- Bitcoin sets new all-time high, boosting market value and institutional inflows.

- Bitcoin hits $125,000 due to robust ETF demand.

- Cryptocurrency market cap surged $110 billion following Bitcoin’s price hike.

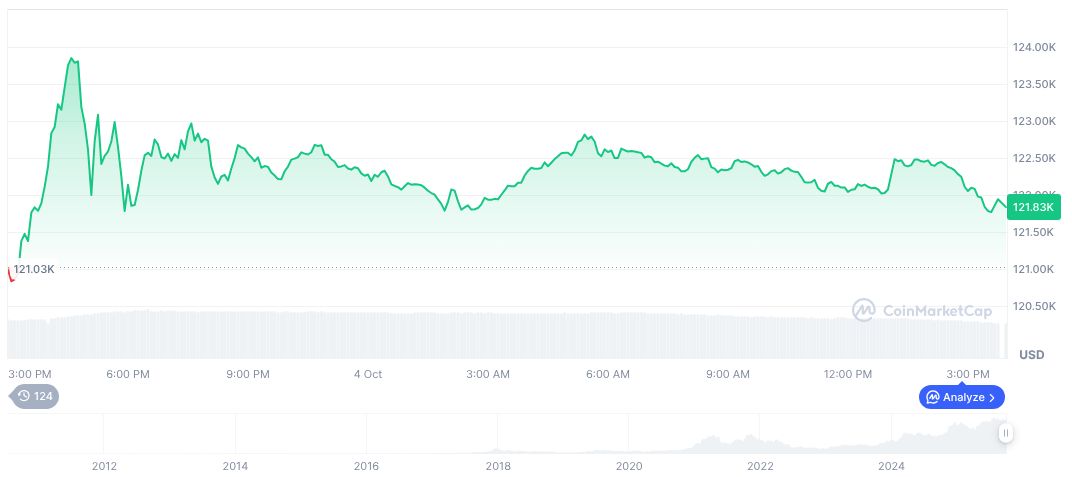

Bitcoin exceeded $125,000 on October 5, leading the cryptocurrency market to a valuation increase of $110 billion, with strong participation from institutional investors in U.S. spot Bitcoin ETFs.

The milestone underscores rising institutional interest and ETF demand, indicating potential shifts in market dynamics and increased asset allocation toward cryptocurrencies.

Bitcoin Surpasses $125,000 Driven by Institutional ETF Demand

Bitcoin’s unprecedented surge past $125,000 is attributed to heightened institutional demand and ETF inflows. This marks a significant milestone for the digital asset, underscoring its growing role as a mainstream investment vehicle. The increase in the crypto market capitalization by approximately $110 billion further highlights this trend.

The rapid inflow into Bitcoin ETFs demonstrates a shift towards embracing digital assets, driven by robust institutional participation. This includes pension funds and asset managers directing portfolio allocations towards Bitcoin as fears of inflation and traditional market volatility rise.

Market sentiment is broadly positive, with growing interest from financial institutions. However, major industry figures like Arthur Hayes and CZ have not publicly commented on this surge. The lack of commentary from key voices indicates restrained optimism awaiting further market stability.

Bitcoin’s Historical Significance and Market Insights

Did you know? Bitcoin’s breakthrough over $125,000 marks not only its highest valuation but also a testament to the consistent trend of institutional interest since its creation in 2008, reminiscent of prior bull runs.

According to CoinMarketCap, Bitcoin’s current price stands at $123,086.98, with a market cap of approximately 2.45 trillion. The cryptocurrency holds a market dominance of 58.13%. Over the last 24 hours, despite a 19.13% decrease in trading volume, Bitcoin’s price rose by 0.67%. The asset’s supply remains steady at 19,928,203 coins out of a maximum of 21,000,000.

Coincu’s analysis suggests that the current market conditions may catalyze further regulatory acceptance, aligning the broader financial framework with cryptocurrency trends. The potential for technological advancements, coupled with favorable policy movements, could sustain this growth trajectory.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-new-high-institutional-demand/