Bitcoin [BTC] has slipped back to the $91,000 zone after failing to sustain a move above the $95,000 level it defended for most of the previous week.

While the pullback reflects short-term exhaustion, it has not meaningfully weakened broader market participation.

Activity among Spot buyers and institutions suggests demand remains intact, providing a potential base for recovery as macro and crypto-specific developments unfold.

Spot demand regains control

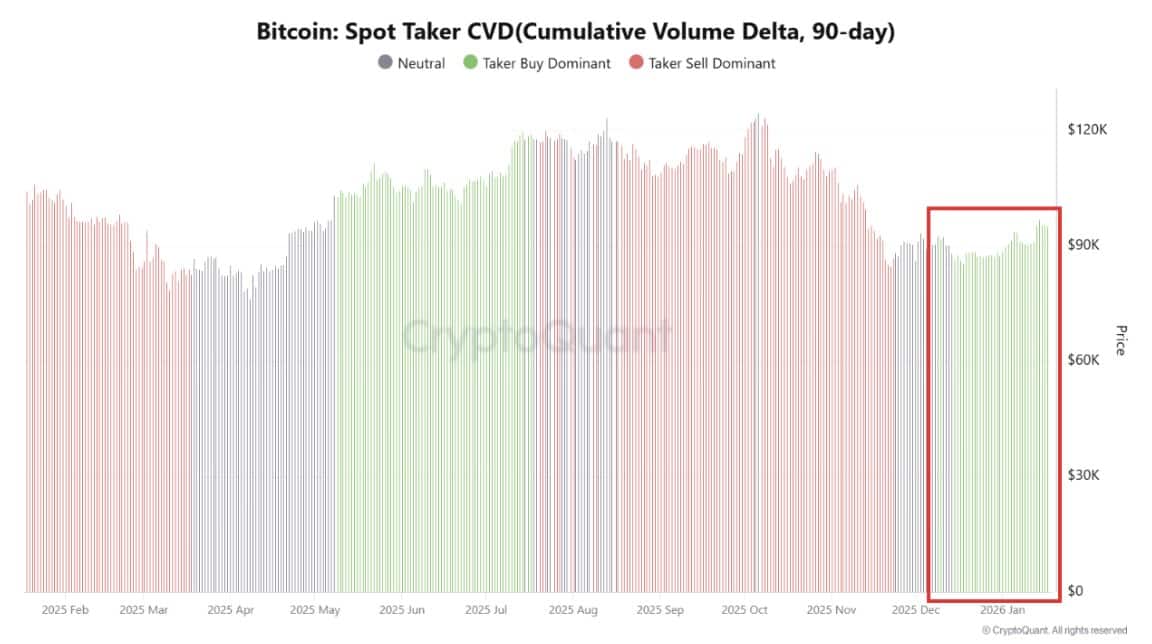

Spot market sentiment has turned constructive for the first time in several weeks, with the Bitcoin Spot Taker CVD (Cumulative Volume Difference) flipping decisively positive.

This metric tracks whether aggressive market activity over a defined period—typically 90 days—is dominated by buyers or sellers. A positive reading indicates that buyers are once again setting the tone.

Source: CryptoQuant

The shift signals a transfer of control from sellers to buyers, a development that often precedes more durable price action.

Importantly, Spot-led demand points to organic accumulation rather than leverage-driven momentum, strengthening the case for medium-term upside.

Exchange data reinforces this narrative. Spot exchange Netflow shows that $171.83 million worth of Bitcoin has been withdrawn from exchanges, reflecting sustained buying pressure.

This marks a sharp reversal from the $203 million in net selling recorded in the week ending January 12.

If this pace of accumulation holds, shrinking exchange balances could begin to tighten supply and support a price rebound.

