- Institutional investments propel Bitcoin price

- Supportive U.S. policies enhance market confidence

- Bitcoin’s price surge indicates expanding asset confidence

Bitcoin’s value surged past $123,000 this week, fueled by institutional investments, spot ETF inflows, corporate treasury allocations, and sovereign nation acquisitions, with notable support from U.S. policies.

Market reactions include increased institutional and sovereign interest, accentuating Bitcoin’s role as a strategic asset amid favorable geopolitical and regulatory landscapes.

Bitcoin’s $123,000 Milestone Driven by Institutional Support

Institutional investments and inflows into Bitcoin spot ETFs were reported as significant contributors to Bitcoin’s price uplift. Corporate interest, helmed by entities like Strategy’s massive holdings, along with governments such as El Salvador, has led to robust market activity. Bitcoin price surge targets $125,000 as momentum builds.

U.S. policies supporting digital assets under former President Donald Trump further foster optimism.

Key market leaders expressed enthusiasm for Bitcoin’s strength. Michael Saylor noted on X/Twitter, “Strategy’s Bitcoin portfolio has hit a record valuation of $77.2 billion.” President Nayib Bukele of El Salvador celebrated the country’s unrealized gain on Bitcoin, reflecting growing asset confidence.

“Strategy’s Bitcoin portfolio has reached a record valuation of $77.2 billion, confirming our aggressive accumulation policy as a key driver of market sentiment.” — Michael Saylor, Founder, Strategy

Historical Insights and Future Implications on Crypto Markets

Did you know? In 2021, Bitcoin similarly surged in value following market-friendly policy announcements, echoing past upward trends and highlighting the effect of government strategies on cryptocurrency performance.

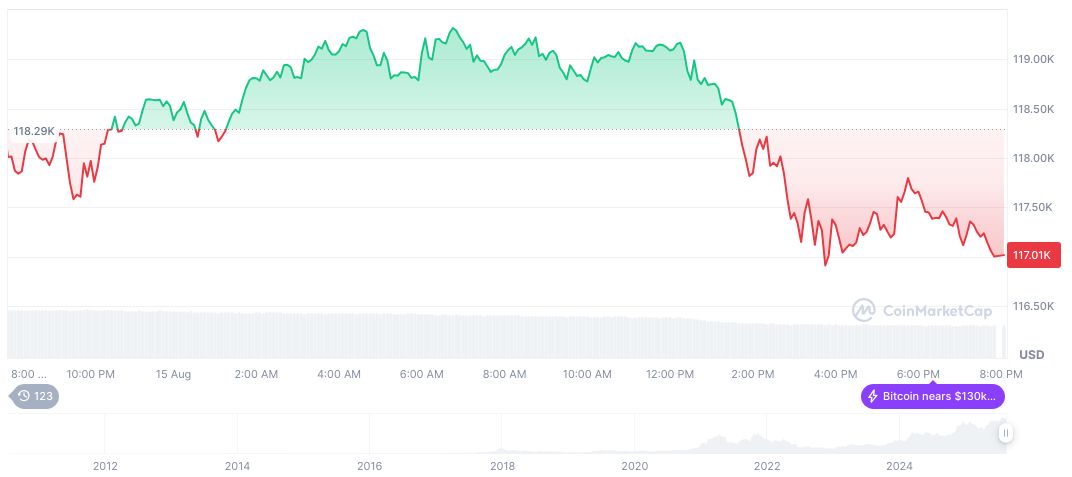

According to CoinMarketCap, Bitcoin’s current price stands at $117,793.93, with a comprehensive market cap of $2.34 trillion. Its market dominance is reported at 59.04%. Despite a recent 27.14% reduction in trading volume, short-term price fluctuations indicate a stable momentum with potential upside.

Coincu analysts anticipate continued volatility as institutional investors accumulate, with potential further regulatory developments influencing future dynamics. The ongoing trend suggests a transformative impact on broader financial markets as cryptocurrency becomes an increasingly integral global asset.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-new-high-institutional-support/