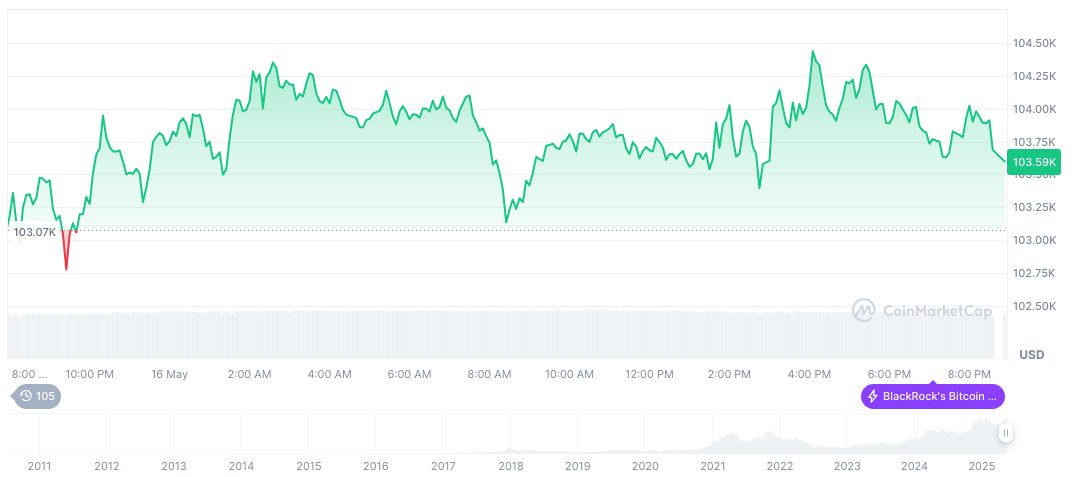

Bitcoin hits $102,900, aligning with gold’s value, prompting analyst predictions of potential market surges.

This price alignment leads to increased speculation among analysts who view Bitcoin’s positioning as a potential digital gold standard.

Bitcoin at $102,900 Matches Gold’s Kilogram Value

Bitcoin’s latest price condition indicates its trading point matches precisely with gold’s kilogram valuation, reflecting anticipated market alignments that analysts have tracked based on cryptocurrency and fiat trends. Historically, parity between Bitcoin and gold sizes the former’s ‘digital gold’ narrative.

This alignment could foster renewed enthusiasm among investors and traders, potentially triggering heightened demand and speculative activity within the market. Analysts, including independent crypto analyst Apsk32, anticipate possibilities of surged valuations if current trajectories hold. Apsk32 stated, “If Bitcoin’s network measured in gold follows the power curve, and gold holds its current value, a surge might arrive.”

Market observers highlight reactions from both crypto enthusiasts and traditional financial sectors, where Bitcoin’s alignment with gold amplifies its stature as an alternative to physical store-of-value assets. Despite significant discourse within crypto communities, there are currently no announcements from major exchange leaders or institutional players regarding strategic shifts tied to this event.

Experts Weigh In on Bitcoin’s Potential as ‘Digital Gold’

Did you know? Previous parity events between Bitcoin and gold, notably in 2017 and 2021, catalyzed significant market interest and investment flow into cryptocurrencies, underscoring Bitcoin’s role as a strategic hedge during periods of fiat currency fluctuation.

According to CoinMarketCap, Bitcoin, trading at $103,044.42, holds a substantial market capitalization of formatNumber(2047007196396.70, 2), dominantly occupying 62.60% of the cryptocurrency sector. Recent market dynamics reflect a 21.90% uptick over the past 30 days, supported by robust 60-day gains of 25.19%. Current trading volumes register formatNumber(42207534934.12, 2) with a noted decrease.

Coincu analysis suggests Bitcoin’s alignment with gold could provoke regulatory and market attention, primarily due to its newfound equivalence with a traditional asset valued as a safe haven. Potential outcomes include closer scrutiny from financial regulators and reinforced narratives from cryptocurrency advocates touting Bitcoin’s viability as a long-term store of wealth. For cryptocurrency updates and news, consider following CoinPaper on Twitter.

Source: https://coincu.com/338105-bitcoin-gold-price-parity-2025/