Institutions stay the course

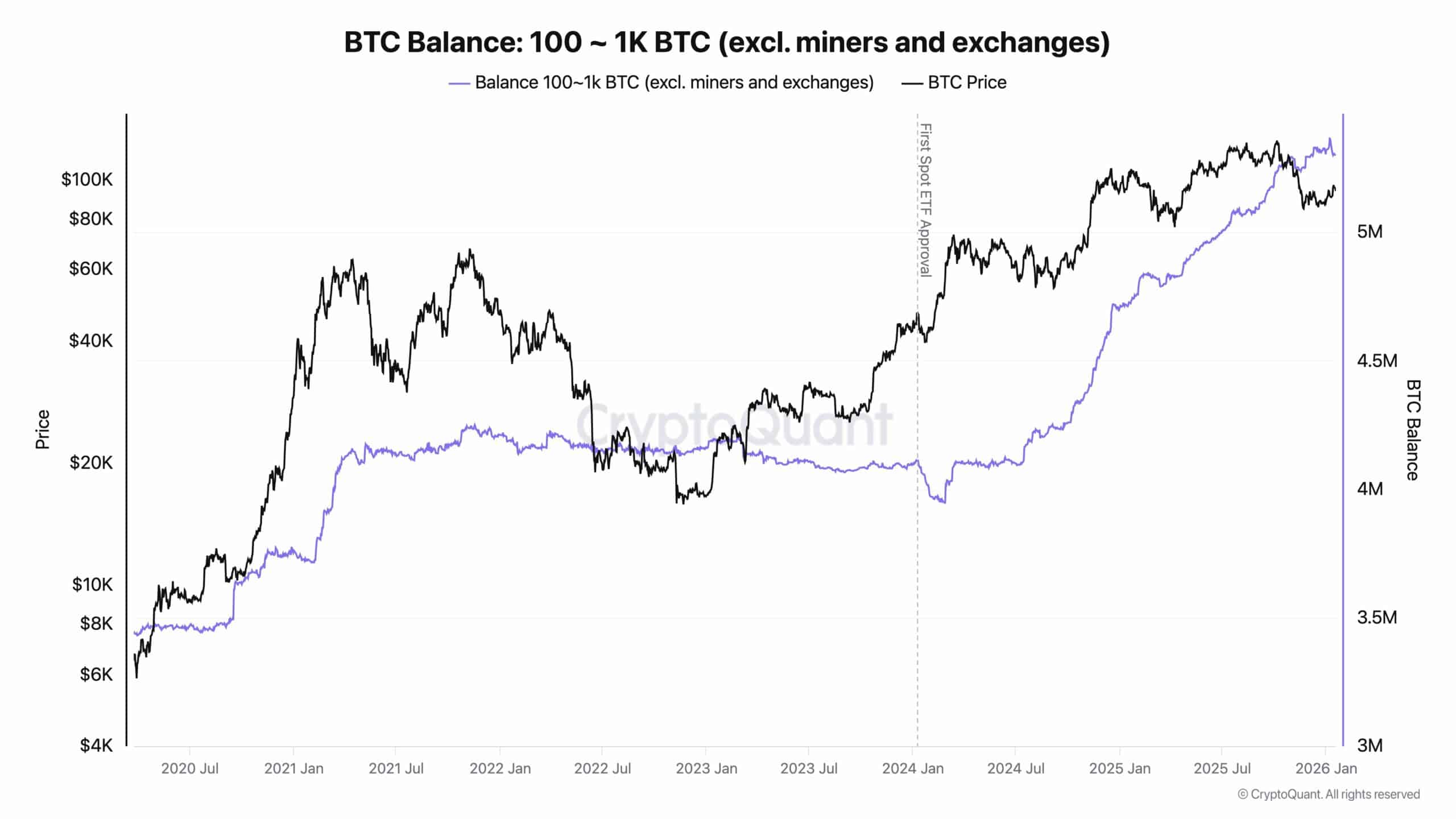

Institutional investors appear unfazed by recent volatility. CryptoQuant data tracking U.S.-based wallets holding between 100 and 1,000 BTC shows steady accumulation over the past year.

Over this period, institutions have absorbed approximately $53 billion worth of Bitcoin, equivalent to around 577,000 BTC. On a monthly basis, this translates to average purchases of $4.4 billion.

Source: CryproQuant

These inflows are largely driven by U.S. Spot Bitcoin ETFs, backed by major asset managers including BlackRock and Fidelity.

AMBCrypto’s review of ETF flows shows that $1.21 billion worth of Bitcoin has already been purchased in January. Based on historical averages, additional inflows of up to $3.19 billion remain possible before month-end.

That said, these figures remain conditional. Institutional positioning will continue to hinge on broader risk sentiment and macroeconomic signals.

Global liquidity still supports upside

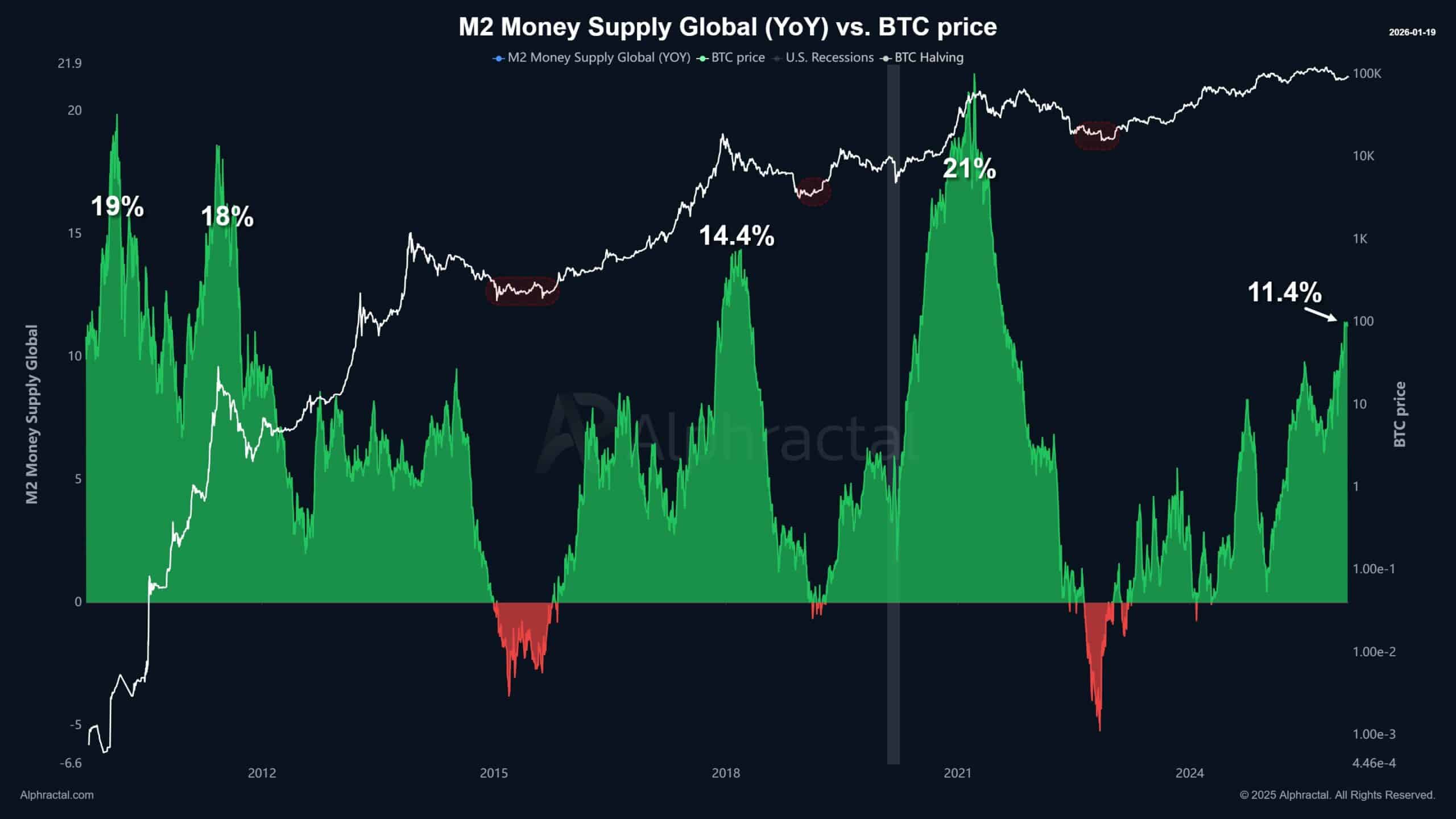

Bitcoin’s long-term relationship with global liquidity continues to favor higher prices. Historically, Bitcoin has topped out when global M2 money supply growth exceeds 14.4 percent.

At present, global M2 growth sits near 11 percent, suggesting liquidity conditions remain supportive and have not yet reached levels typically associated with cycle peaks.

Source: Alphractal

Still, macro risks remain in focus. Farzam Ehsani, CEO of cryptocurrency exchange VALR, warned that renewed U.S.-EU tariff tensions could pressure risk assets, including Bitcoin.

Ehsani said in an email to AMBCrypto.

“President Trump’s aggressive trade rhetoric is pushing markets back into a full de-risking phase.”

He added that the tariff dispute has weighed on cryptocurrencies primarily because they are treated as risk assets rather than due to market-specific weakness.

“While U.S.-EU trade concerns have weighed most heavily on sentiment, other risk assets such as the KOSPI are trading flat or higher. This points to crypto-specific caution, with capital rotating toward alternative risk markets,” he noted.

For now, institutional accumulation and Spot demand provide constructive signals, but tariff developments remain a key variable that could shape near-term market direction.

Final Thoughts

- Spot market participants are returning, with buying pressure overtaking selling and driving a net inflow of $171 million.

- Institutional investors have deployed an estimated $53 billion into Bitcoin over the past 12 months, averaging roughly $4.4 billion per month.

Source: https://ambcrypto.com/bitcoin-pulls-back-to-91k-spot-buyers-quietly-take-control/